Econ 366: Energy Economics

Topic 3.2: Economic Regulation

Andrew Leach, Professor of Economics and Law

Economic Regulation

What do we mean when we say an industry is regulated?

Are there really unregulated industries?

We're interested in a particular kind of regulation: utility regulation which "aims to steer an industry’s performance towards improving general welfare," (... and) "to protect consumers from the market power that may enable monopolies and oligopolies to set unjustifiably high prices or lower the quality of their goods or services."

Carlos Batlle & Carlos Ocaña, “Electricity Regulation: Principles and Institutions” and Tomás Gómez, “Monopoly Regulation” in Ignacio J Pérez-Arriaga, ed, Regulation of the Power Sector, (London: Springer, 2013) at 127

Economic Regulation

Regulation may include measures which:

- restrict or require the construction of infrastructure;

- limit the prices at which goods or services are provided;

- set quality and service standards;

- direct or permit investment and/or asset retirement;

- oversee agent/actor behaviour (e.g. competition policies).

Economic Regulation

Regulations may also protect investors in critical industries from state intervention:

- restricts political involvement in prices or costs;

- limits (?) political involvement in investments or asset retirements;

- protect reasonable recovery of returns on capital deployed;

- protects investors from expropriation.

Theory of Natural Monopolies

Economic regulation has its roots in the idea of natural monopolies.

An industry is a natural monopoly if the production of a particular good or service by a single firm minimizes cost

Why does this create a monopoly condition by default?

Theory of Natural Monopolies

Baumol's definition:

a) An industry in which multifirm production is more costly than production by a monopoly (subadditivity of the cost function).

b) An industry to which entrants are not "naturally" attracted, and are incapable of survival even in the absence of "predatory" measures by the monopolist (sustainability of monopoly). Baumol, at 810.

William J. Baumol, “On the Proper Cost Tests for Natural Monopoly in a Multiproduct Industry,” American Economic Review 67 (December 1977): 809–22.

Natural Monopoly in practive: the Alberta Utilities Commission

From the Alberta Utilities Commission, which regulates utilities:

"Alberta’s utility industry is known as a natural monopoly, meaning that there is limited or no competition. While monopolies are generally considered a negative thing, in this case there would be more negative economic and environmental impacts than benefits to having more than one set of wires and poles or pipelines to deliver energy to customers."

Instead, per the AUC, Alberta:

- sets defined service territories for utility companies;

- determines the rate of return on capital;

- sets customer rates.

Natural Monopoly in Canadian courts

"Public utilities are typically natural monopolies: technology and demand are such that fixed costs are lower for a single firm to supply the market than would be the case where there is duplication of services by different companies in a competitive environment"

ATCO Gas and Pipelines Ltd. v. Alberta (Energy and Utilities Board), 2006 SCC 4 [Stores Block] at para 3, citing A. E. Kahn, The Economics of Regulation: Principles and Institutions (1988), vol. 1, at p. 11.

Natural monopoly, economies of scale and scope

A firm which exhibits increasing economies of scale is one where costs increase more slowly than production (e.g. you can double production with less than a doubling of costs, leading to lower average costs as production increases);

A firm which exhibits increasing economies of scope is one where costs decrease as a firm produces a range of goods or provides a range of services (e.g. you might think about accounting firms or law firms offering diverse services).

Production of multiple goods is described as subadditive if producing X and Y together costs less than producing X and Y separately (e.g. mobile voice and data services, accounting and tax services).

Natural monopoly, economies of scale and scope

A strong natural monopoly describes a situation were average costs are decreasing over all possible output levels or combinations. A weak natural monopoly exists in cases where returns to scale and/or scope may become exhausted.

What is the optimal size of a utility service area?

The economic regulation policy problem

The policy problem at play is how society can benefit from the lower cost of the monopolist while avoiding the rent extraction of the monopolist

Left to its own devices, the monopolist will extract the benefits of low production costs while charging monopoly (higher than normal) prices

Prices will be greater than marginal (last unit) cost, and much greater than average cost, and the firm will collect super-normal profits or rents.

Economic regulation can maintain prices at close to average costs, reducing rent extraction. Economic regulation generally tries to force prices toward marginal costs.

Why do we need cost-of-service regulaion to get this done?

Can price regulation alone work in a capital-intensive industry?

In a capital intensive industry with economies of scale, average costs are always higher than marginal costs (the average cost is higher than the incremental cost of providing the last unit) because the average cost of capital never quite gets to zero

So, how do you manage investment? If you force firms to charge marginal costs, they'll lose money. They need an incentive to invest in infrastructure.

Economic regulation tries to set price equal to (prudent) operating costs and taxes(?) plus a reasonable (fair) rate of return on capital.

Costs and benefits of regulation

Regulation reduces monopoly rents and increases the allocative efficiency of the economy

The regulated return on capital, and the reimbursement of costs means fewer incentives for cost reductions and thus higher overall costs than would exist with a monopoly.

This tension is present through all of cost-of-service regulation of utilities

Traditional Regulatory Model

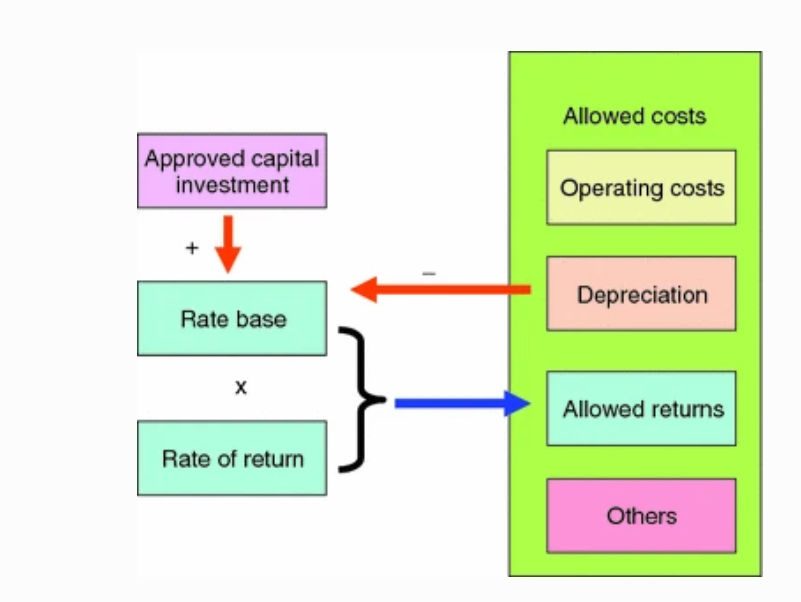

The traditional regulatory model is cost-of_service regulation.

Cost-of-service regulation (the math):

∑ni=1piqi=Cf+∑ni=1ciqi+sB

Cost-of-service regulation (the words):

Total Revenues=Fixed Costs+Operating Costs+Rate of Return (s)×Rate Base(B)

Traditional Regulatory Model

Figure 4.1 from Gómez, Monopoly Regulation, at 158

The main tasks of the regulator

determining what is included in the rate base, B

- regulators may determine what gets built, and which assets get retired;

determining the fair rate of return on capital, s;

determining which operating costs, c and Cf, are eligible for reimbursement

calculating the price(s) to be changed for services in order to yield the required revenues;

calculating the share of revenue collected through fixed vs variable charges;

determining the distribution of common costs across customer groups.

The Regulatory Compact

Regulator mandates are generally expressions of the regulatory compact

"Under the regulatory compact, the regulated utilities are given exclusive rights to sell their services within a specific area at rates that will provide companies the opportunity to earn a fair return for their investors. In return for this right of exclusivity, utilities assume a duty to adequately and reliably serve all customers in their determined territories, and are required to have their rates and certain operations regulated."

Stores Block at para 63, citing Northwestern Utilities at 192-93.

The Regulatory Compact

Regulator mandates are generally expressions of the regulatory compact

"The duty of the [Board of Public Utility Commissioners of Alberta] was to fix fair and reasonable rates; rates which, under the circumstances, would be fair to the consumer on the one hand, and which, on the other hand, would secure to the company a fair return for the capital invested."

Northwestern Utilities Ltd. v. City of Edmonton, [1929] S.C.R. 186 [Northwestern Utilities] at 192-93.

The Regulatory Compact

Regulator mandates are generally expressions of the regulatory compact

"The obligation of a public utility or other body having a practical monopoly on the supply of a particular commodity or service of fundamental importance to the public has long been clear. It is to supply its product to all who seek it for a reasonable price and without unreasonable discrimination between those who are similarly situated or who fall into one class of consumers.

Chastain et al. v. British Columbia Hydro and Power Authority, [1973] 2 W.W.R. 481, at 491 per McIntyre, J.

The Regulatory Compact

The utility is granted the right to provide a service in a particular area with the opportunity to earn a reasonable return on its investment and to recover its prudently incurred expenses. The utility must provide that service to all, in a consistent, non-discriminating manner at a fair and reasonable cost. [...]

The inherent tension between achieving profit for utility shareholders at a reasonable cost to ratepayers has, not surprisingly, led to considerable disagreement and litigation.

FortisAlberta Inc v Alberta (Utilities Commission), 2015 ABCA 295 (CanLII) at paras 9 and 15

Incentive-based regulation

Does regulation mean that the utility is guaranteed a profit?

Does cost-of-service regulation mean that costs will be lower for consumers over time?

Averch–Johnson effect

- If allowed rate of return on capital is higher than market cost of capital, firms will over-invest in capital

- presumes that the allowed rate of return on capital is higher than the market rate of return.

- If regulators under-estimate market rates of return, then the Averch-Johnson conditions flip and utilities under-invest in capital.

Harvey Averch and Leland L. Johnson, “Behavior of the Firm Under Regulatory Constraint,” American Economic Review 52 (December 1962): 1052–69)

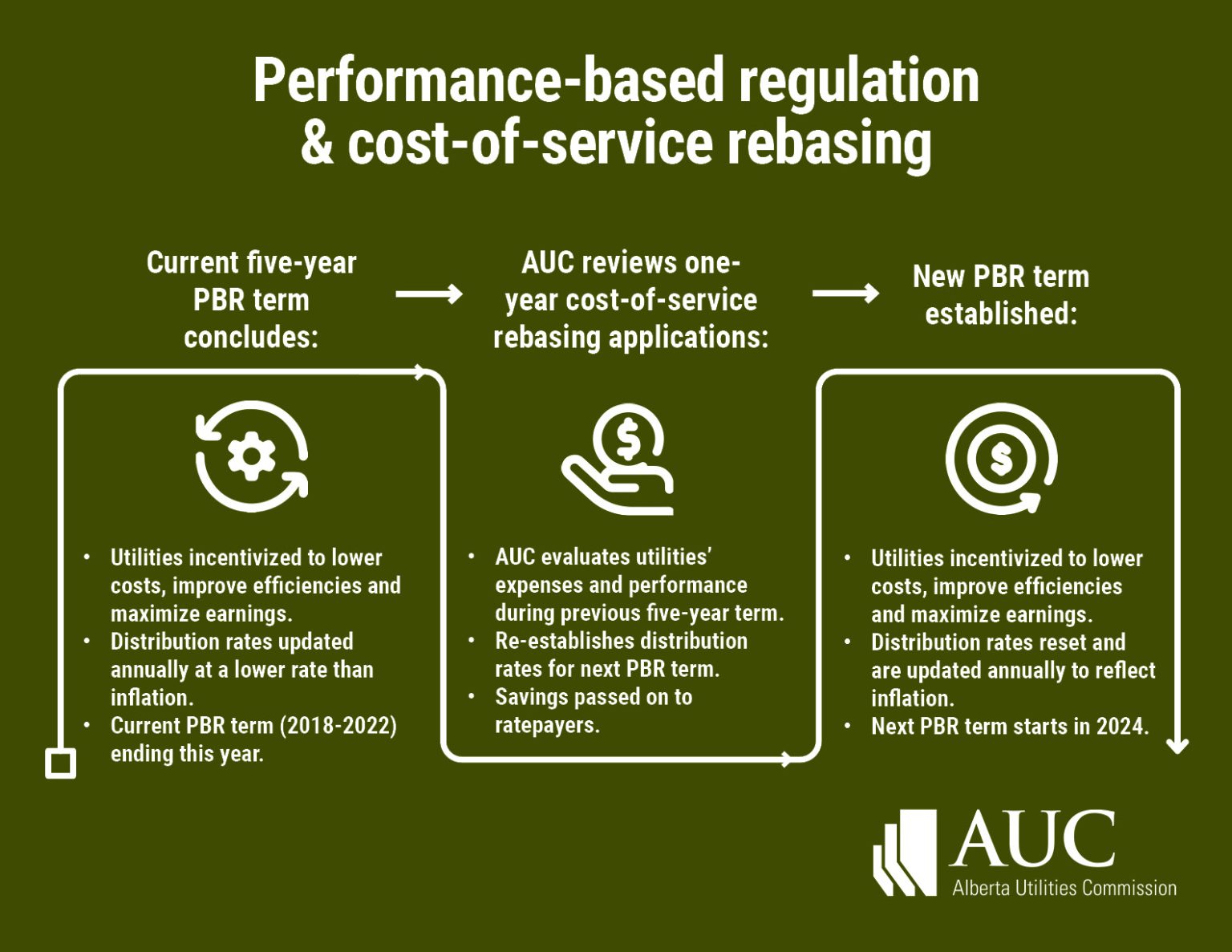

Incentive-based regulation

Incentive-based regulation can help with these objectives.

Incentive-based regulation

What are some of the potential challenges you might imagine with PBR or similar initiatives?

Key concern will be service standards and ensuring that utilities do not compromise service in attempting to lower costs and thereby increase their rates of return.

Solution? Reliability standards, e.g. AUC Rule #002:

System average interruption frequency index (SAIFI), a measure of the average number of times that a customer experiences an interruption in the year.

System average interruption duration index (SAIDI), a measure of the amount of time in total the average customer experiences interruptions throughout the year.

Are we likely to be as good at measuring service quality as return on capital?

Which utilities do (or don't) we regulate in Alberta?

- Alberta restructured its utilities and opened segments of electricity and natural gas markets to competition in the 2000s

- electricity generation and retail contracts were deregulated

see Terry Daniel, Joseph Doucet & Andre Plourde, “Electricity Restructuring: The Alberta Experience” in Electric Choices: Deregulation and the Future of Electric Power (Rowman & Littlefield, 2007) [on eClass]

- this doesn't mean they are not subject to oversight - quite the opposite - but that they are not subject to cost-of-service regulation

What makes these sectors natural monopolies? Are they all natural monopolies?

- electricity generation and retail contracts were deregulated

What about elsewhere in Canada?

Federally, the Canada Energy Regulator regulates inter-provincial pipelines.

Other provinces regulate electricity and natural gas differently from Alberta

- Many provinces (SK, MB, QC, BC) have Crown-owned, often vertically-integrated utilities

- Ontario has a hybrid electricity system

Utilities tribunals include: the Alberta Utilities Commission, the British Columbia Utilities Commission, the Manitoba Public Utilities Board, the New Brunswick Energy and Utilities Board, the Newfoundland & Labrador Board of Commissioners of Public Utilities, the Northwest Territories Public Utilities Board, the Nova Scotia Utility and Review Board, the Nunavut Utility Rates Review Council, the Ontario Energy Board, the Prince Edward Island -- Island Regulatory and Appeals Commission, la Régie de l'énergie du Québec, the Saskatchewan Rate Review Panel and the Yukon Utilities Board

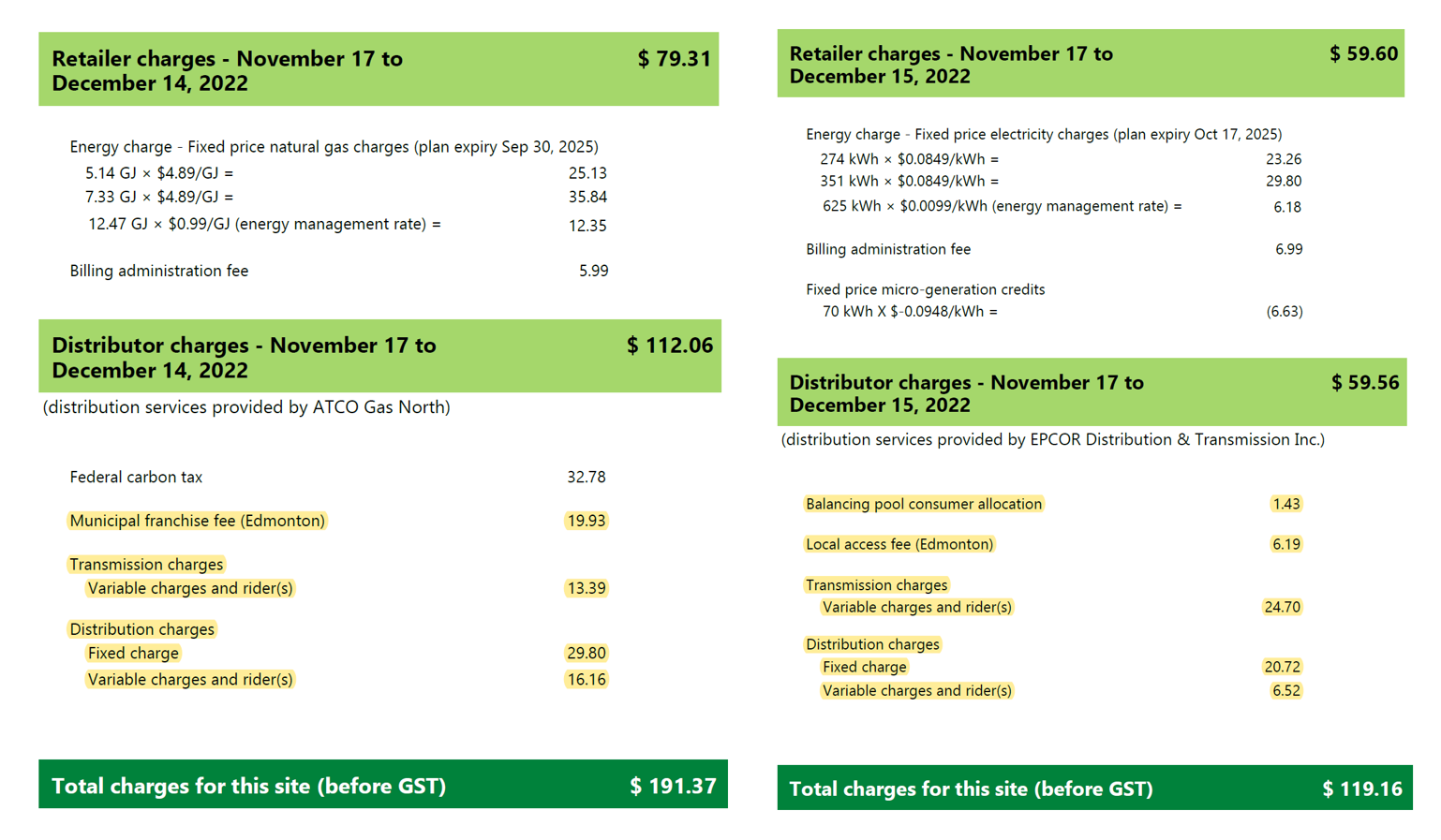

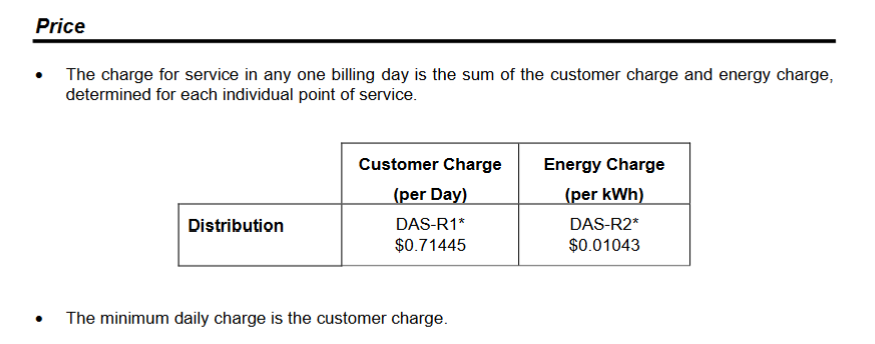

Distribution and transmission charges

Have you ever taken a moment to look at your electricity bill? Or your natural gas bill?

AUC Processes

- Distribution and transmission charges are payments to regulated utilities

- Each of these charges is determined through an AUC rate-setting process

- cost-of-service rate applications for transmission

- performance-based regulation for distribution

see AUC Decision 26852-D01-2021 re: EDTI 2022 Annual Performance-Based Regulation Rate Adjustment(December 14, 2021).

see AUC Decision 26852-D01-2021 re: EDTI 2022 Annual Performance-Based Regulation Rate Adjustment(December 14, 2021).

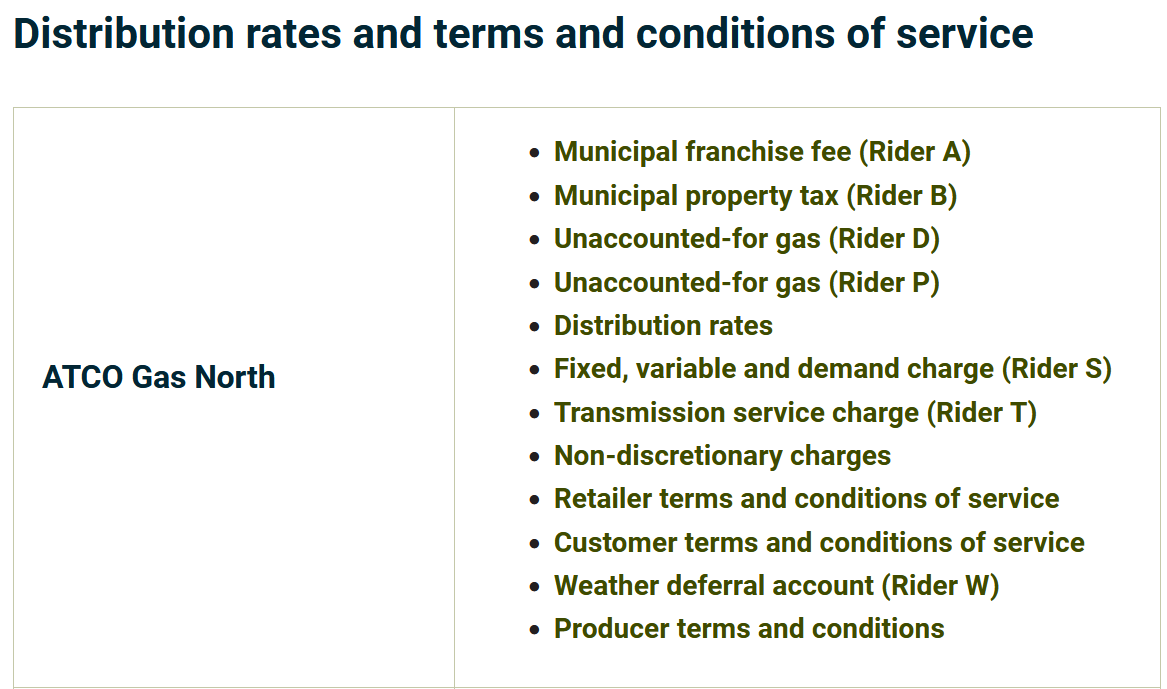

Natural gas rates

Natural gas distribution rates are set similarly although there are more riders.

See here and compare to your bills.

See here and compare to your bills.

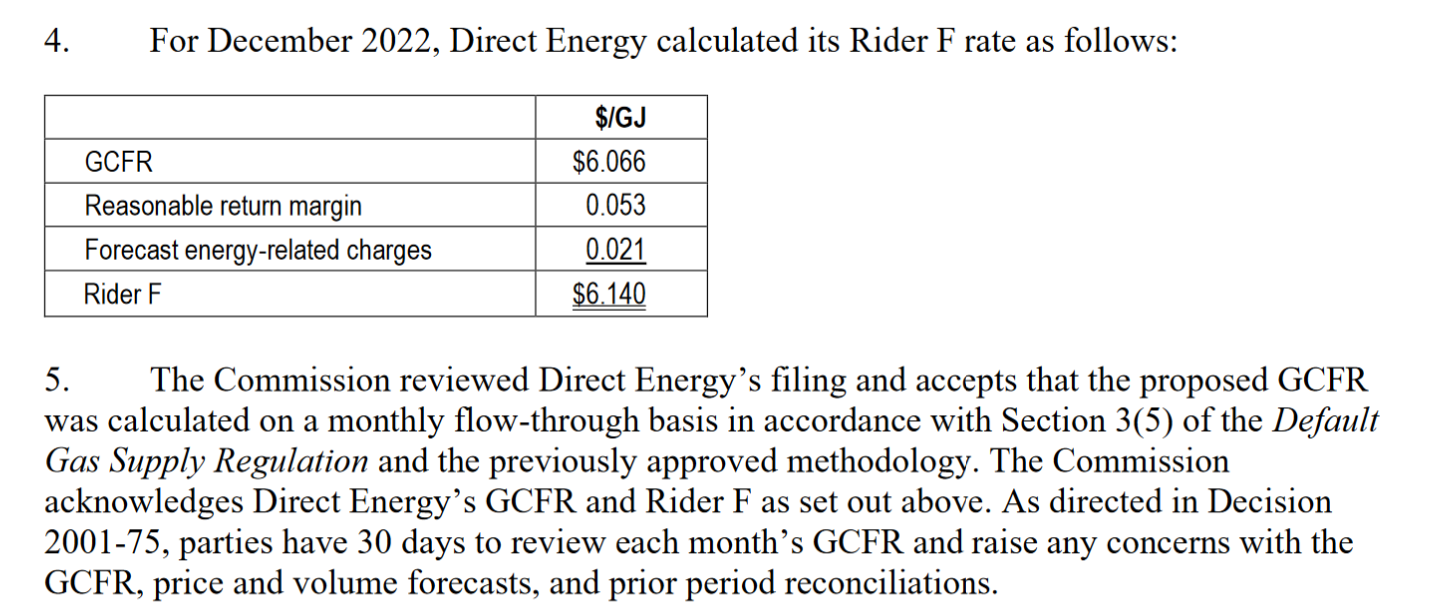

The Default Supply of Gas: Rider F

Gas Rider F, Direct Energy Marketing, December 2022 per AUC Disposition 27798-D01-2022

Electricity Generation, Gas Production and Retail

Electricity generation is a competitive market in Alberta.

- Power plants still need approval for construction and operation via AUC Rule 007, but are not rate regulated anymore

- Contra example: BC Hydro is subject to regulation by the BC Utilities Commission (see application here).

Similarly, retail sales of electricity or natural gas (the contracts) are a competitive (but still heavily regulated) market

Interprovincial Pipelines

- Interprovincial pipelines are regulated by the Canadian Energy Regulator

- the type of regulation depends on the commodity (oil and natural gas are regulated differently) and the operating company

- Group 1 companies (13 of them) are pipeline companies with extensive systems and several third-party shippers.

- Group 1 (ex KM Cochin and Enbridge Norman Wells) may have tolls set by:

- cost of service regulation based on an appplication; or

- negotiated toll settlements

See CER resource here

Interprovincial Pipelines

- Interprovincial pipelines are regulated by the Canadian Energy Regulator

- the type of regulation depends on the commodity (oil and natural gas are regulated differently) and the operating company

- Group 2 companies (82 of them) consist of all other pipeline companies which operate smaller, less complex pipelines with fewer or no third-party shippers.

- Group 2 pipelines are regulated on a complaints basis

See CER resource here

"the pipeline company is responsible for providing shippers and other interested persons with enough information to determine whether the tolls are reasonable. Shippers or other parties who cannot resolve a concern with the pipeline company may file a complaint with the CER."