ECON 366: Energy Economics

Topic 5.2: Climate Change Policies and the Energy Industry

Andrew Leach, Professor of Economics and Law

April 2025

aleach@ualberta.ca

leachandrew

@andrew_leach

Environmental Policy

The goal of this session is to introduce you to the basic economic policy problem of externalities and the prototypical solutions to it. By the end of this session, you should know (or, in some cases, recall):

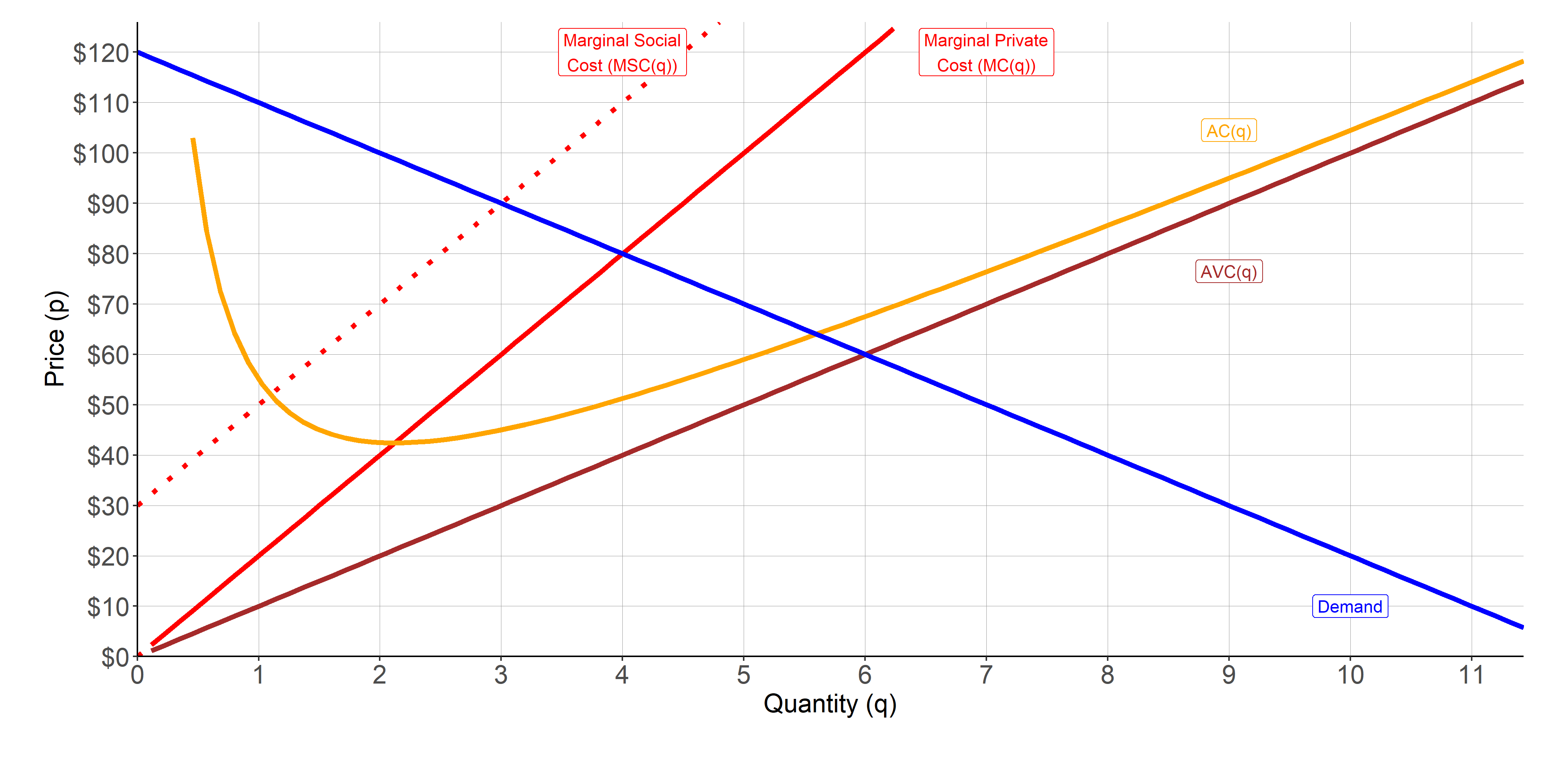

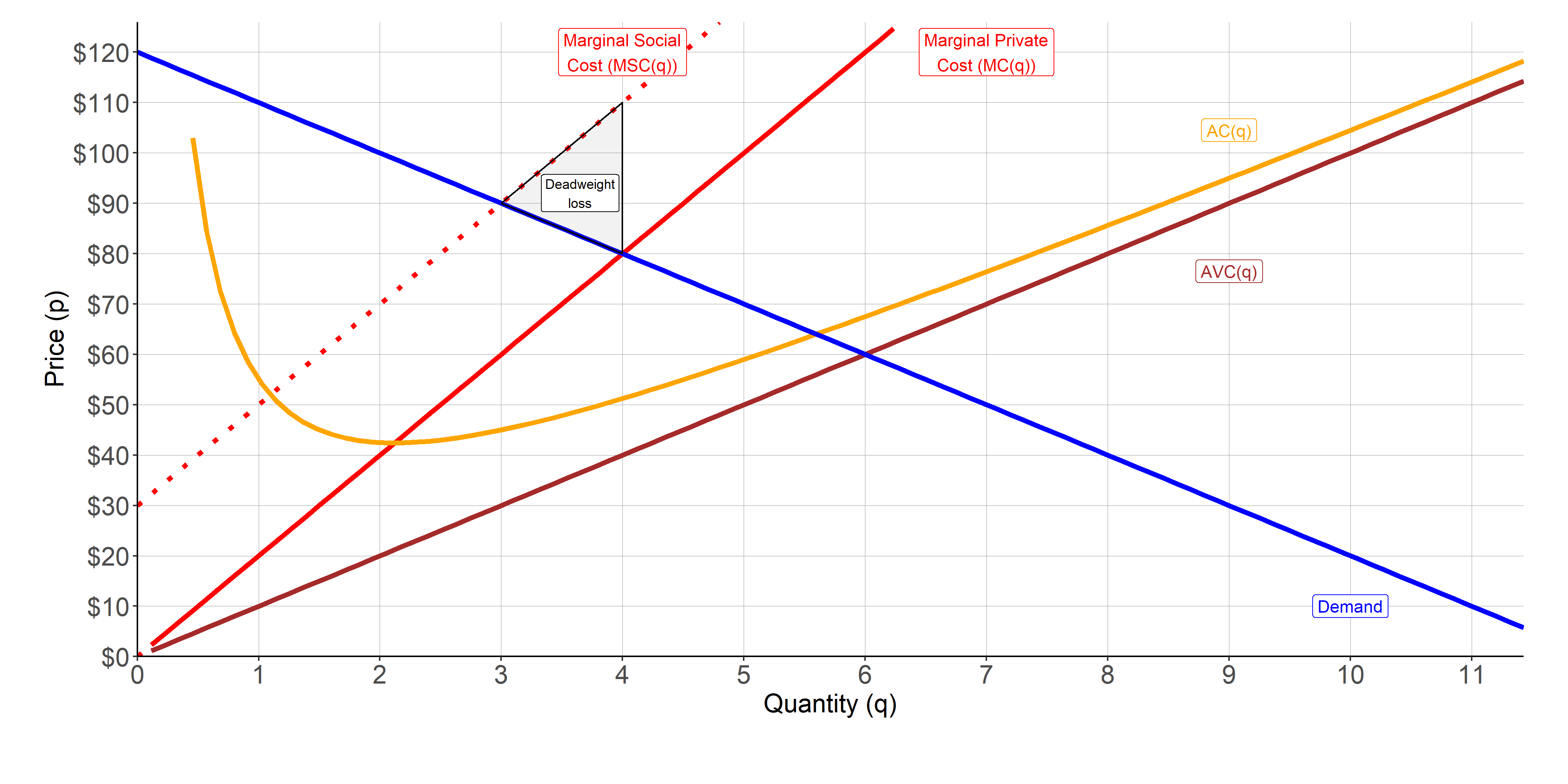

- the difference between private and social costs

- the notion of a market failure due to an external cost

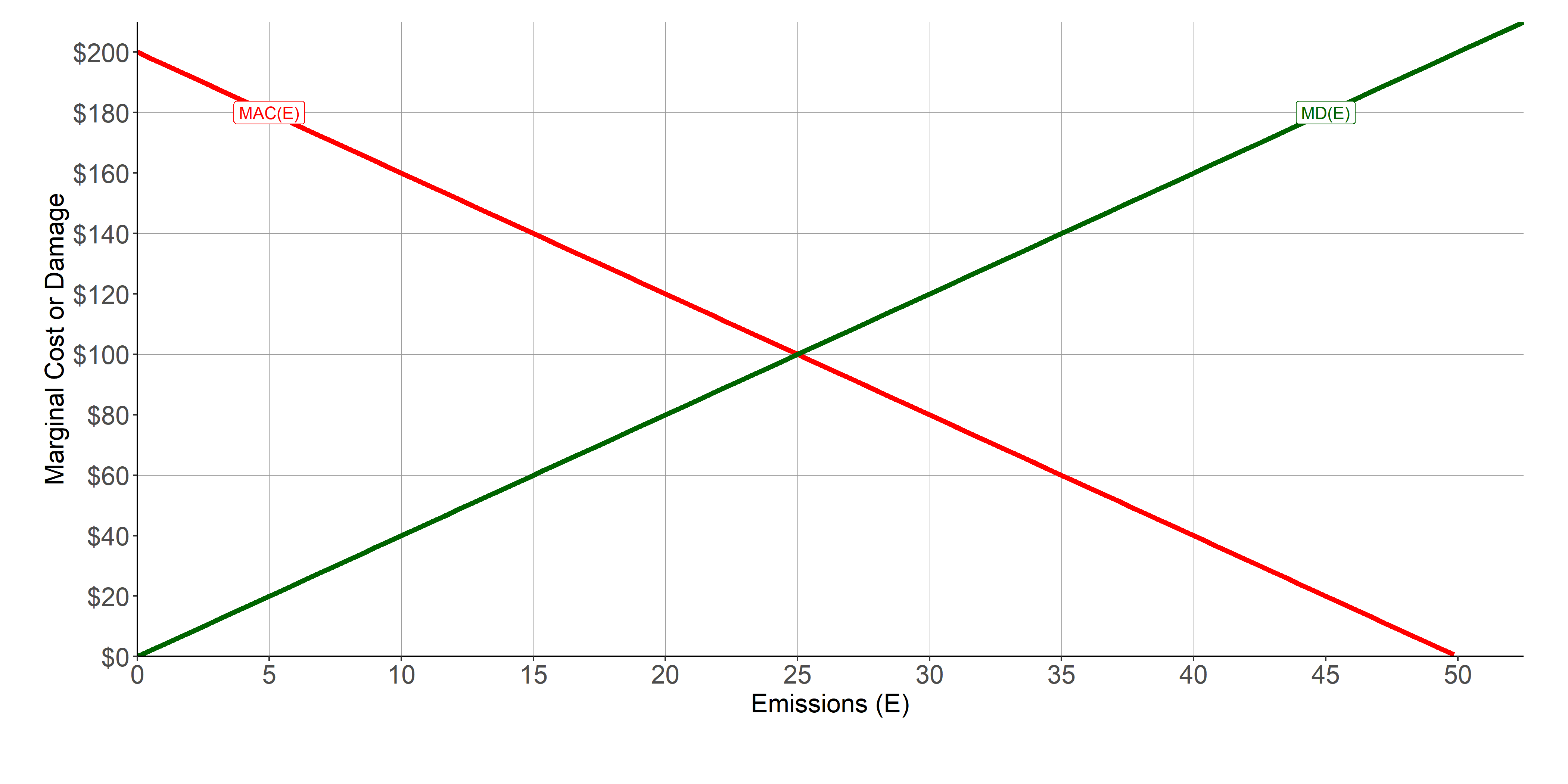

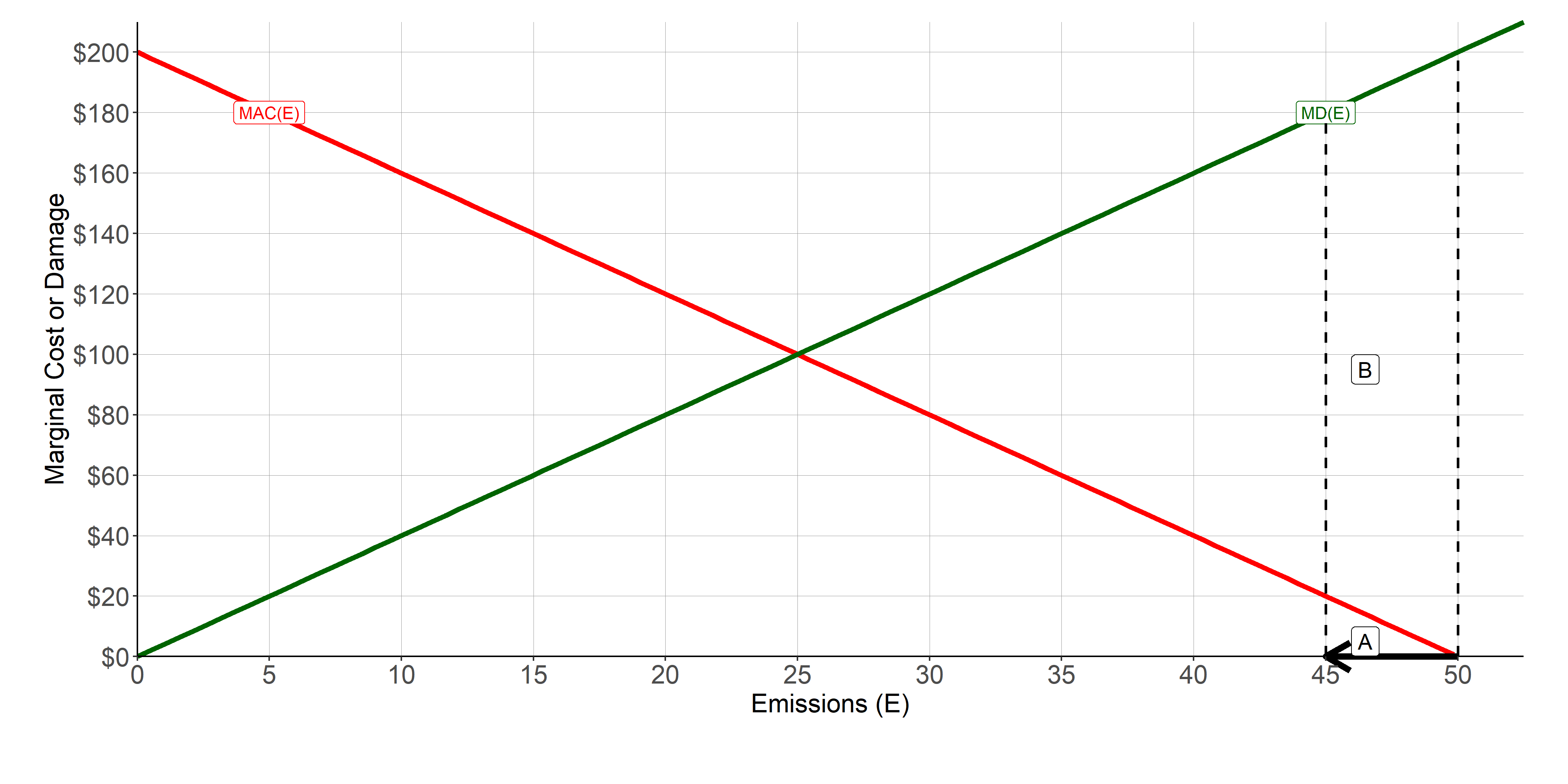

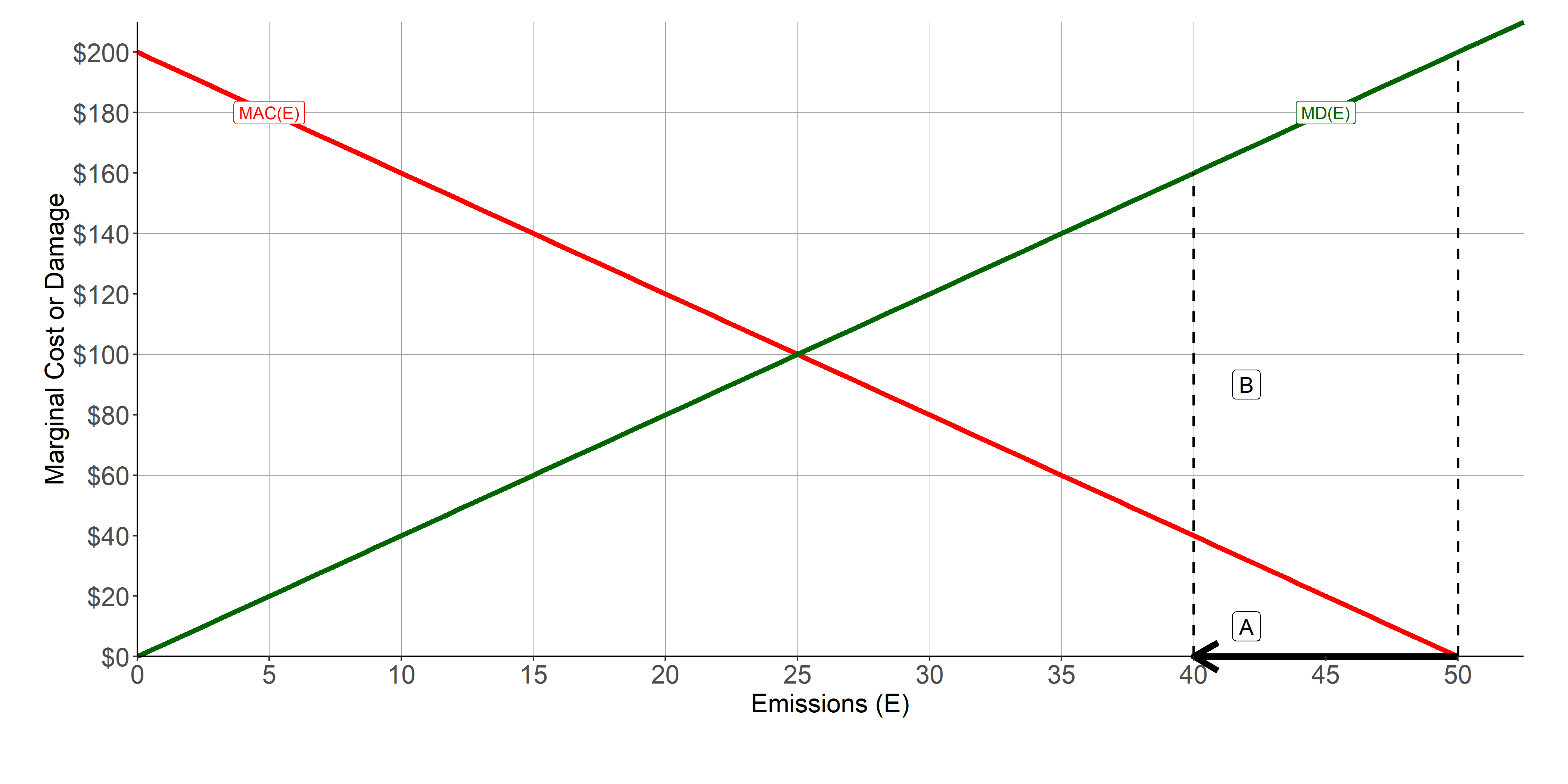

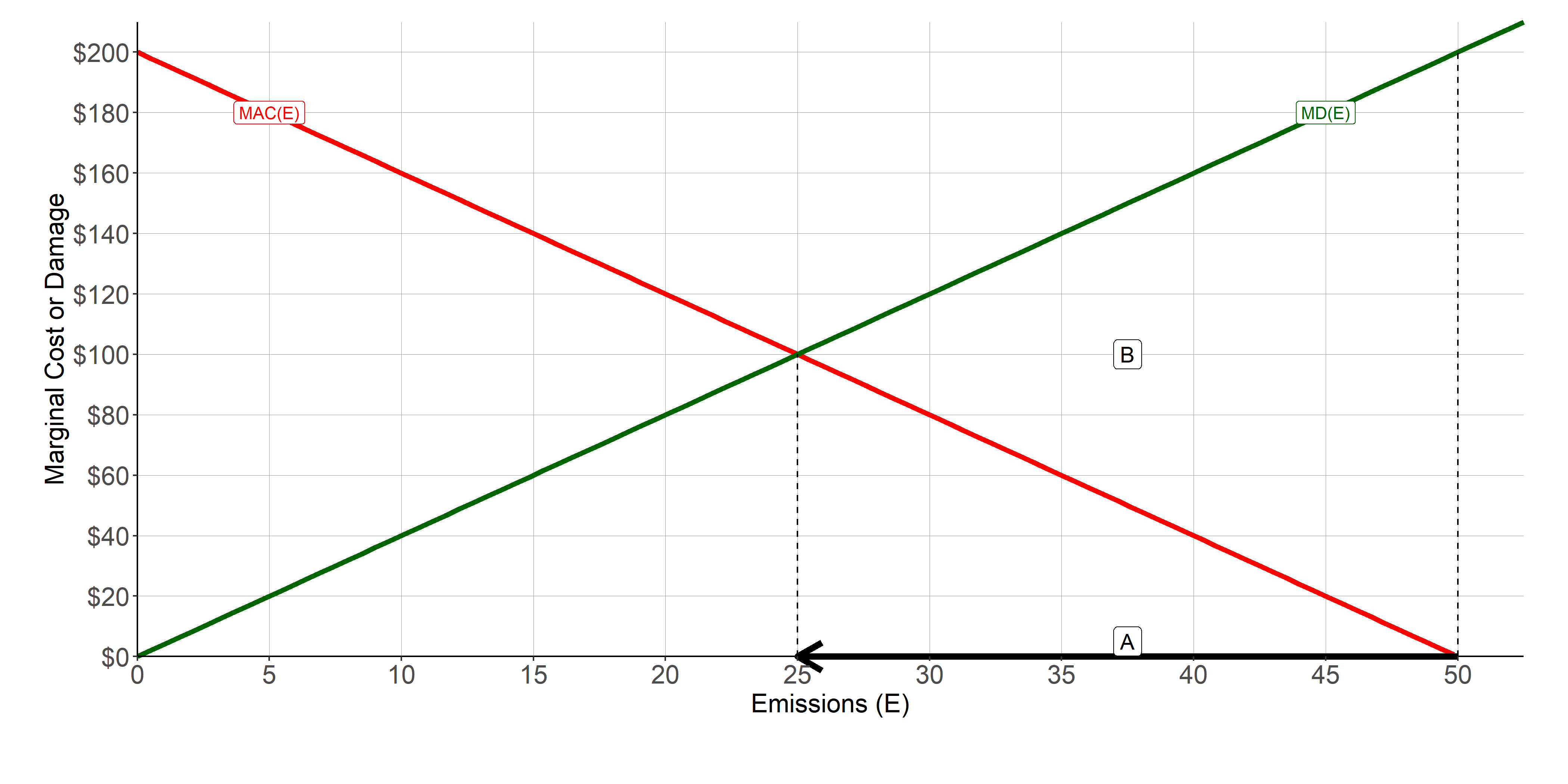

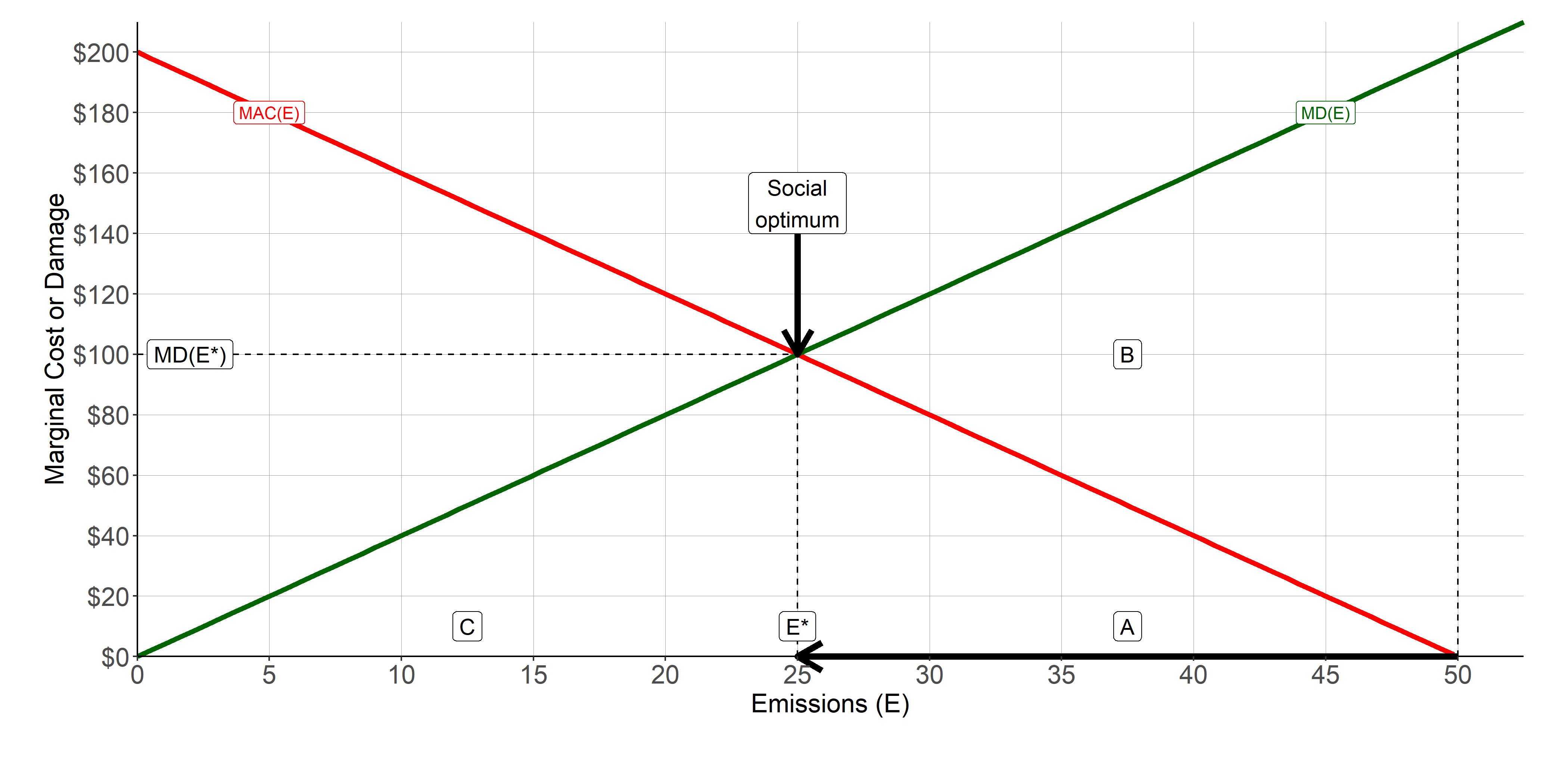

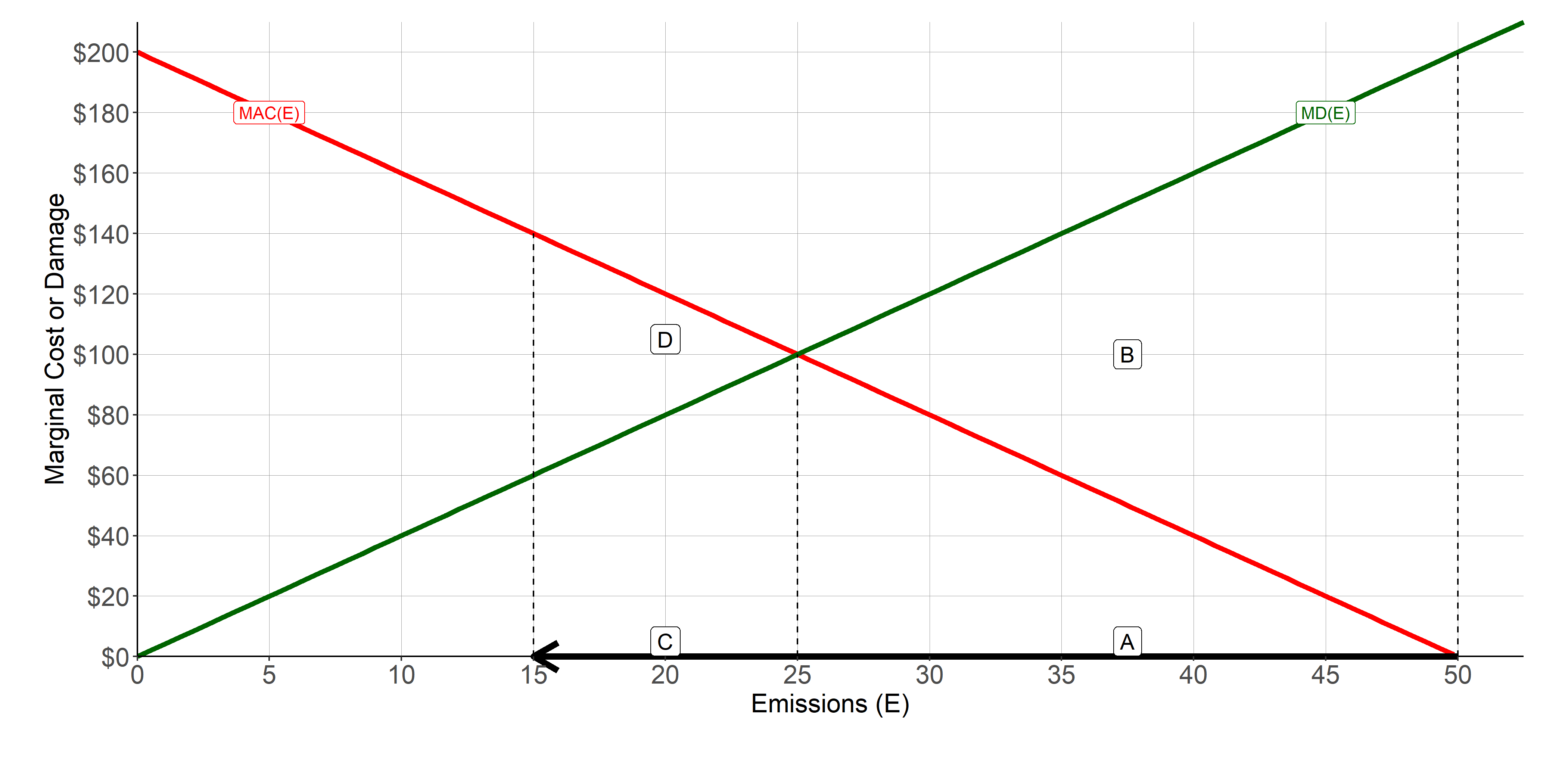

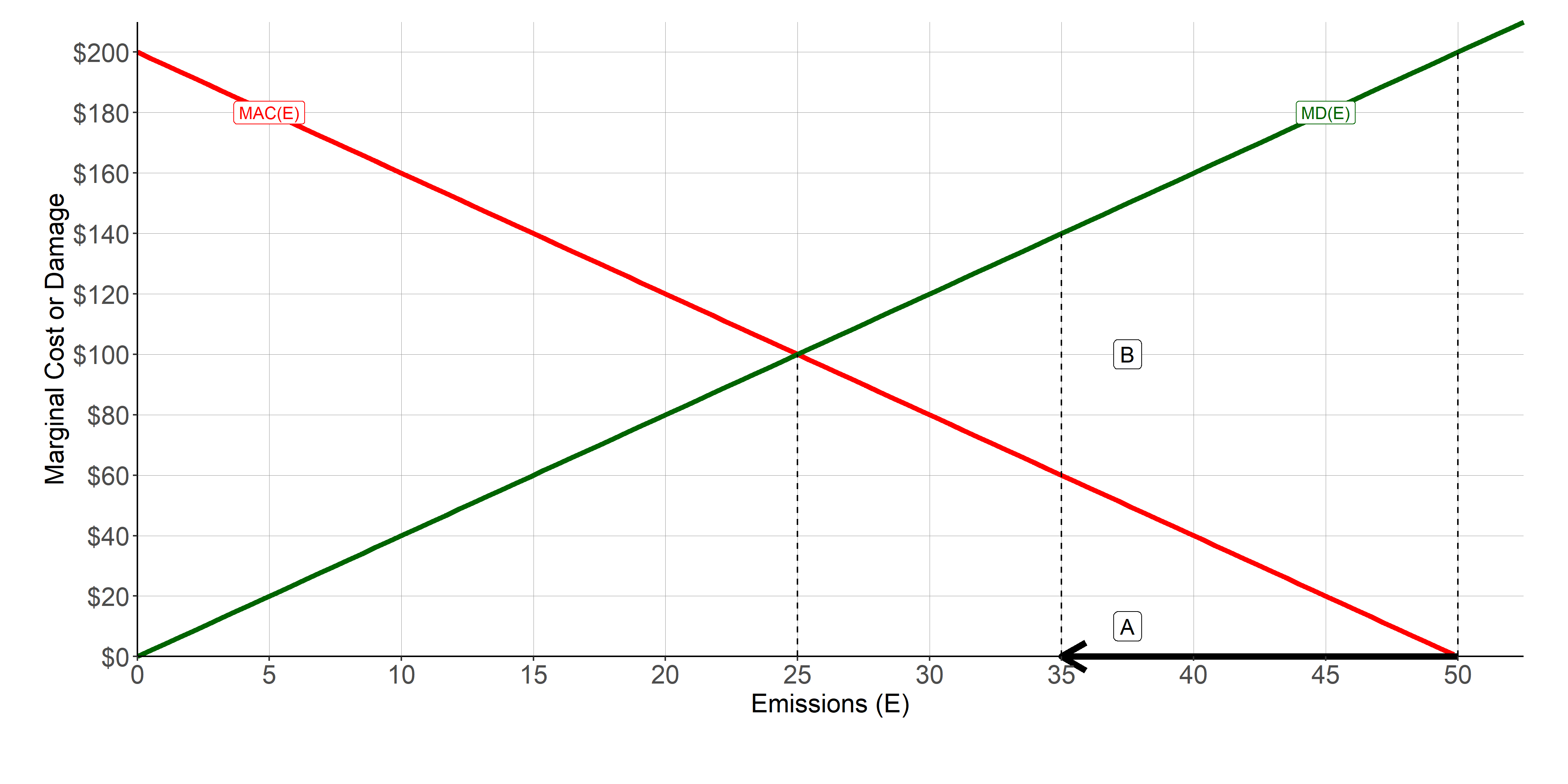

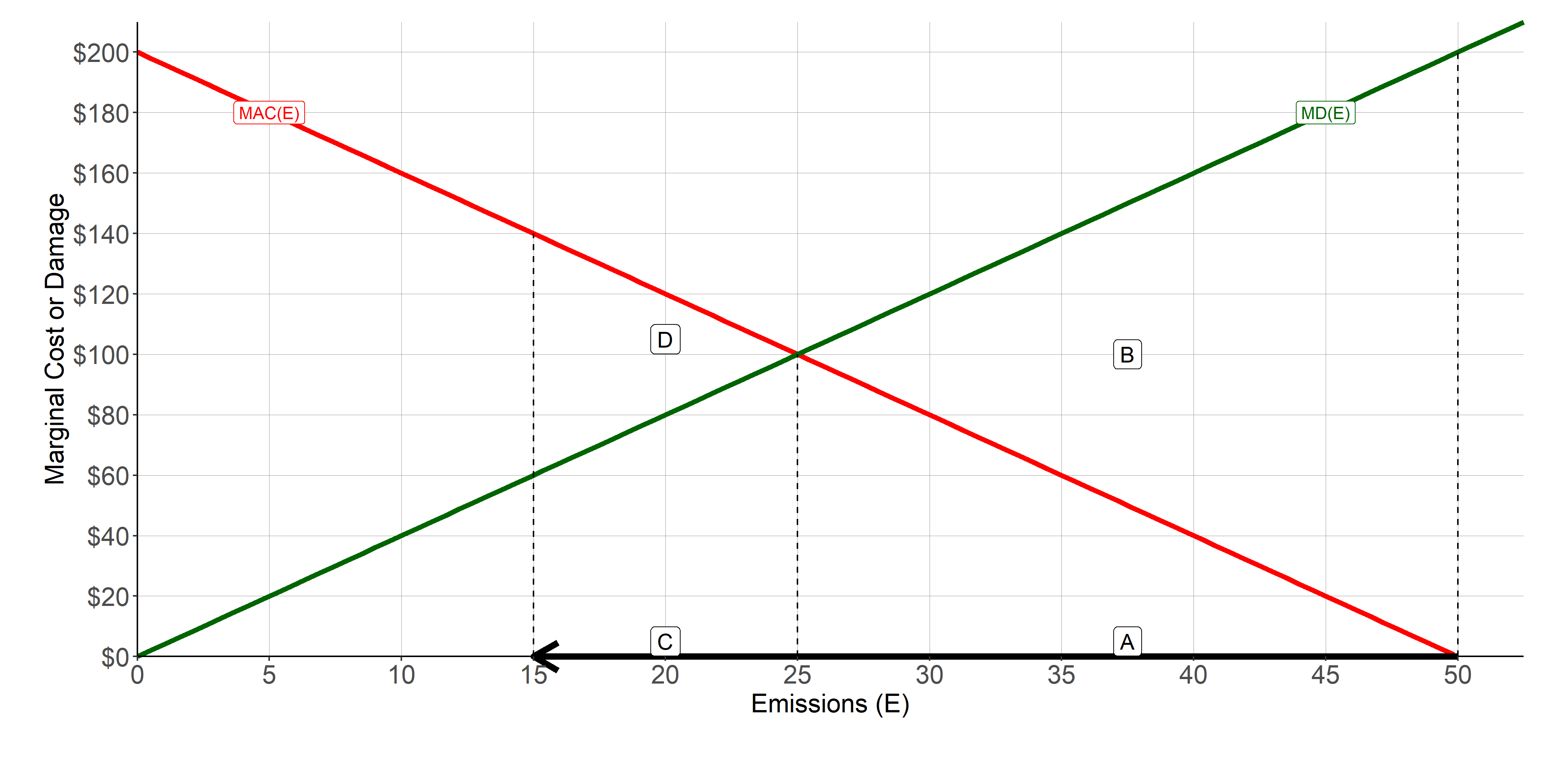

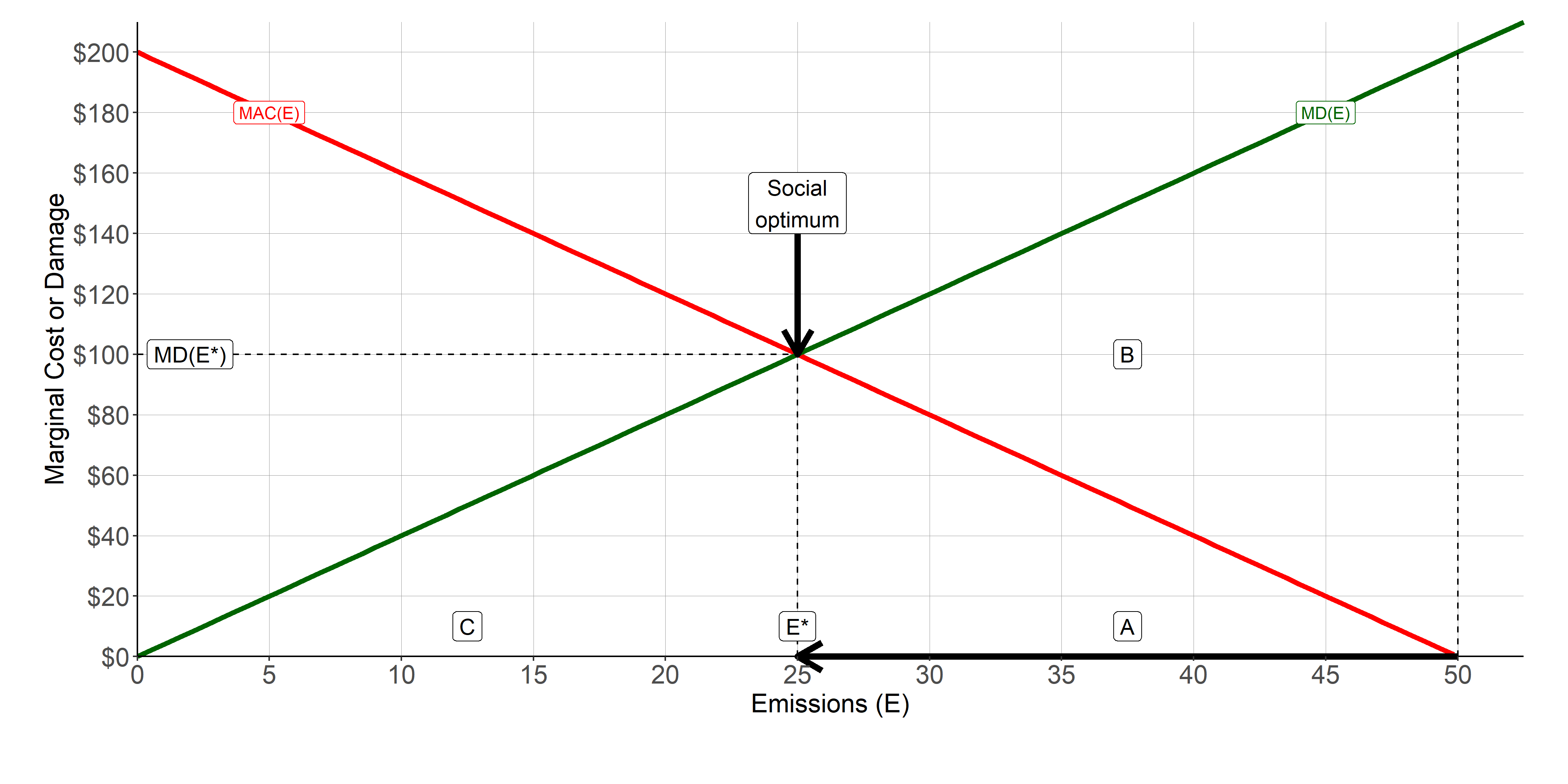

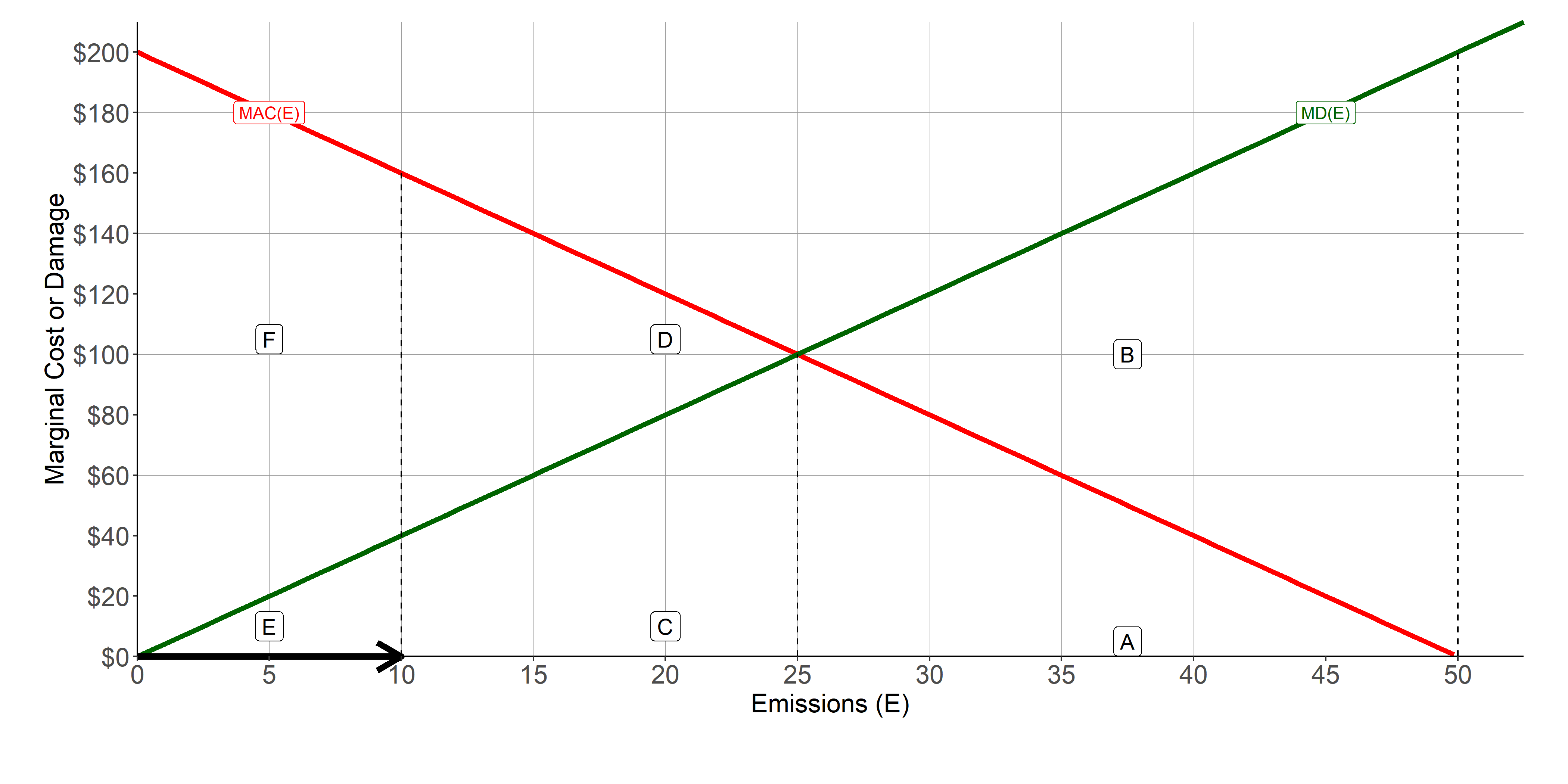

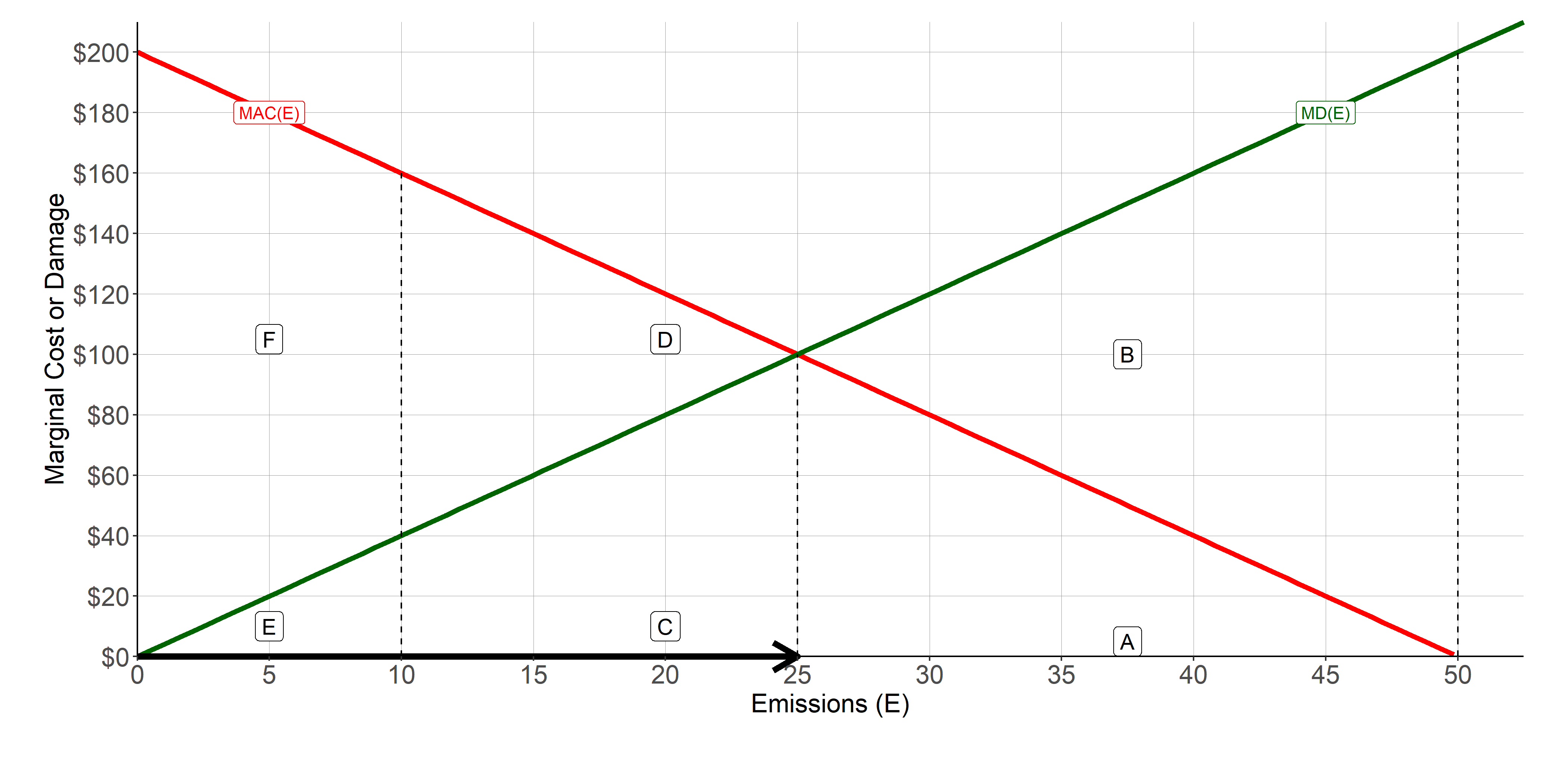

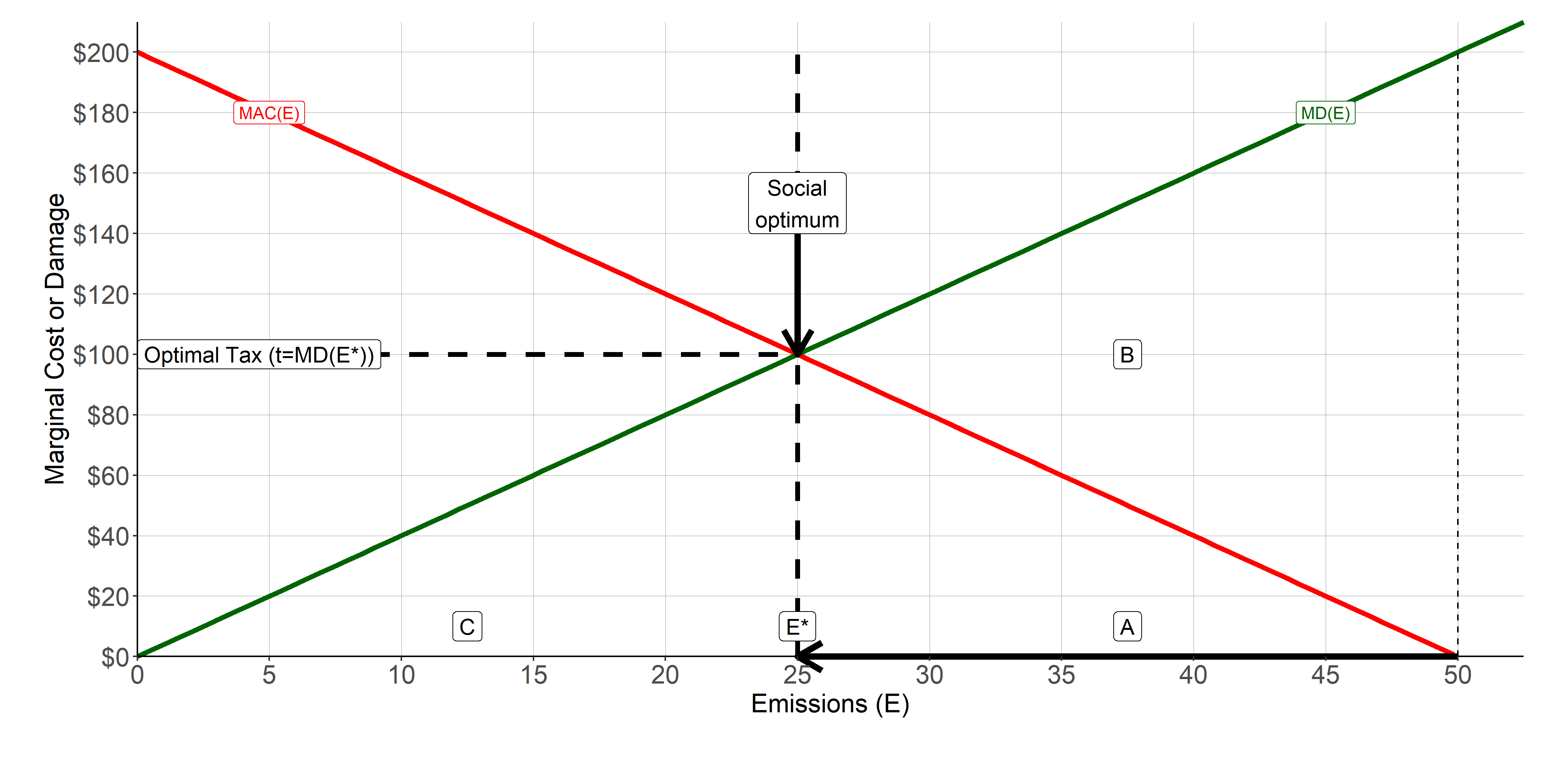

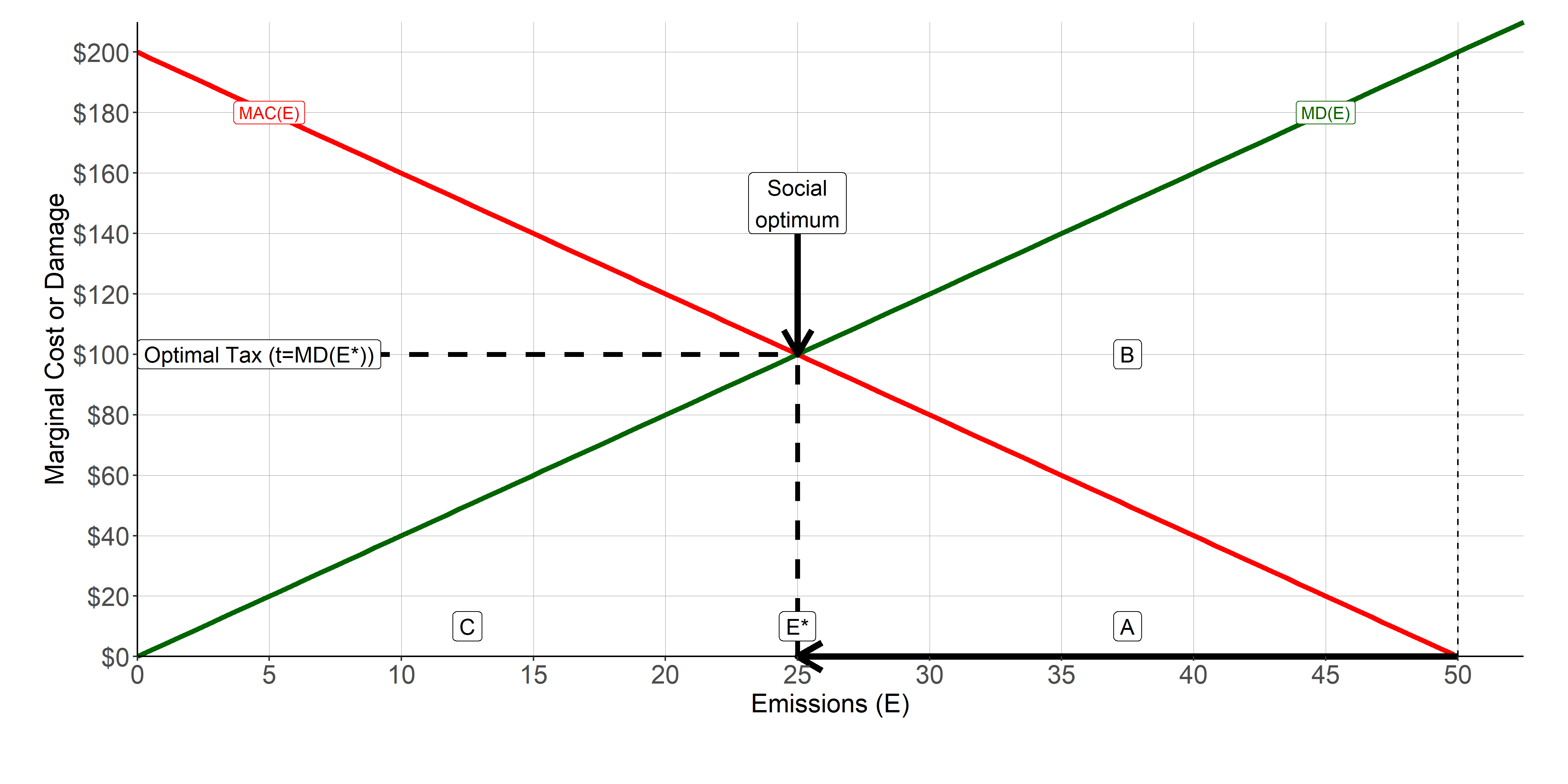

- the reduced form (MD - MAC) model of emissions or pollution control

- the Coase Theorem

You should also be able to demonstrate that you:

- Understand the social optimum in the MD-MAC model

- Understand how the social optimum obtains with the Coase theorem conditions

- Understand how taxes or regulations can drive reductions in pollution (or emissions)

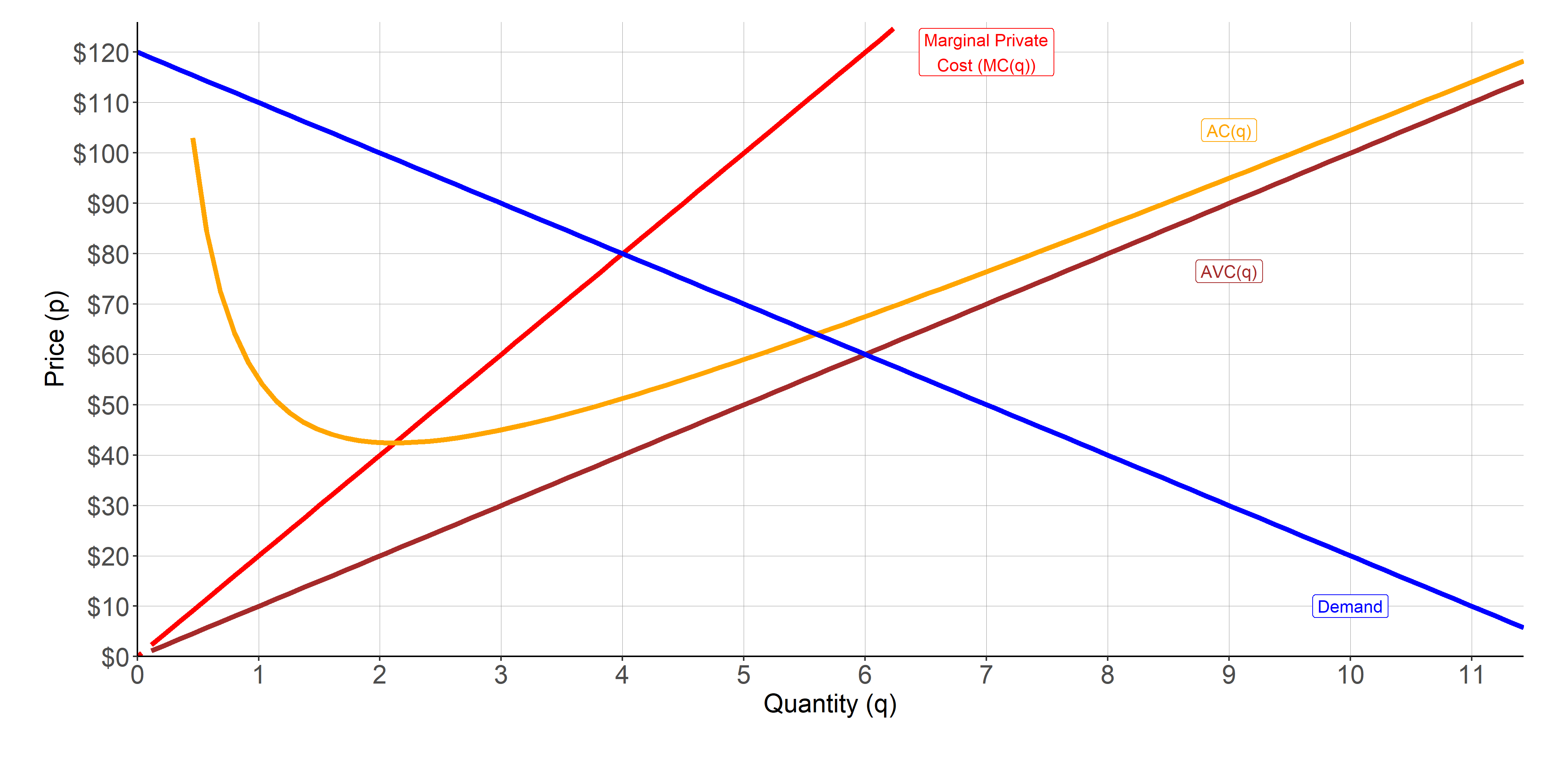

Recall the market in perfect competition?

The Basic Environmental Economics Problem

The Basic Environmental Economics Problem

The Reduced Form Environmental Economics Toolkit

The Basic Environmental Economics Toolkit

Left to its own devices, what is the firm's problem? Maximize profits.

Does the firm have to care about environmental damage?

Why or why not?

- liability in tort;

- regulations;

- taxes.

The Basics of Environmental Economics

The Basics of Environmental Economics

The Basics of Environmental Economics

The Basics of Environmental Economics

The Basics of Environmental Economics

Coase Theorem : Liability for Damages

Imagine a situation with:

- clearly defined and enforceable property rights;

- perfect information;

- zero transaction costs.

Now, what happens if:

the firm has the right to pollute?

the victim has the right to prevent any and all pollution?

Assume that, in this case, rights are tradeable.

Coase Theorem : What if the Firm Has the Right to Pollute?

Coase Theorem : What if the Firm Has the Right to Pollute?

Coase Theorem : What if the Firm Has the Right to Pollute?

Coase Theorem : What if the Damaged Have Full Property Rights?

Coase Theorem : What if the Damaged Have Full Property Rights?

Emissions Permits? How much will they be worth?

Emissions Taxes

Types of Climate Policies

Market-based tools:

carbon taxes

- a fee per unit emissions or a fee per unit deemed emissions in fuels

cap-and-trade systems

- fixed number of emissions rights and a system for trading those rights

Regulatory tools:

- regulatory regimes

- technology standards, emissions limits or caps, fuel or electricity content standards

- regulatory regimes may also have tradeable compliance credits (renewable fuel or electricity standards, for example)

Types of Climate Policies

Spending tools:

- subsidies

- feed-in tariffs, production tax credits, investment tax credits, etc.

Hybrids policies (flexible regulations) are almost always what gets implemented

Combinations of most of the above now exist in many jurisdictions

Command-and-control measures

This is a broad category of measures that basically involve the government regulating one of:

- Technology (e.g. A ban on coal power)

- Performance (e.g. emissions intensity or fuel economy standards)

- Emissions output (licensing rules on facilities)

- Siting or permitting regulations (IAA, SARA, etc.)

Command-and-control measures

Federal and provincial programs currently implement standards of all different types

Small engines (Off-Road Small Spark-Ignition Engine Emission Regulations, SOR/2003-355 under CEPA, 1999)

Light duty vehicles (SOR/2014-207 under CEPA, 1999)

Alberta regulates upstream venting and flaring (AER Directive 60)

Federal Reduction of Carbon Dioxide Emissions from Coal-fired Generation of Electricity Regulations (SOR/2012-167 CEPA, 1999)

Command-and-control measures

Economic critiques

- Requires a lot of information on the part of government

- Limited incentive to innovate

- May require very expensive emissions reductions from some facilities while ignoring cheap opportunities elsewhere

Market-based approaches

Easiest (IMO) to start with two questions:

- Who has the right to emit by default or how is such a right obtained?

- Are rights scarce in the economic sense – do they bind total emissions?

Market-based approaches to emissions control essentially:

- create and distribute regulatory rights (or licenses) to emit or, equivalently, exemptions from tax on emissions

- Enforce a requirement that emissions be less than held licenses/rights/exemptuions, or to pay a tax on emissions net of rights/licenses/exemptions

Market-based approaches

Cap-and-trade programs are the prototypical market-based approach for pollution

First implemented widely in the context of acid rain in the 1990s

Now implemented in the European Union (EU-ETS) and in a joint Quebec-California market (WCI) among others for carbon emissions

Implementation in each market varies in terms of:

- Distribution rules, including share of rights that are auctioned vs allocated freely

- Safety valves, including reserves of rights that are made available if prices climb too high

- Trading rules – in some markets there are clawbacks when rights are exchanged

Market-based approaches

Example : Quebec’s cap-and-trade system

- Who is an emitter? (s. 2)

- What must an emitter do, including registration, reporting, etc. (Title II, Ch. 2)

- What GHG emissions are included and how entities must quantify their emissions and use allowances or offset credits to cover these emissions (Title II, Ch. 3)

- Rules for transactions of emissions allowances (Title II, Ch. 4) including limits on banking of allowances

- Emissions allowances (ss. 36-7), reserve allowances (s 38), free allocation (s. 39), auctions (ss 45-64) including minimum prices (s 49), and other ways to receive allowances (ss 65-70)

Remainder of the Regulation includes penalties for violation and appendices establishing industry-level conditions

Market-based approaches

Example : Quebec’s cap-and-trade system

The system has been expanded to recognized allowances from the California and, at one point, Ontario systems for compliance in Quebec

From an individual firm’s point of view, the markets are unified and you can purchase or sell allowances to entities in any market. In practical terms, this ensures a common price between California and Quebec

Market-based approaches

Pure cap-and-trade approaches provide quantity certainty and let the market determine the price of allowances/offsets/licenses/rights to emit

The introduction of price mitigation (reserve allowances, etc.) cuts against that price certainty, allowing emissions to rise if prices get too high

Average cost of the policy to firms depends on the emissions allowances allocated free of charge, the auction prices, and perhaps the volatility of prices through the year

Marginal cost – the value of an incremental emission or emissions reduction – is determined by the market price for allowances

Market-based approaches

Economists favour market-based approaches in general because of:

- Limited information requirements compared to facility-specific standards

- Market mechanism ensures cost-effectiveness – facilities with cheapest emissions reductions will reduce first, and more expensive reductions will not be undertaken

- Incentives to innovate are strong, since lowering emissions allows for the sale of allowances and/or avoided purchases

Environmentalists have tended to favour cap-and-trade approaches because of emissions certainty, although that was challenged by relatively weak targets in the EU for many years

Carbon taxes

A carbon tax sees the government act, effectively, as the default seller of emissions allowances and total emissions are not capped

Prototypical carbon tax implemented in BC in 2007

A reasonable proxy for a carbon tax in some ways is implemented in Canada under the Greenhouse Gas Pollution Pricing Act (GGPPA), but that’s better described as a hybrid policy

Key attributes of a carbon tax regime

- Coverage (which emissions or which facilities/sectors/etc)

- Stringency (how much is the tax)

- Exemptions and credits (are there ways to avoid the tax)

Average cost of the policy to firms will generally be equal to the price ($/tonne) applied through the tax

Marginal cost – the value of an incremental emission or emissions reduction – is the same as the average cost: the value of the tax

Carbon taxes

Example: BC's Carbon Tax Act, SBC 2008, c 40

What’s covered by the tax? fuel at point of purchase (s. 8) or imported fuel (ss. 9-10) or fuel used in BC that was not otherwise taxed (s. 11)

Exemptions (s 14) and credits (ss 14.1 – 14.2)

Collection mechanics and penalties

Carbon tax rates for different fuels (Schedule 1)

Carbon taxes

Economists favour carbon taxes for the same reasons as cap-and-trade:

- Limited information requirements compared to facility-specific standards

- Market mechanism ensures cost-effectiveness – only emissions reductions which cost less than the tax will be undertaken, since otherwise it makes more sense to pay the tax

- Incentives to innovate are strong, since lowering emissions allows for avoided carbon tax payments

Environmentalists have tended to favour cap-and-trade approaches because of emissions certainty

- Skepticism of carbon taxes has historically also focused on regressive elements of the tax on fuels

Hybrid policies

Most emissions pricing policies contain some elements from each policy type

Flexible regulations: regulations with some ability to trade credits for over-compliance or to substitute with financial compliance (i.e. paying a fee)

Output-based pricing systems: elements of cap-and-trade (allowance issuance, trading rules, offsets) combined with carbon taxes (gov’t sets a fixed price for sale of reserve allowances)

The GGPPA, for example, has a consumer carbon tax combined with an output-based pricing system for larger emitters

Alberta’s Alberta's Technology, Innovation and Emissions Reduction Regulation is an output-based pricing system with government as default seller of carbon credits

Renewable fuel and vehicle emissions regulations allow flexible compliance (trading)

Clean Fuel Standard allows for flexible compliance and a credit market

Hybrid policies

Example: Alberta's TIER Regulation

Facilities emitting more than 100kt/yr are covered (s.3), with an opt-in (s.4) or aggregation (s.5) for facilities emitting more than 10kt/yr if there is a covered, competitor facility

Each product has a benchmark, which you can think of as a rate at which allowances are issued (0.2974 tonnes of allowances per barrel of bitumen, for example) (s.6)

Facilities may have facility-specific benchmarks (s. 7)

Facilities where compliance costs exceed competitiveness thresholds may qualify for a higher benchmark (s.8)

Hybrid policies

Example: Alberta's TIER Regulation

Facilities must report emissions and output, as well as on-site heat and power generation if applicable

Allowable emissions (s. 9) are equal to the sum of:

- Allocation rate times output for each product net of:

- Allocation rate for net electricity exports

- Credits for imported hydrogen or heat

Hybrid policies

Example: Alberta's TIER Regulation

Any gap between allowable and actual emissions must be trued-up (s. 13(2)) by:

- Retirement of emissions offsets

- Retirement of emissions performance credits banked from a previous year or bought from another facility

- Payments to the government to buy credits from the Fund at a fixed price per tonne

A facility which has more allowable than actual emissions may be issued emissions performance credits (s. 20) which can be banked or traded

Hybrid policies

Key differences between a program like TIER and a pure carbon tax charged on every tonne of emissions will be the average cost of compliance

- Benchmarks effectively act like refundable tax credits, giving facilities some free emissions

- Hybrid programs can still provide a strong incentive to reduce emissions at operating facilities, while not encouraging reductions in output

- The output-based allocation or benchmark is effectively an output subsidy

- Hybrid programs have very different implications for investment or divestment/shut-in decisions, since they affect the average profitability less than a pure carbon tax

- Output-based allocations of credits can also exist in cap-and-trade systems, just as output-based tax credits might be issued under a carbon tax.

No bright line between carbon pricing, carbon taxes, cap-and-trade, and hybrid policies

Environmental Policy

Key takeaways and what I expect you to remember, and be able to reproduce:

- What is the unregulated level of pollution in the MD-MAC model;

- What is the social optimum;

- What happens under Coase theorem conditions;

- What happens under a given emissions or pollution tax.

- key attributes of different policy types

- know what I've told you in this deck about the different examples