ECON 366: Energy Economics

Topic 2.1: Oil and Gas Markets

Andrew Leach, Professor of Economics and Law

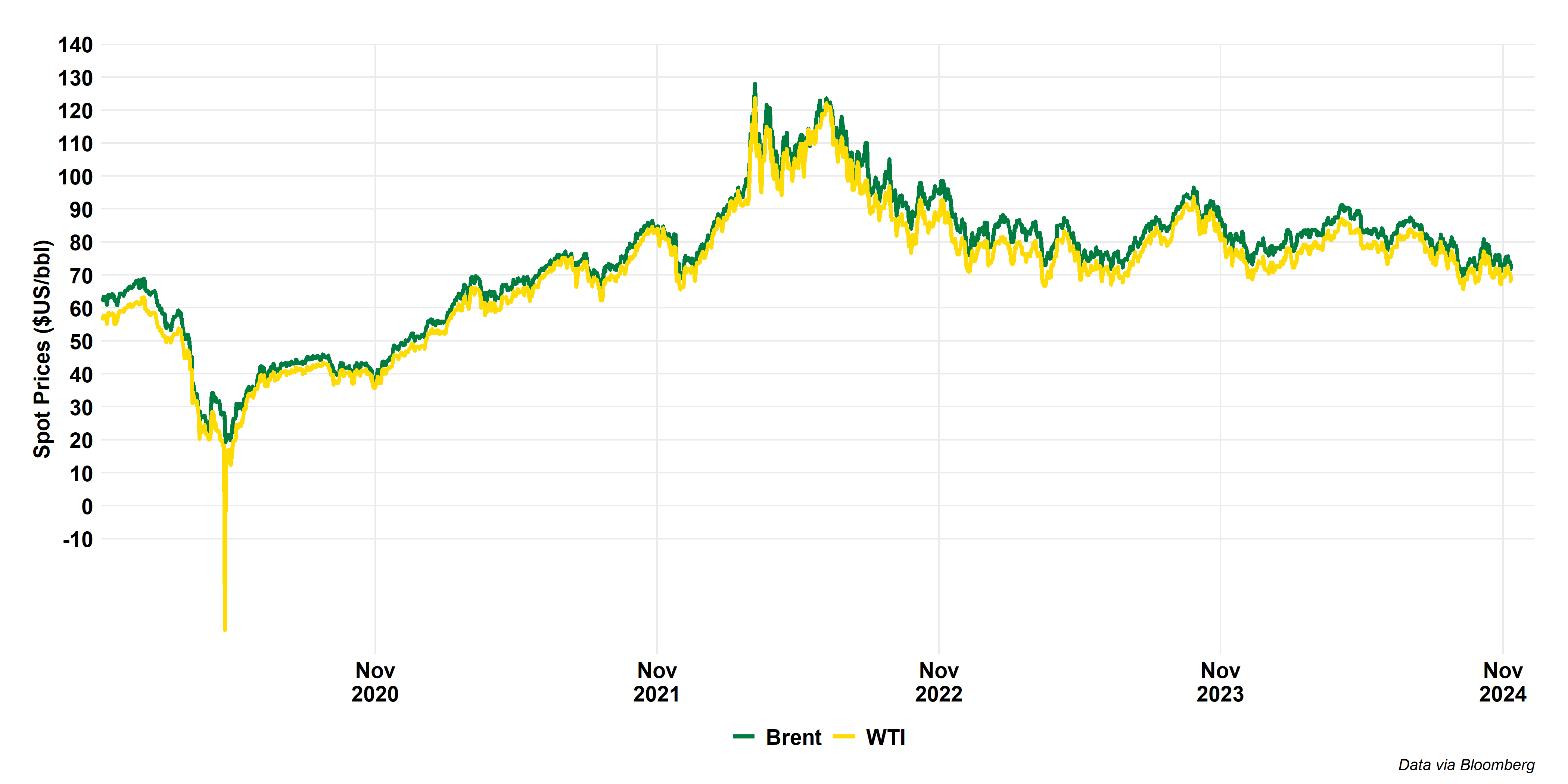

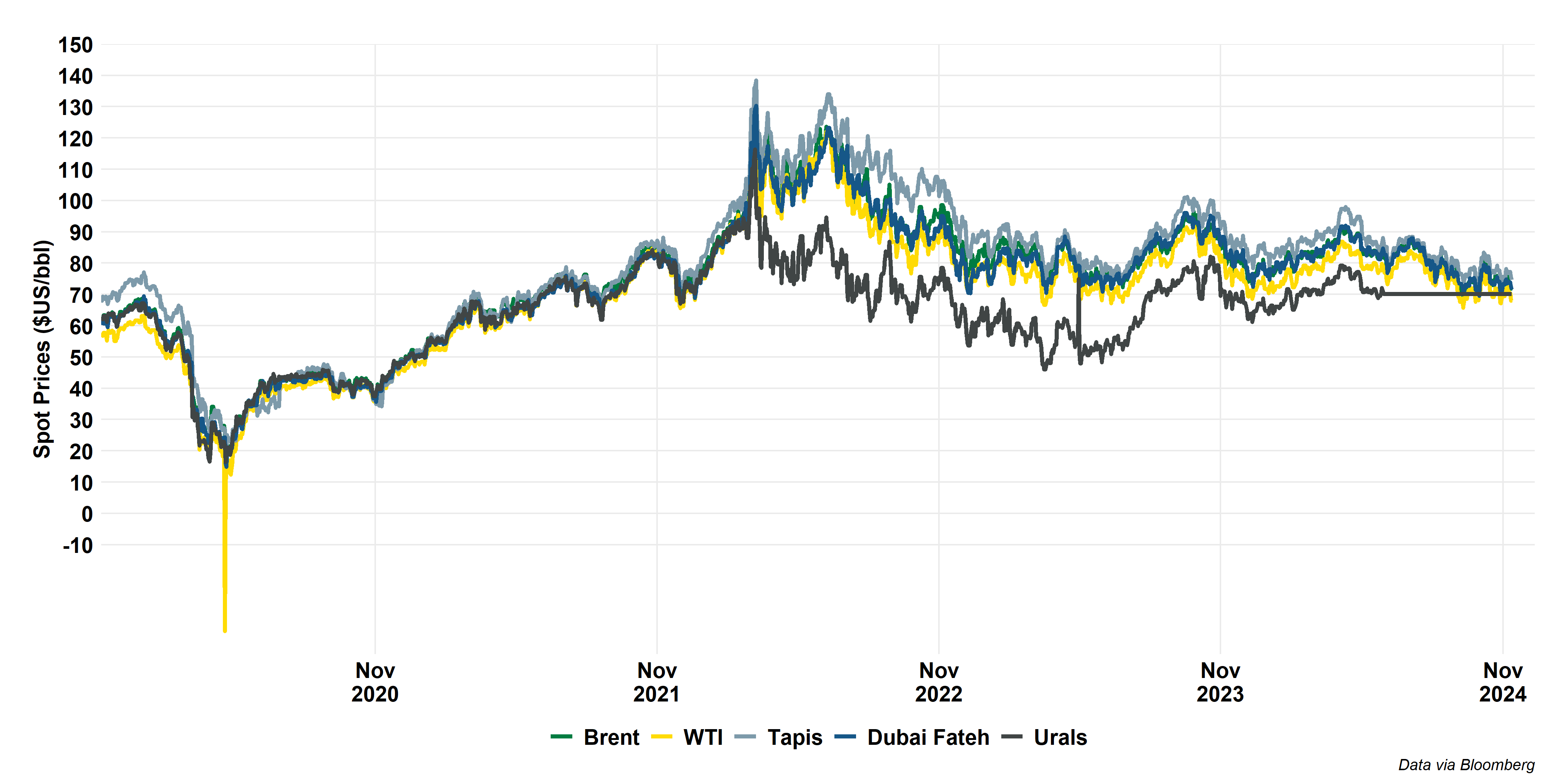

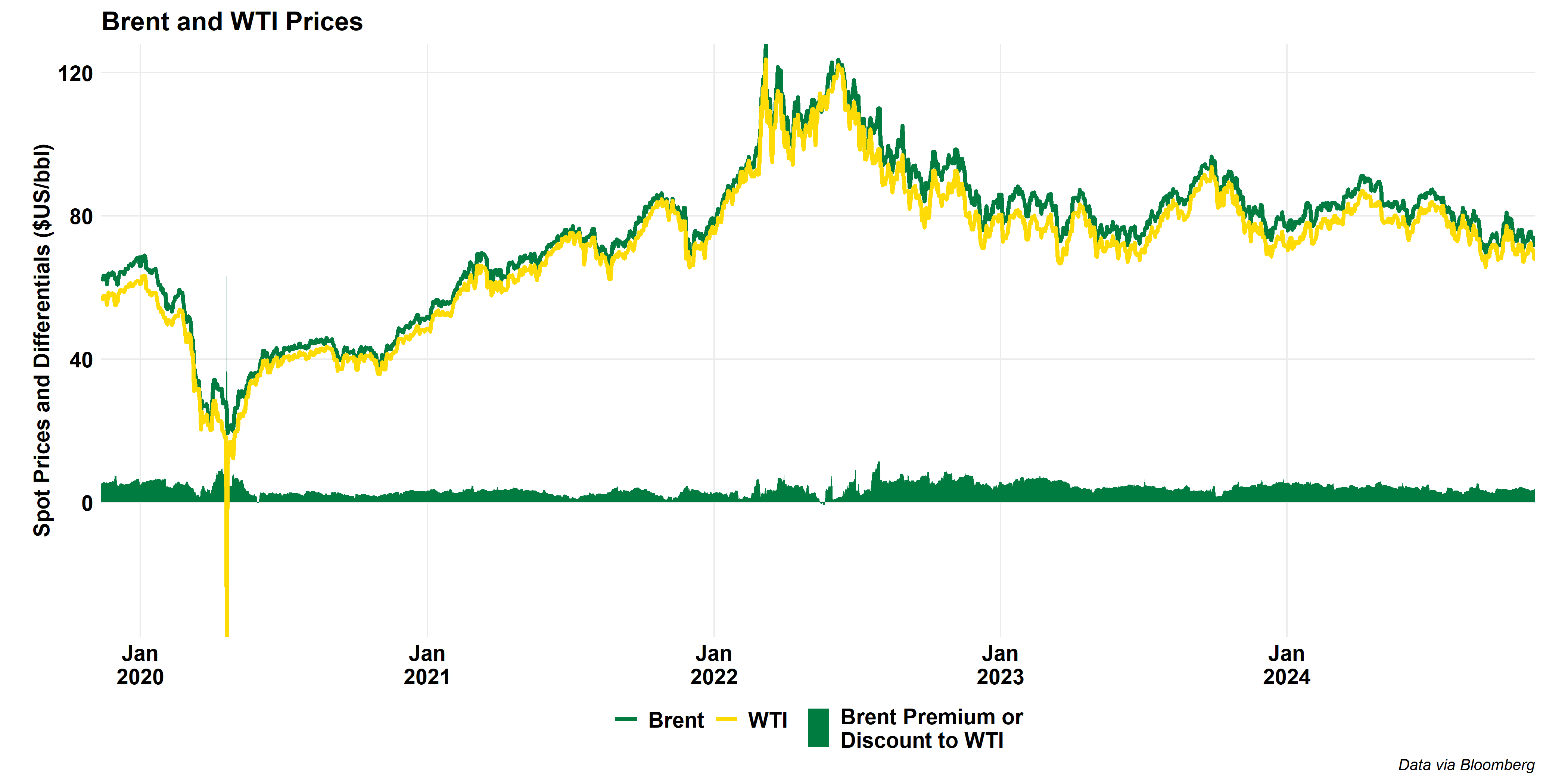

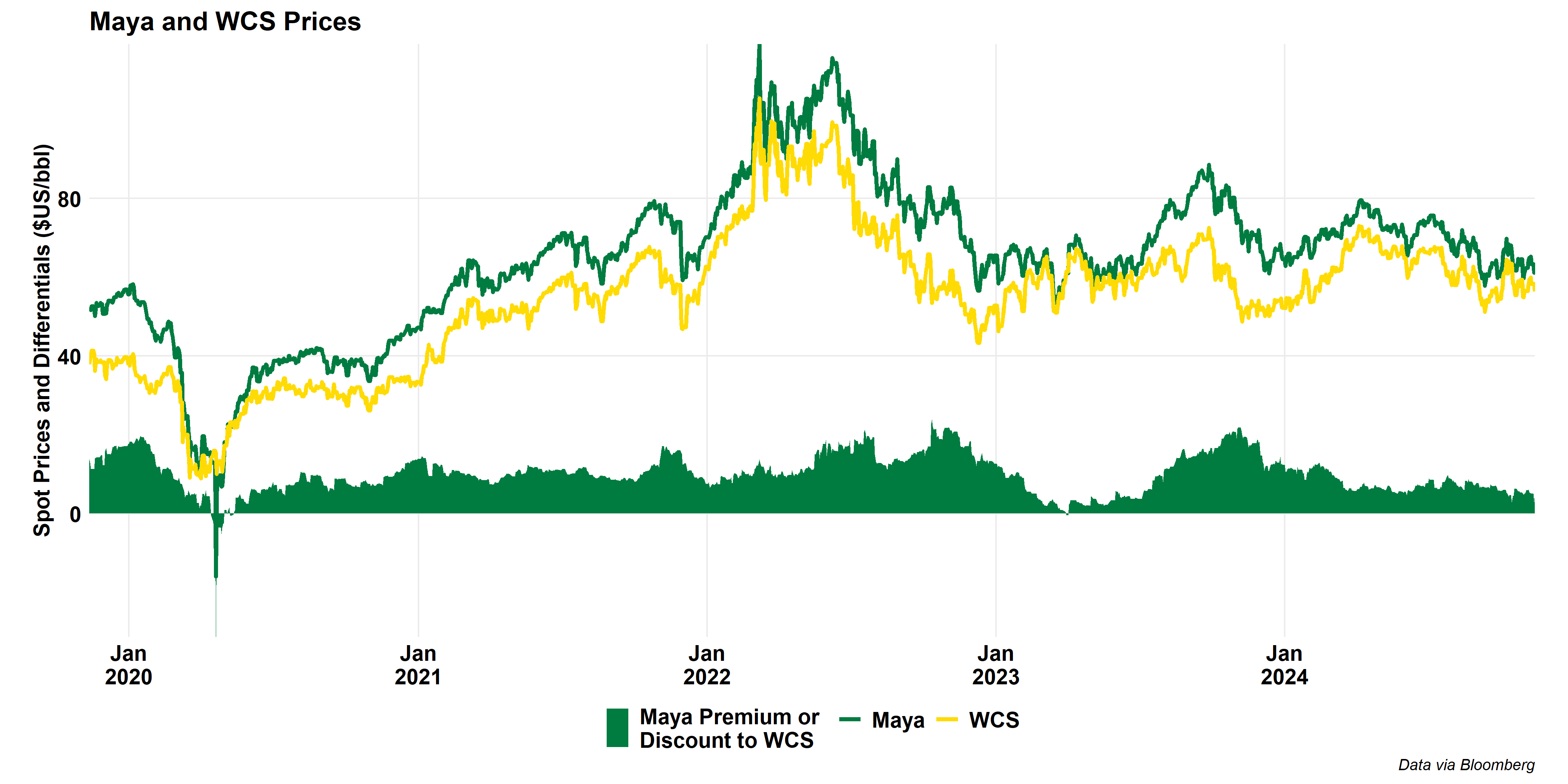

Oil and gas prices

Oil, gas, and related product prices tend to vary based on four characteristics:

- Fundamentals of the commodity

- Quality differences like heating values or sulphur content

- Location where the price is set

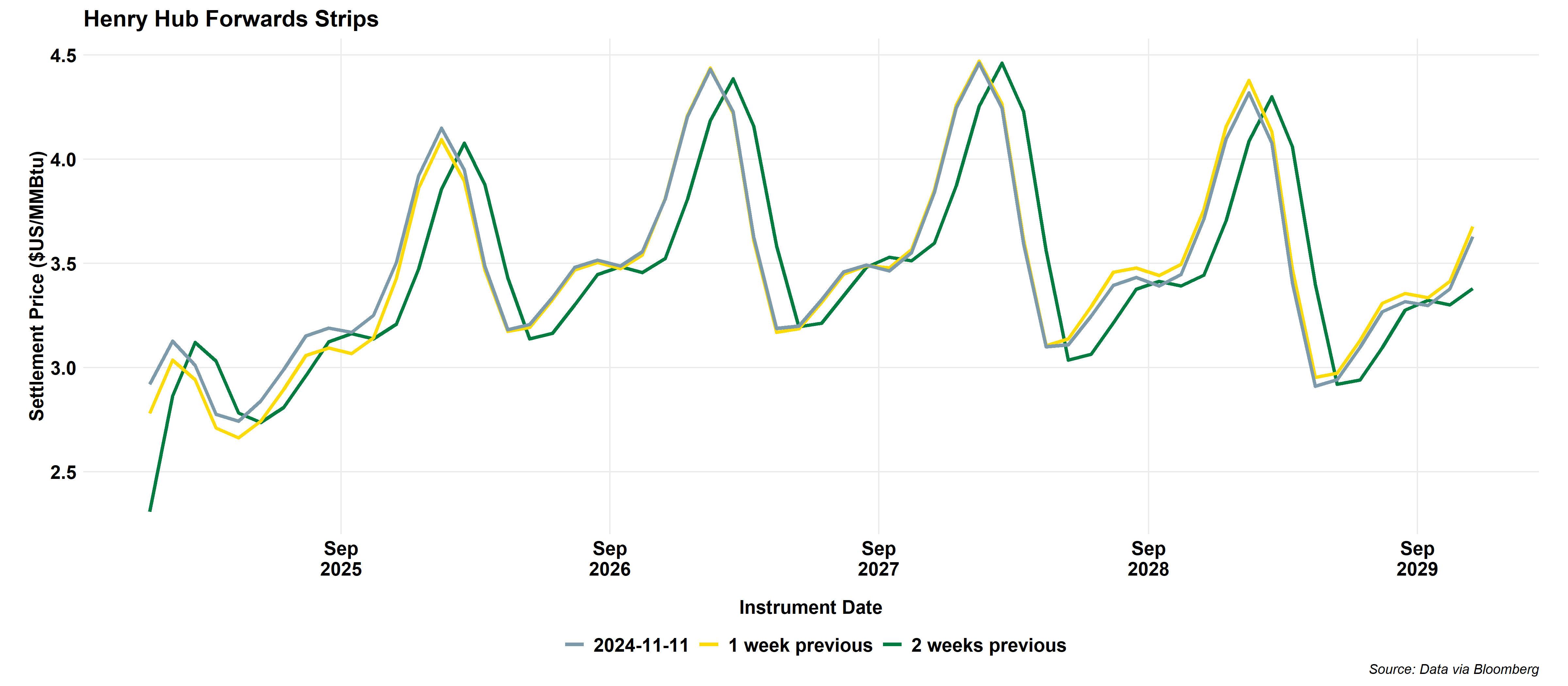

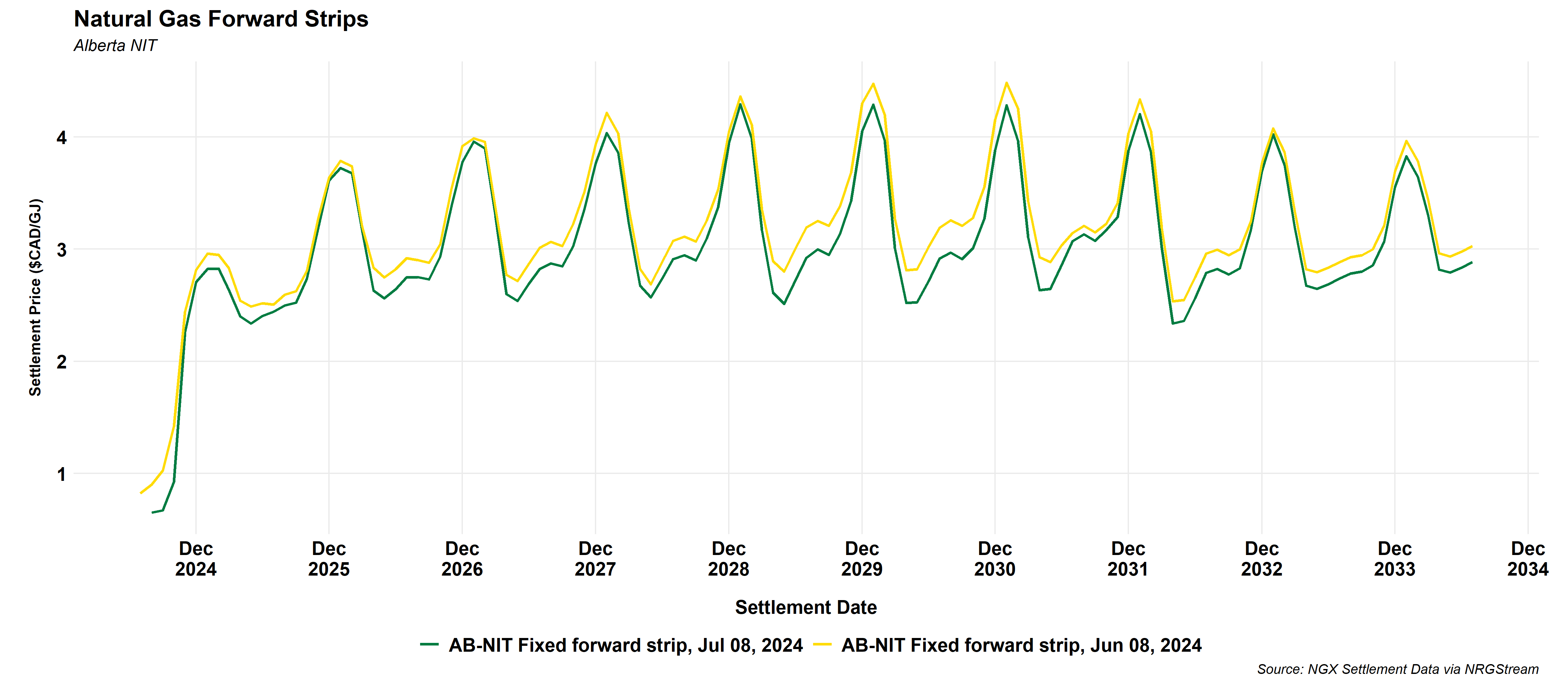

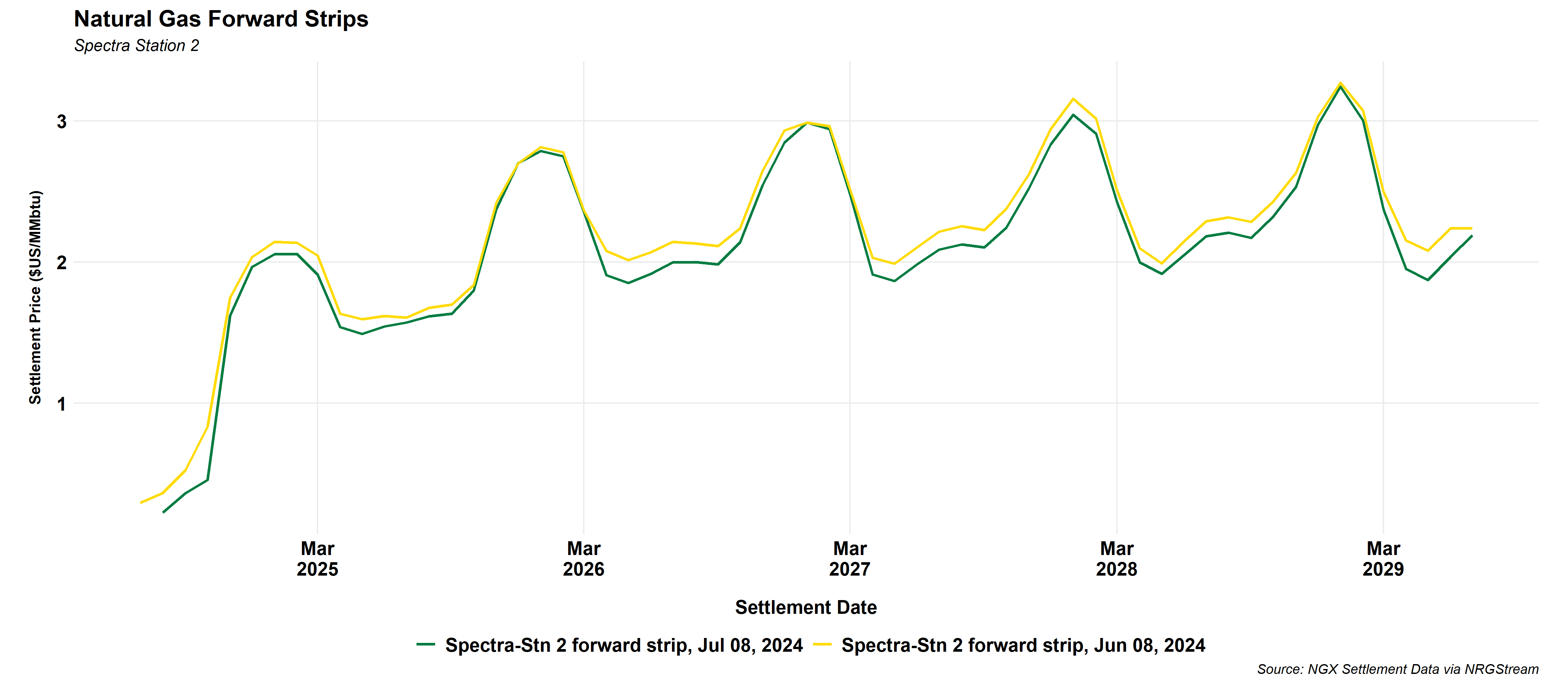

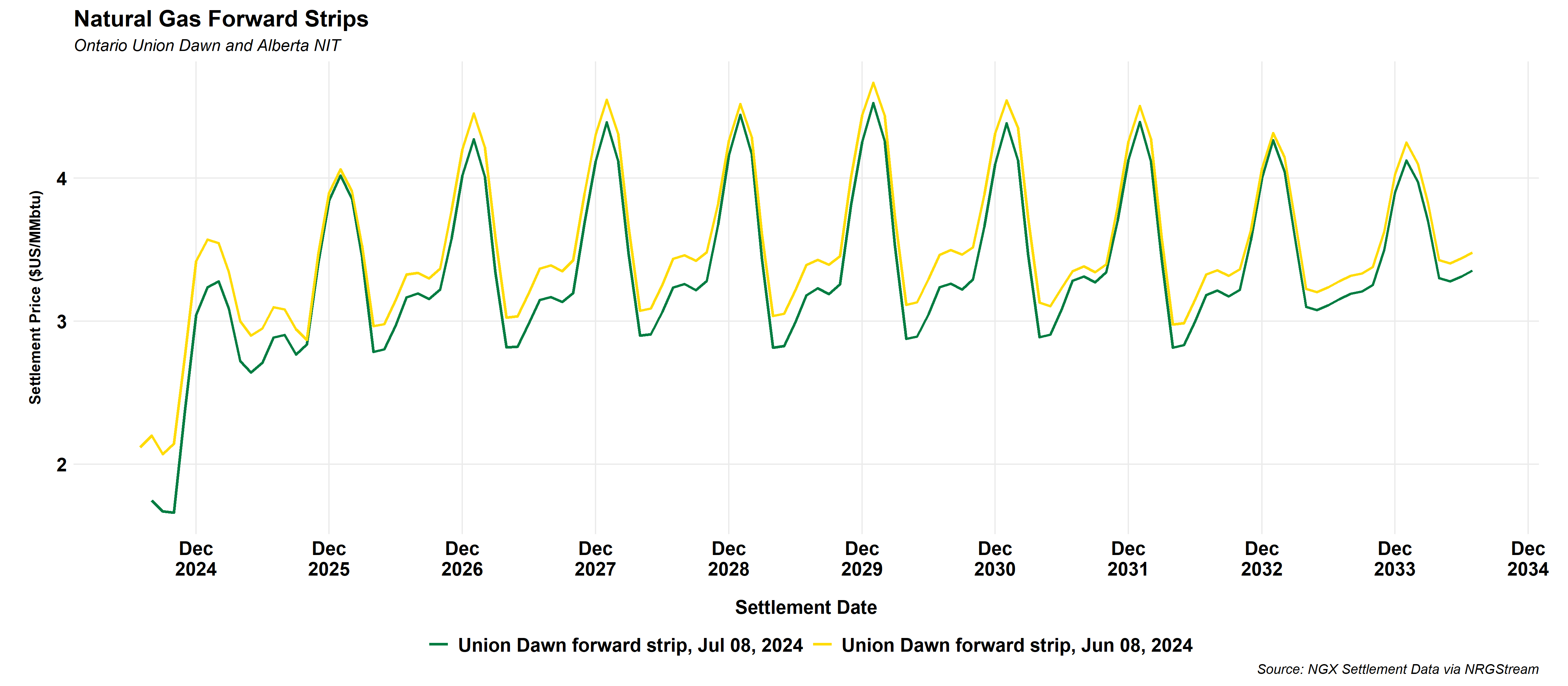

- Time – gas prices are seasonal, oil and gas futures prices vary over time

For example, the answer to the question “what’s the price of oil,” should not be, “$54.15 per barrel.” It should be, “what type of oil, when, and where?” Similar variations exist in gas markets.

Product definitions

Oil

- All oil blends are mixtures of various hydrocarbon molecules and impurities

- Crude assay tells you the properties of any given mixture

- Benchmark crudes (WTI, WCS, Brent) have target assays

- Key components of value are density (or API gravity, which is an inverse density), and sulphur content (sweet vs sour)

- Different crudes with the same API gravity and sulphur content may differ in other characteristics (light ends, bottoms, etc) which lead to premia or discounts

WCS specifications

Crude Quality

Global oil – main pricing locations

Global oil – main pricing locations

North American oil – main pricing locations

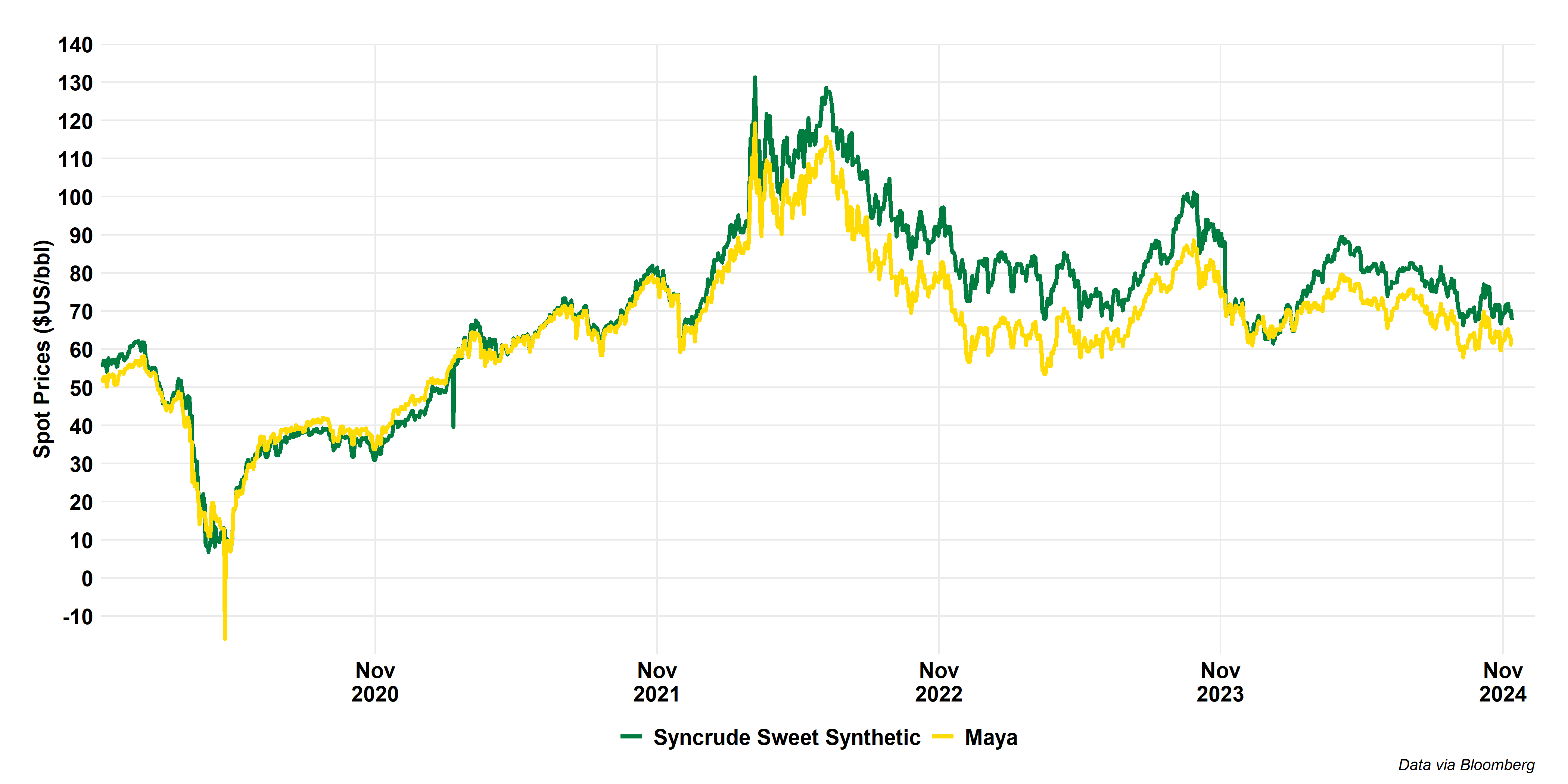

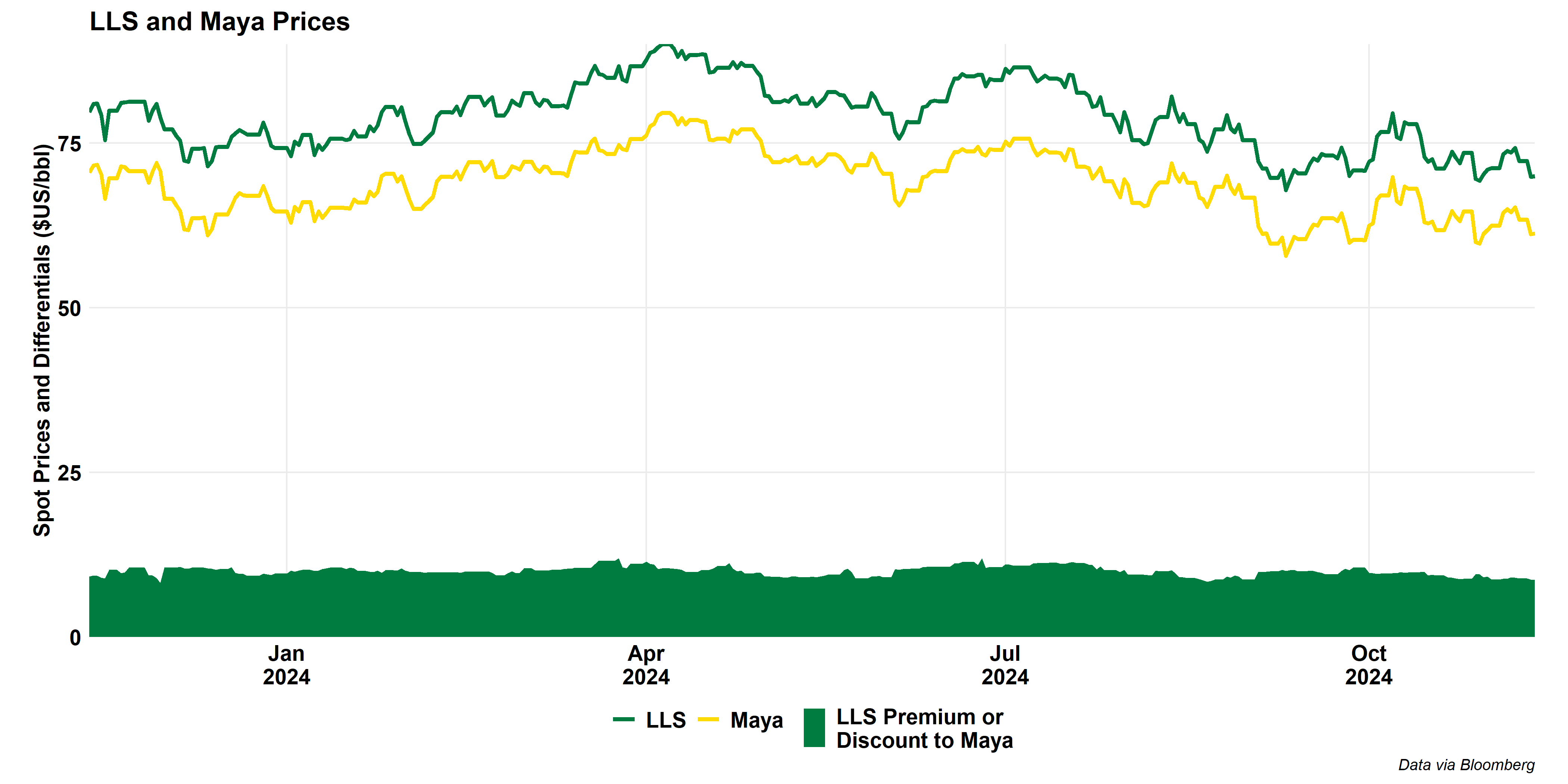

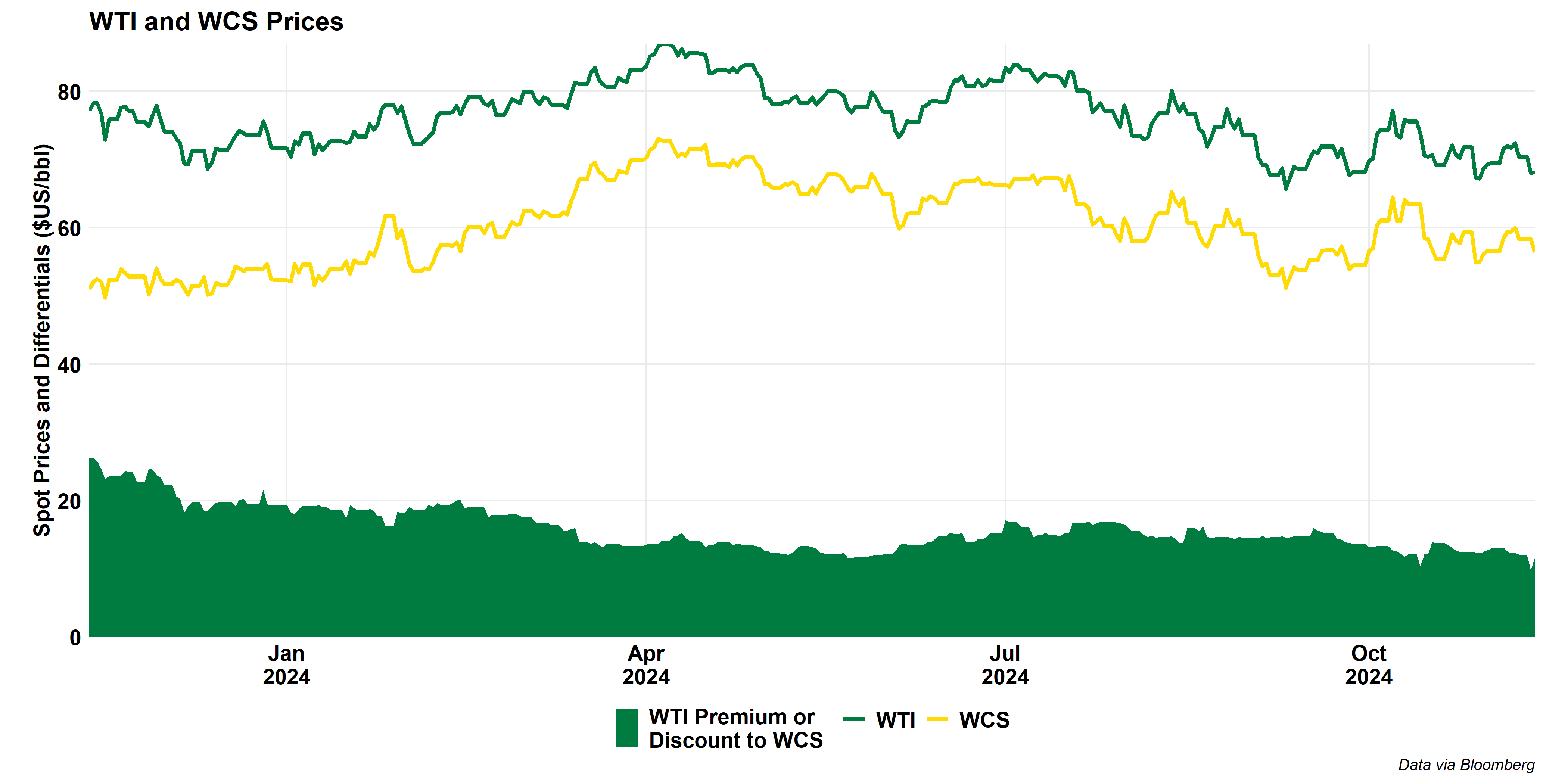

Crude Quality and Location

Crude prices vary by location

- Export (long) markets tend to have lower crude prices than import (short) markets

- Location-based price relationships determined by transportation costs, infrastructure availability, and trade flows

Location differences

Global Crude

Location differences

Location differences

Heavy pricing higher than light? Check location

Quality Differences

Quality and Location Differences

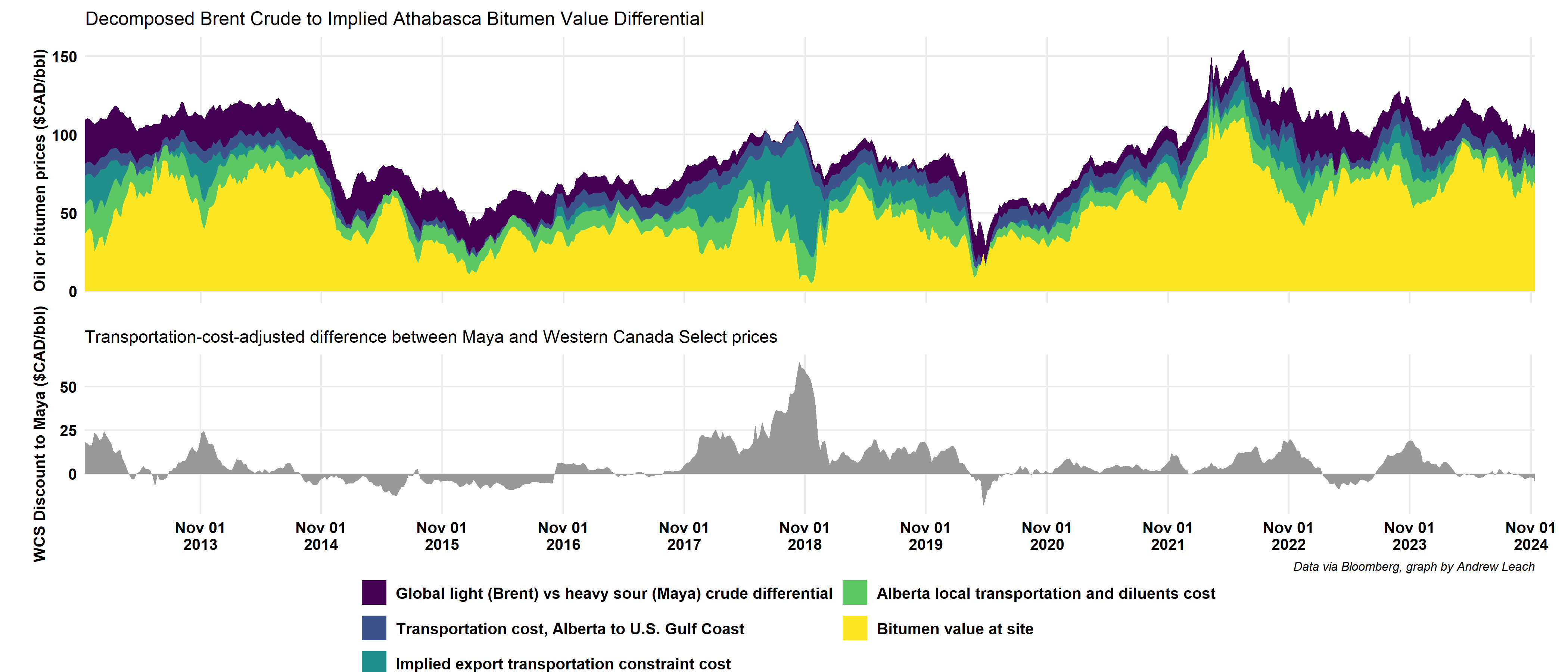

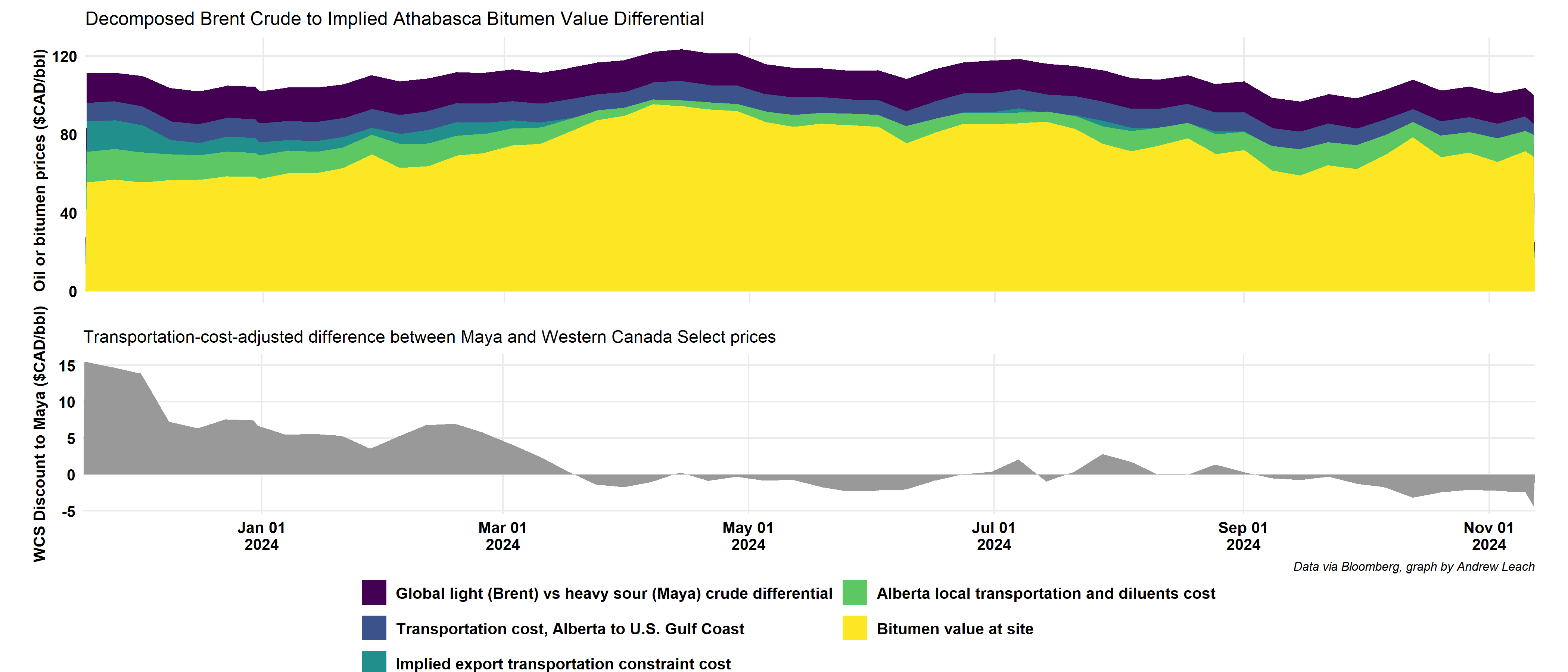

Bitumen – even larger differentials

Bitumen – even larger differentials

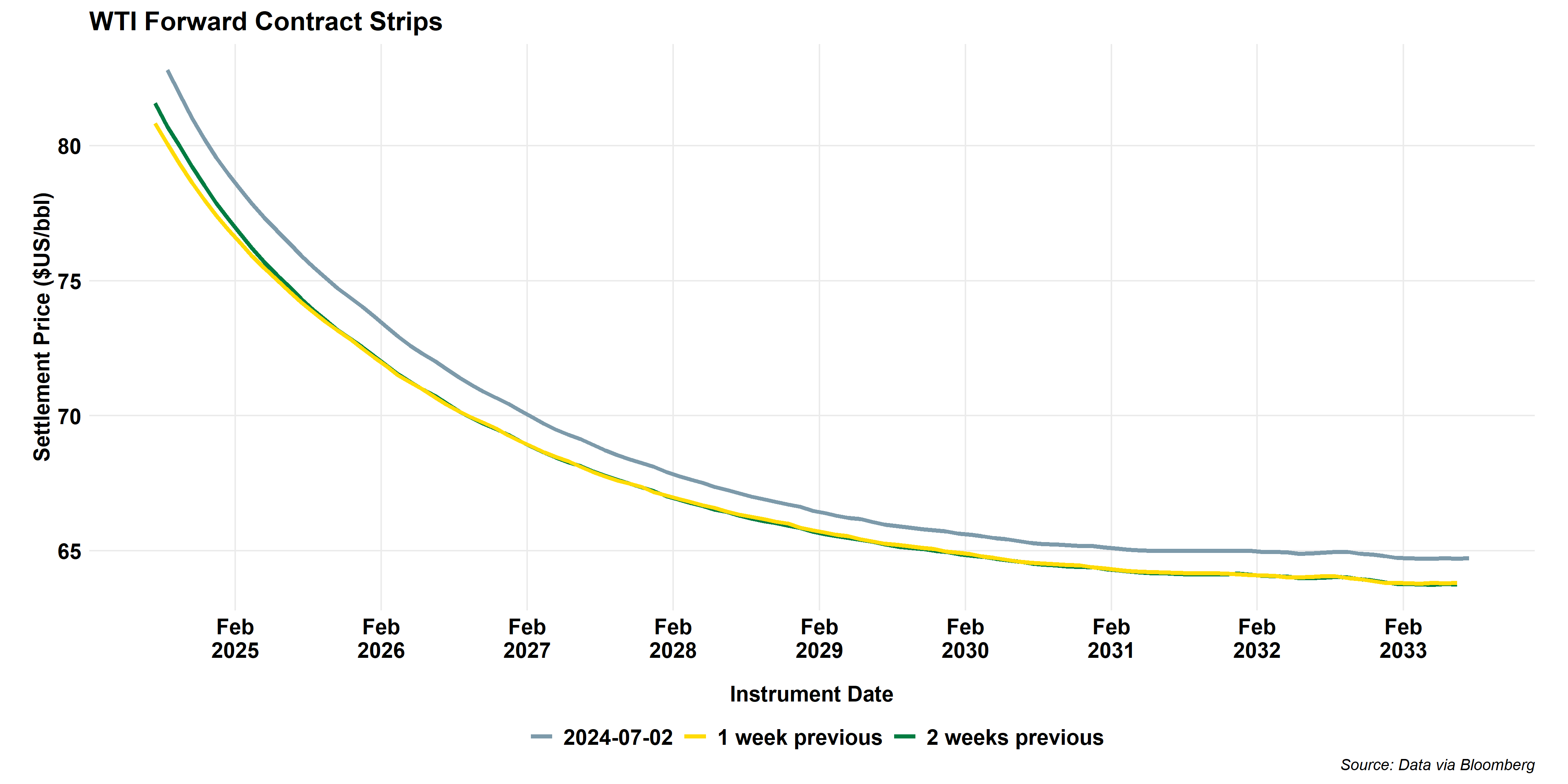

Time dimension of oil prices: the futures contract

- Futures contracts are promises to deliver a commodity at a future date

- The contract has value based on the expected future value of the commodity in question

- Futures contracts are either cash settled or physically delivered.

- Futures contracts that are physically delivered require the holder to either produce the commodity (seller) or take delivery (buyer).

- Futures contracts that are cash settled are not deliverable and a simple debit or credit is issued when the contract expires based - on the value of the underlying commodity or commodities.

Time dimension of oil prices: the futures contract

WTI Futures Contract:

- Contract Unit: 1,000 barrels

- Price Quotation: U.S. Dollars and Cents per Barrel

- Settlement: Deliverable

- Delivery between the first and last calendar day of the delivery month

- Delivery shall be made free-on-board ("F.O.B.") at any pipeline or storage facility in Cushing, Oklahoma with pipeline access to Enterprise or Enbridge Cushing storage.

- At buyer's option, delivery may be made by inter-facility transfer ("pumpover”), in-line (or in-system) transfer; or simple transfer of title to the buyer in tank farm.

Time dimension of oil prices: the futures contract

WTI Futures Contract Specifications:

- Gravity: Not less than 37 degrees American Petroleum Institute (“API”), nor more than 42 degrees API

- Sulfur: 0.42% or less by weight

- Viscosity: Maximum 60 Saybolt Universal Seconds at 100 degrees Fahrenheit

- Reid vapor pressure: Less than 9.5 pounds per square inch at 100 degrees Fahrenheit

- Basic Sediment, water and other impurities

- Pour Point: Not to exceed 50 degrees Fahrenheit

Time dimension of oil prices: the futures contract

WTI Futures Contract Grades in lieu:

- West Texas Intermediate, Low Sweet Mix (Scurry Snyder),New Mexican Sweet, North Texas Sweet, Oklahoma Sweet,South Texas Sweet (deliverable at par)

- U.K.: Brent Blend (seller paid 30 cent per barrel discount)

- Nigeria: Bonny Light (seller paid 15 cent per barrel premium)

- Nigeria: Qua Iboe (seller paid 15 cent per barrel premium)

- Norway: Oseberg Blend (seller paid 55 cent per barrel discount)

- Colombia: Cusiana (seller paid 15 cent per barrel premium)

Time Dimension of Oil Prices

We trade energy commodities, not energy

What is natural gas?

- Natural gas is a naturally occurring hydrocarbon consisting primarily of methane, but it may also contain small amounts of ethane, propane, butane and pentanes. (capp.ca)

- Produced natural gas is not perfectly homogeneous

- Pipeline quality gas is nearly homogeneous, and trades based on heating value, not volume which facilitates transactions. See here

- Contracts may be priced in $/MMBtu (US) or $/GJ (Cdn)

Produced gas

- At the well-head, gas will have different values by volume

- Hot gas, or gas with high heating values will sell for more per unit volume

- Liquids-rich gas, or gas with high concentrations of propanes, butanes, pentanes, etc will sell for higher prices

- Sour gas, or gas with measurable amounts of hydrogen sulfide is more difficult to handle and process, and therefore less valuable per unit volume or per unit heating value

- Gas processing plants process produced gas into pipeline gas which is mostly methane with some concentrations of liquids remaining

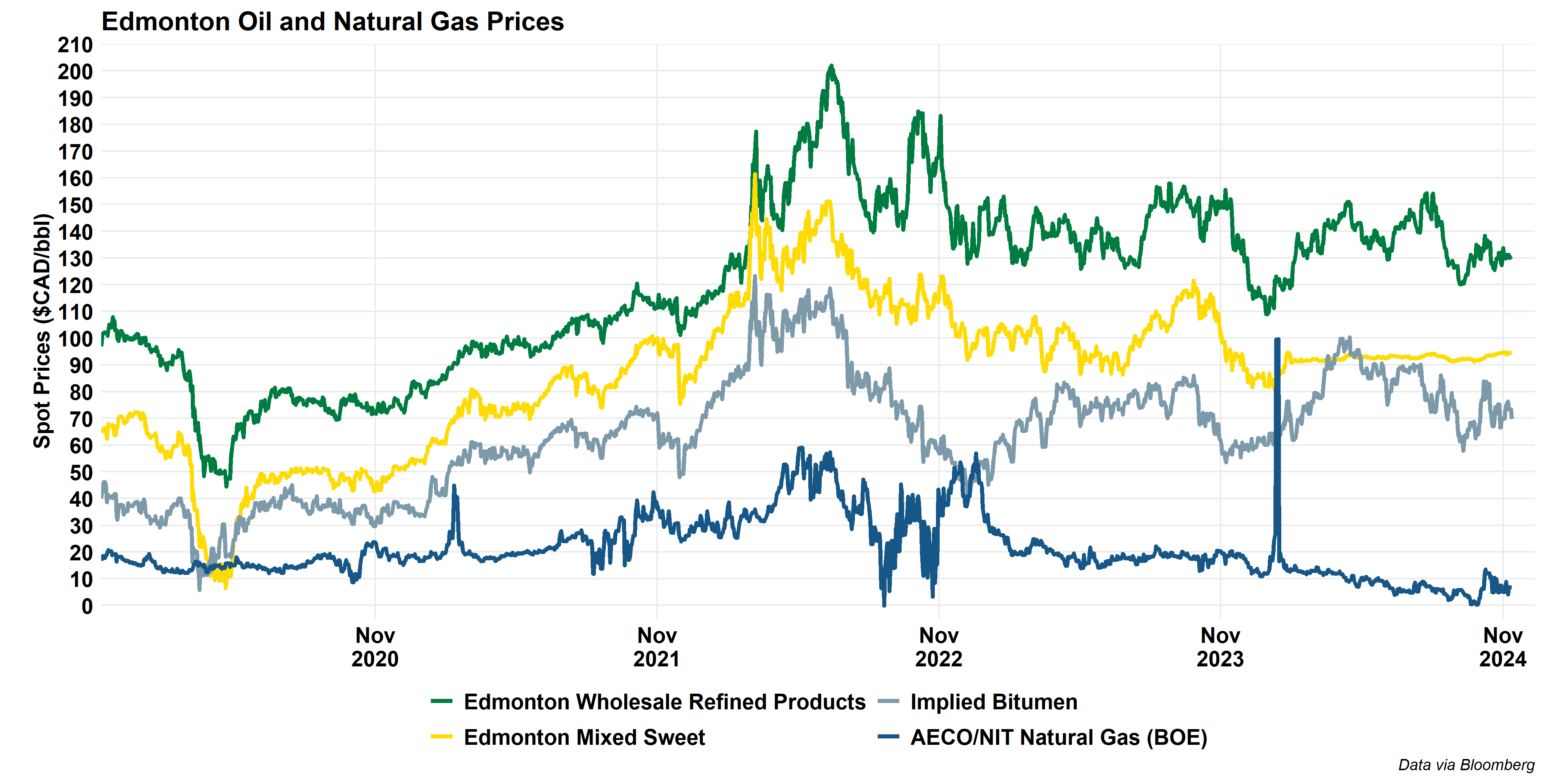

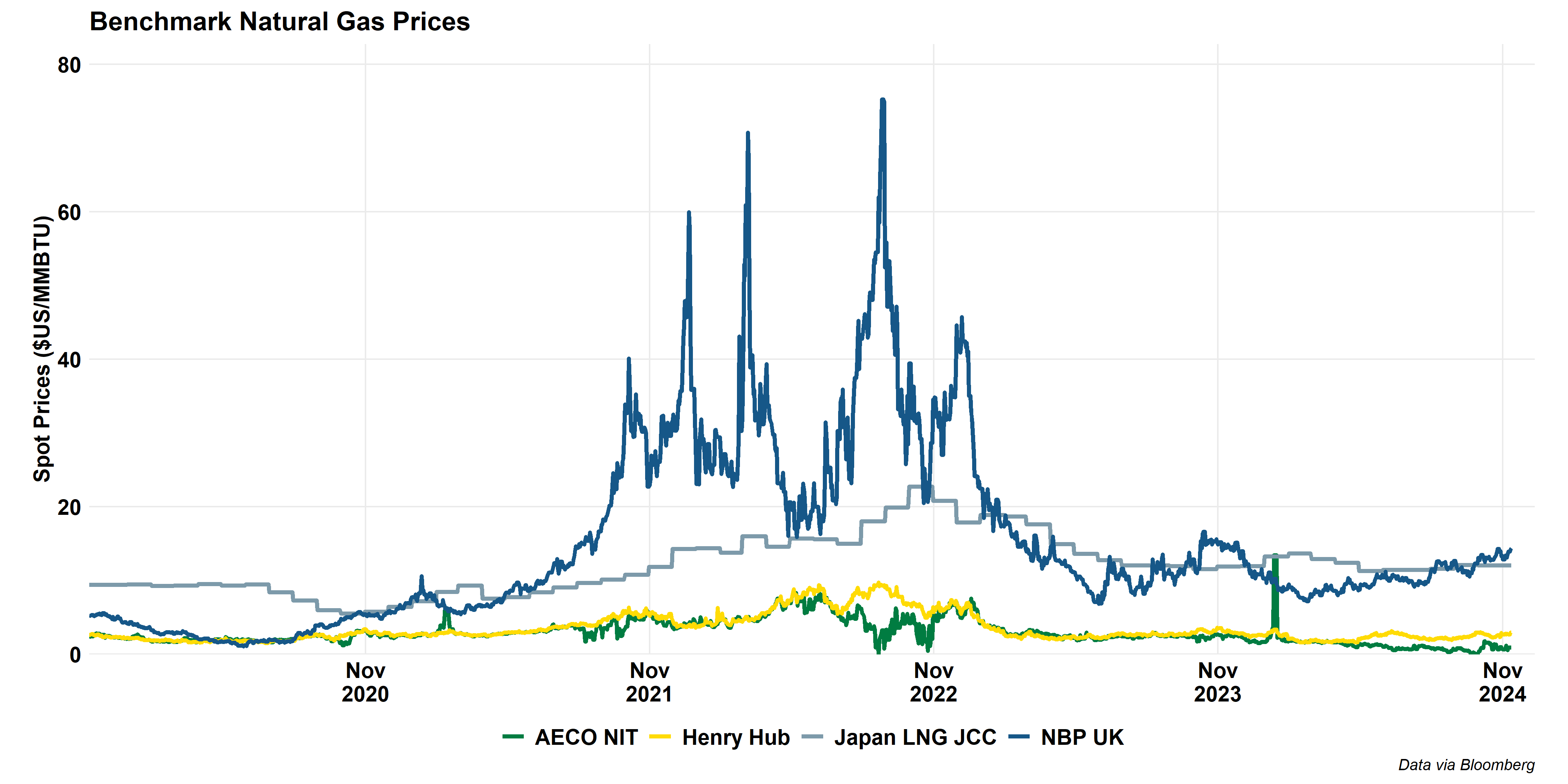

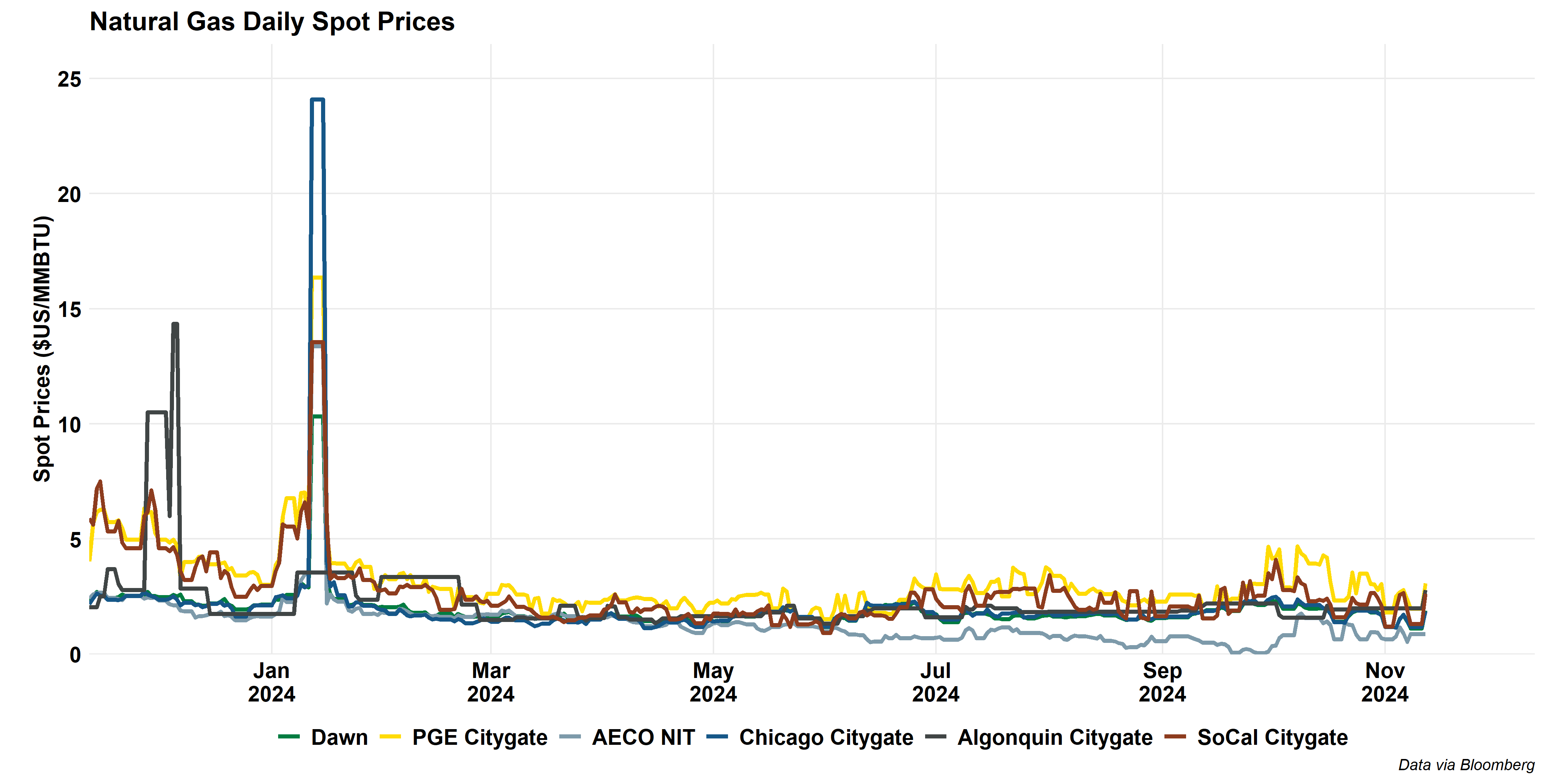

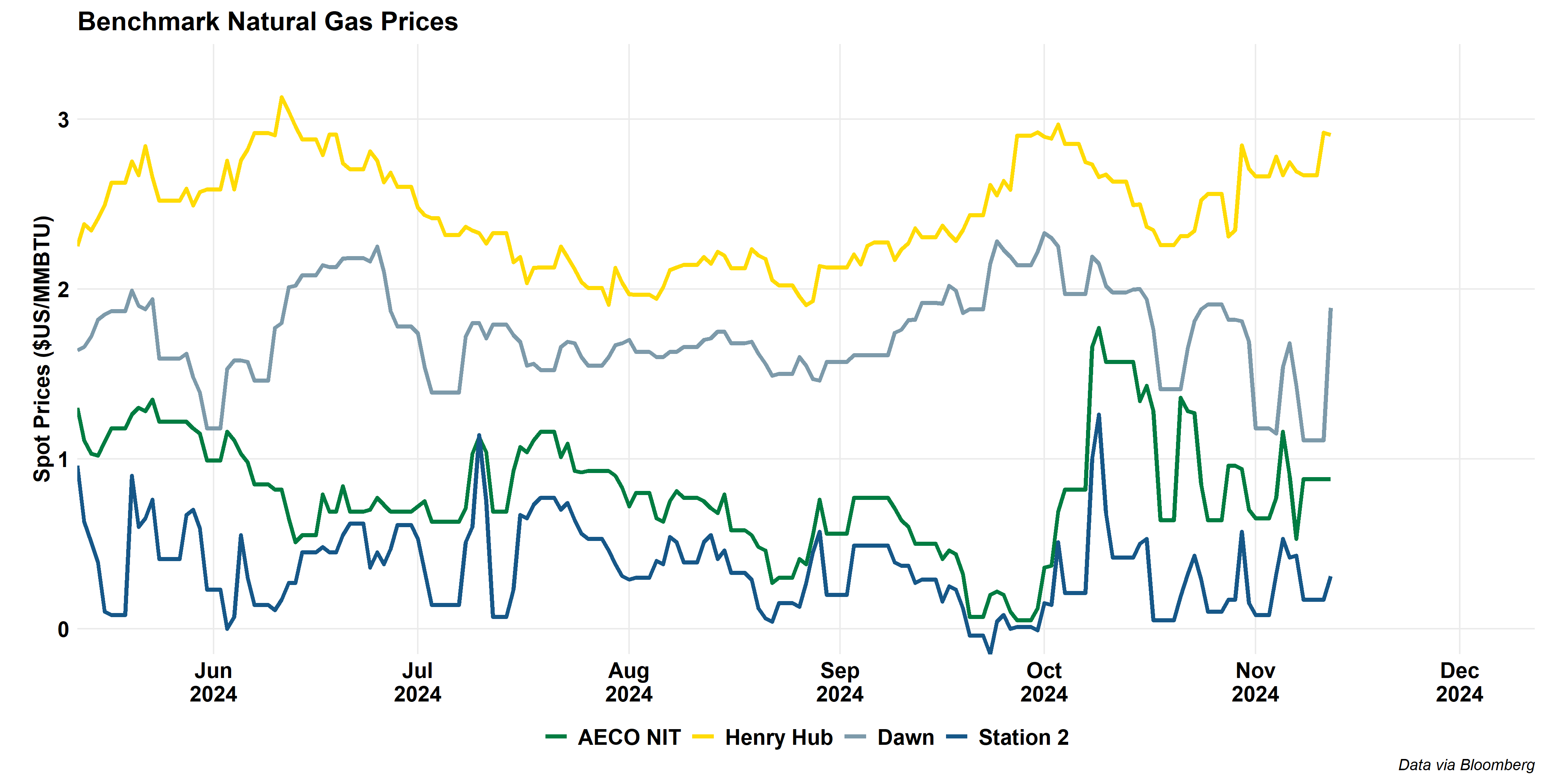

Gas prices vary by region

Gas prices vary by region

Gas prices vary by region

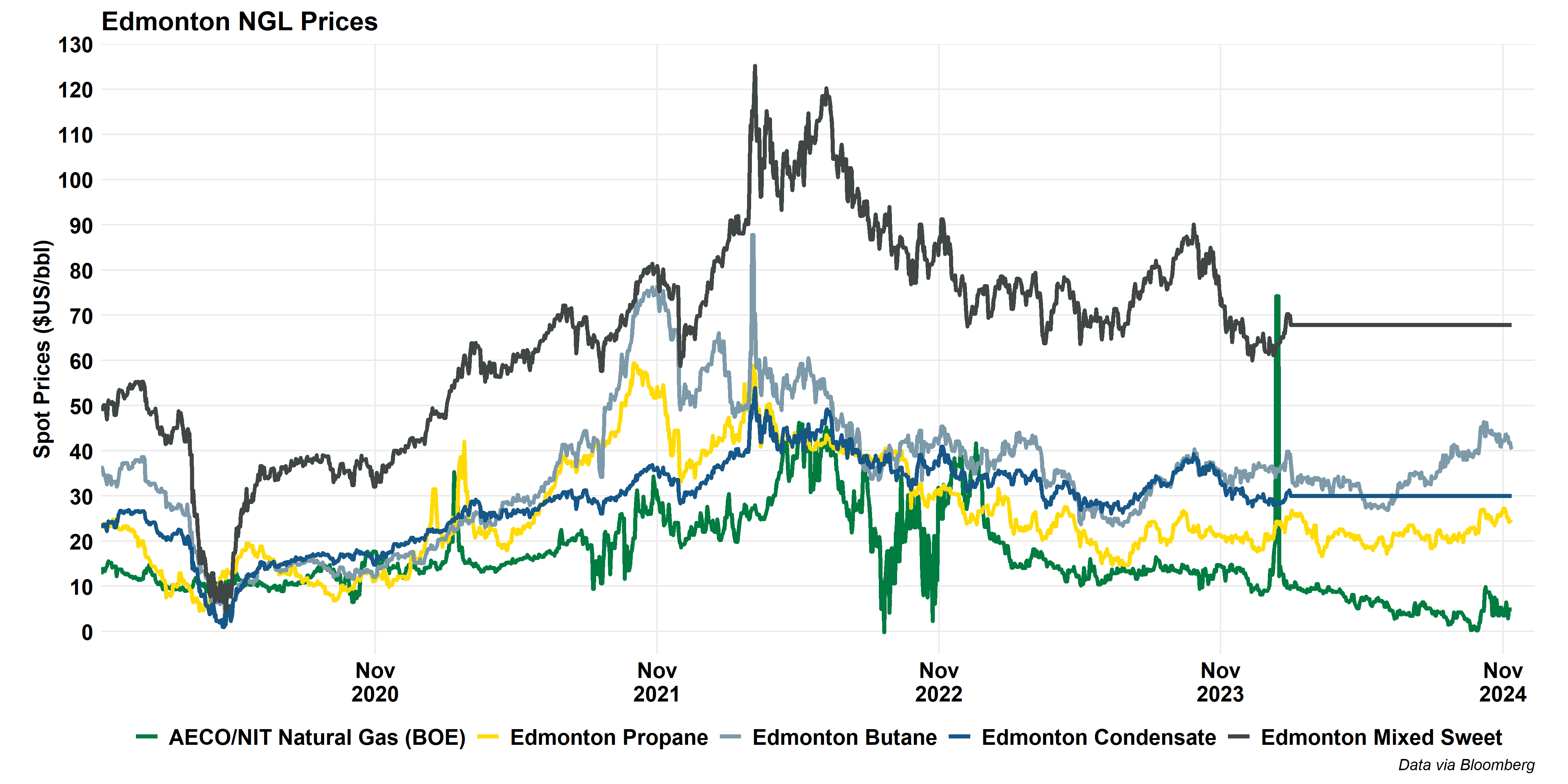

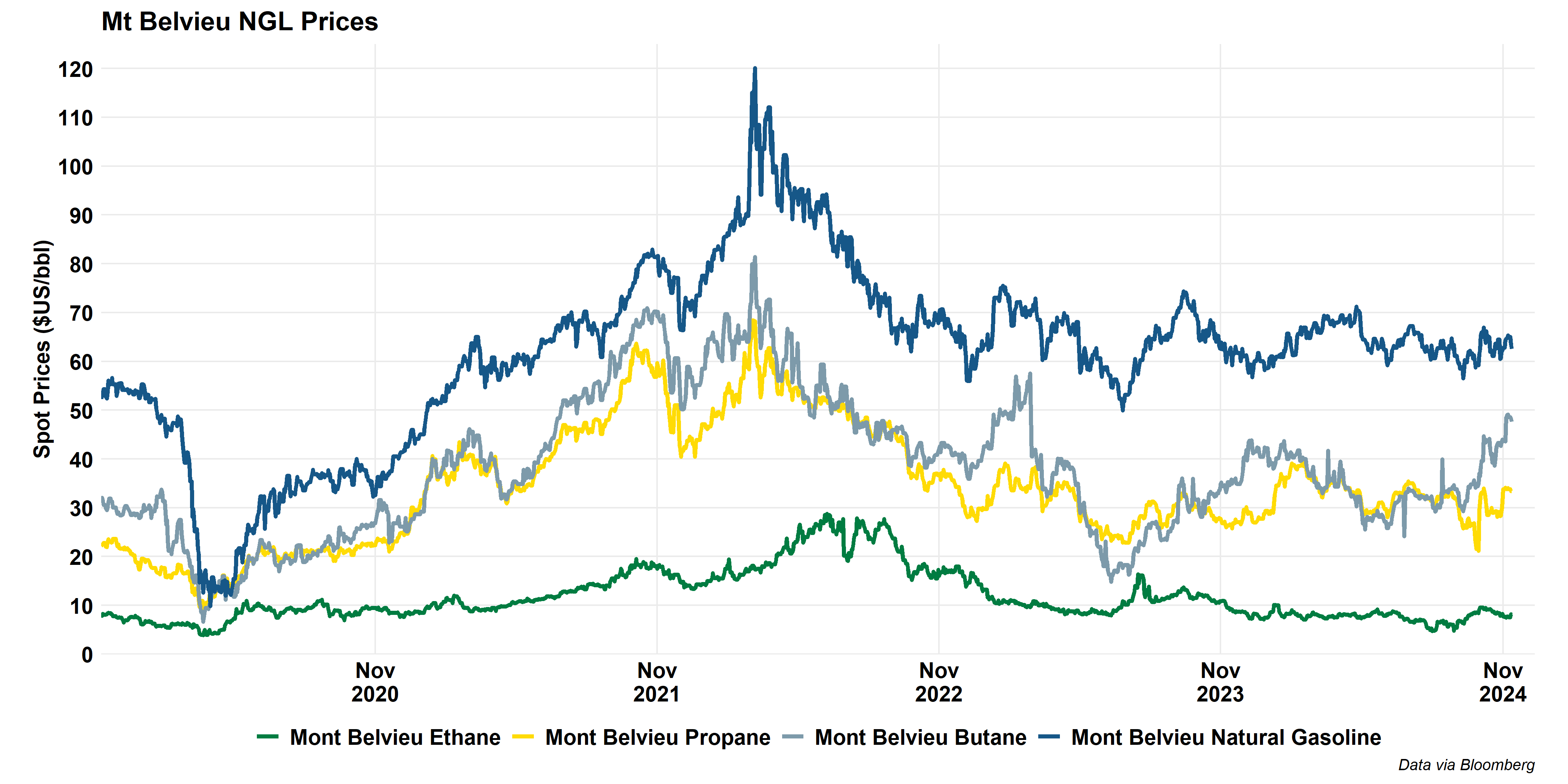

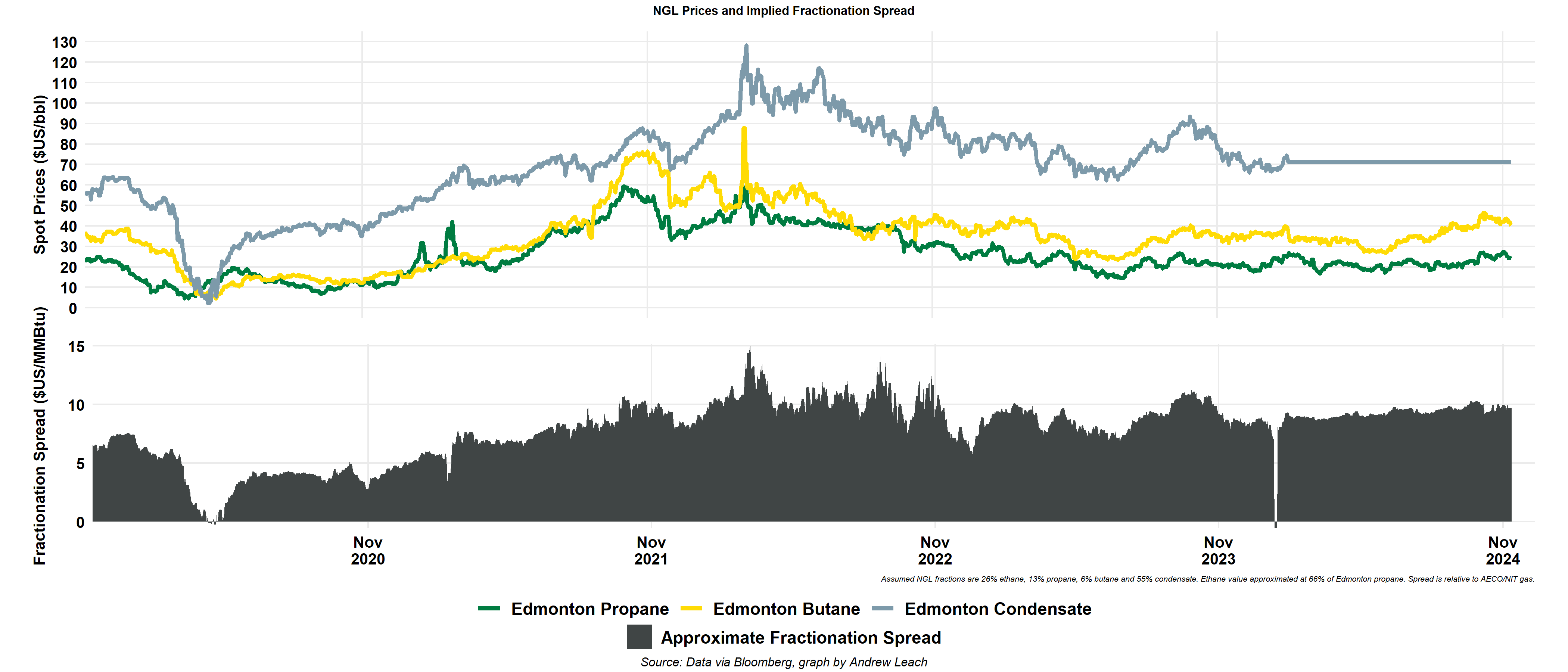

Natural gas liquids – the intervening commodity

Natural gas liquids – the intervening commodity

Natural gas liquids – the intervening commodity

Natural gas liquids – the intervening commodity

Natural gas liquids – the intervening commodity

Key concept review

- Contract components

- Commodity

- Location

- Quality

- Time

- Oil vs. gas energy vs quantity

- NGLs and the frac spread