ECON 366: Energy Economics

Topic 3.4: Electricity Generation

Andrew Leach, Professor of Economics and Law

Electricity Generation Basics

- plant characteristics

- plant costs

- plant revenues

- levelized cost of electricity (equiv. supply costs)

- generation mix here and elsewhere in Canada (data assignment)

- challenges of renewable integration

- forward markets and hedging

Key plant characteristics

- capacity: peak generation, in MW

- capacity factor: average share of peak (%)

- dispatch: can I turn it on or off?

- seasonal constraints

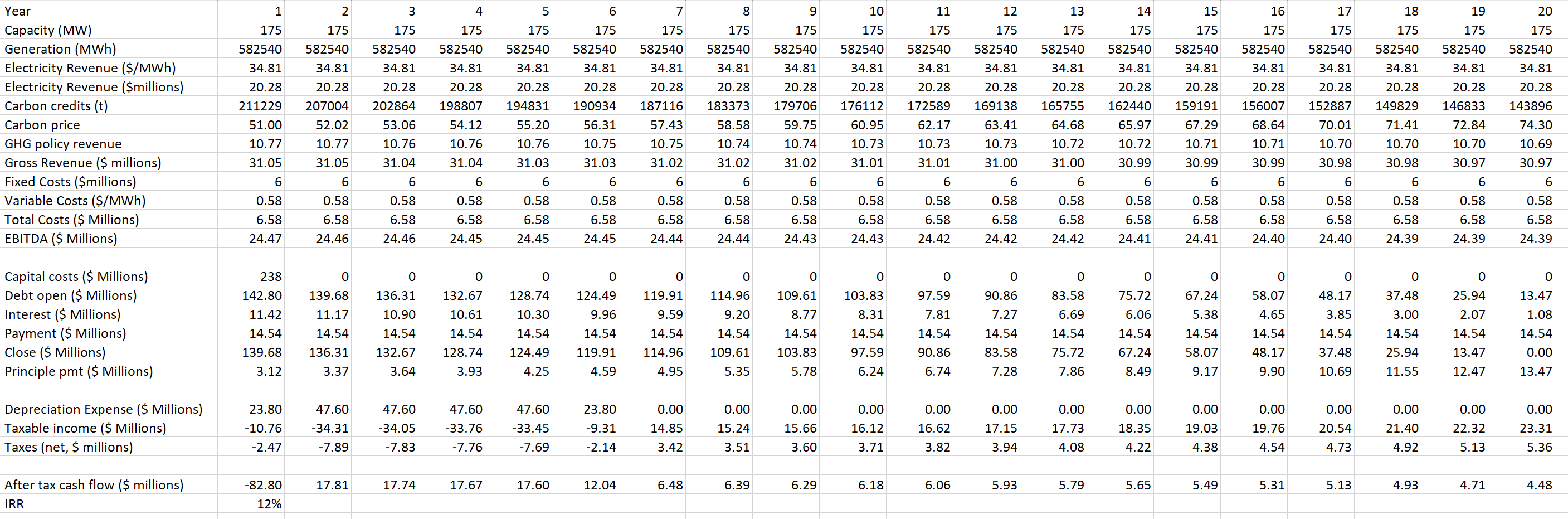

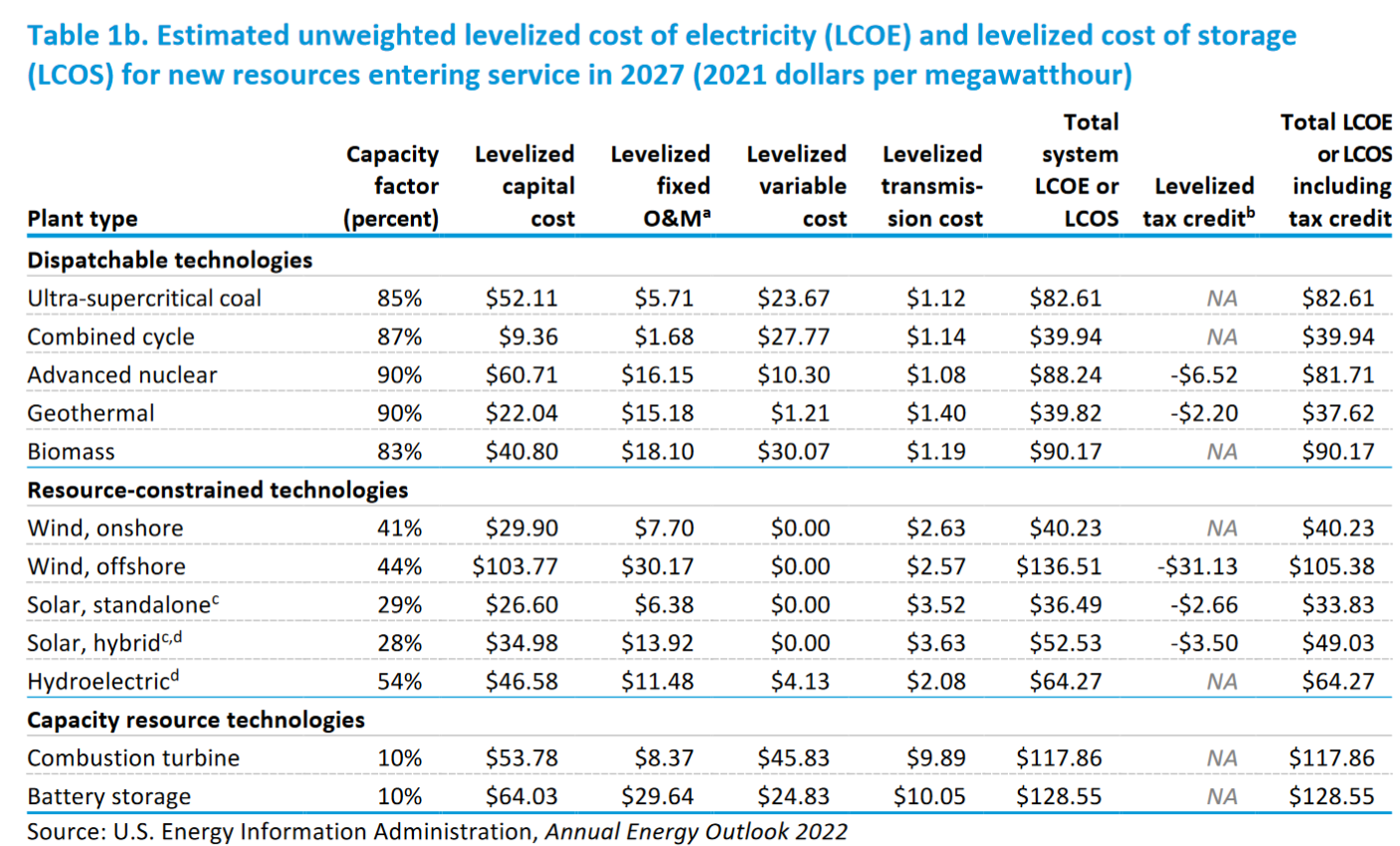

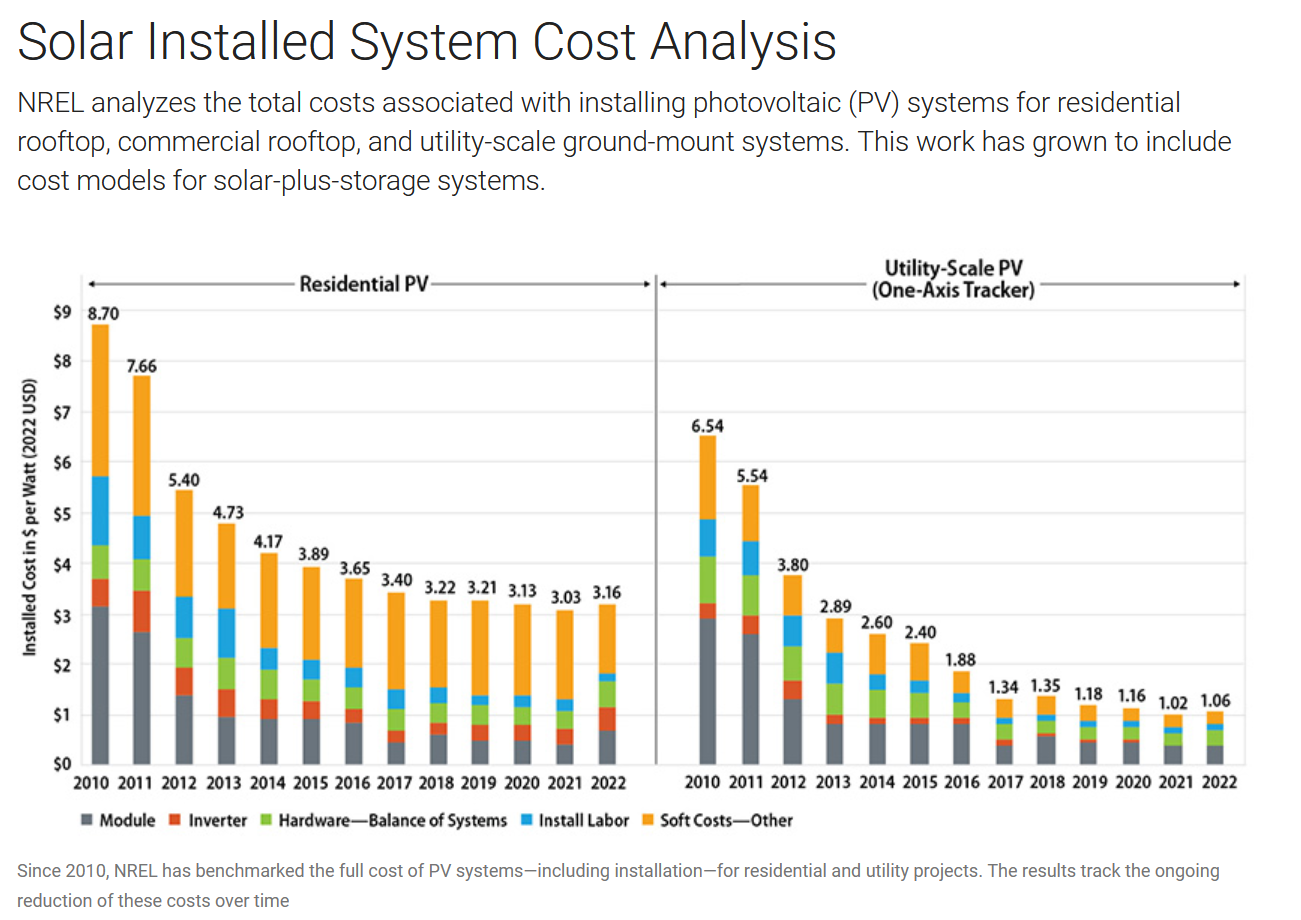

Cost of New Generation

- we tend to express the costs of new generation as the levelized cost of electricity (LCOE)

- this is, like the supply cost for oil sands, a value that represents the electricity market revenue you need to earn to make a reasonable rate of return on capital and/or equity

- you can think of it as an gross or a net measure, and I'll show you what I mean in both cases

Simplified LCOE

You can simplify an LCOE using an annual amortization method (see NREL) to calculate a project's levelized cost of energy (LCOE), using the following inputs:

Capital cost, $ (TCC)Fixed annual operating cost, $ (FOC)Variable operating cost, $/kWh (VOC)**Fixed charge rate (FCR)**Annual electricity production, kWh (AEP)NREL's LCOE calculator uses the following equation to calculate the LCOE:

LCOE=(FCR×TCC+FOC)AEP+VOC

The fixed charge rate, or FCR, is an annualized share of capital costs recovered each year, based on project financial parameters

True LCOE

The LCOE is no different from a supply cost that we did for oil sands projects:

Capital cost, $ (K)Fixed annual operating cost (FC)Variable operating cost (VC), $/MWhDiscount rate (r), %Annual electricity production (Q), MWhLCOE=T∑t=011+r(Kt+FCt+VCt×Qt)Qt

It's a production-weighted average of the net present value costs per unit of generation, generally calculated at a rate of return of 5-10%

LCOE vs supply cost

The LCOE is no different from a supply cost that we did for oil sands projects:

LCOE=T∑t=011+r(Kt+FCt+VCt×Qt)Qt

Think of it this way: if prices are such that:

T∑t=011+rPt=T∑t=011+r(Kt+FCt+VCt×Qt)Qt The project makes it's break even rate of return on capital

What determines LCOE

- capital cost

- capacity factor

- operating costs

- taxes and subsidies incl. carbon prices

- fuel costs

- transmission costs (in some locations, not Alberta)

- debt and equity costs (WACC)

- non-electricity revenue (e.g. RECs or offsets)

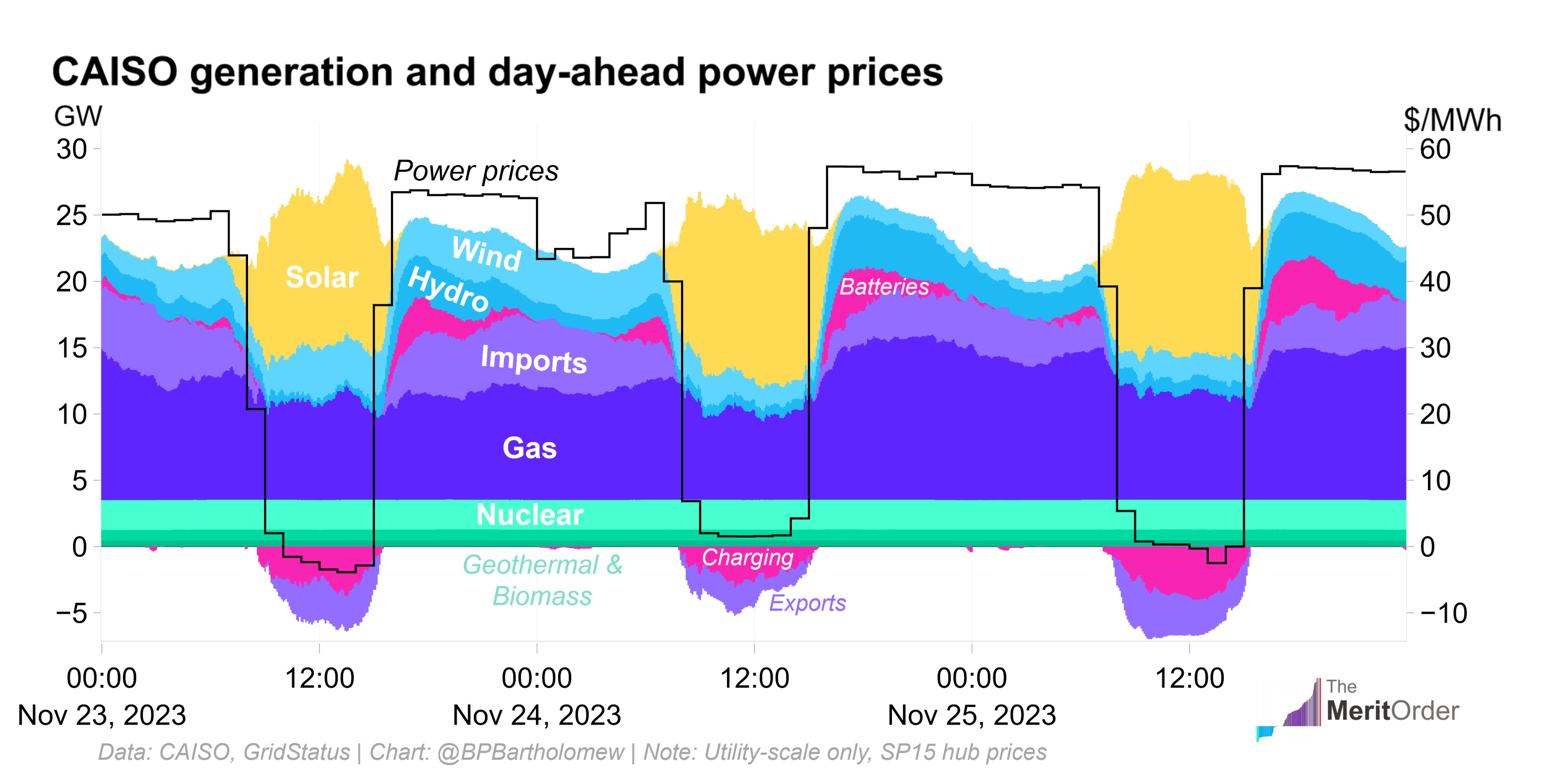

What about revenue?

- dispatchable plants can avoid low cost periods and take advantage of high cost periods

- storage assets can arbitrage high and low prices

- some non-dispatchable assets may generate at peak price periods (e.g. solar)

- renewable generation tends to be correlated and thus associated with lower prices

- renewable generation can erode value of base-load plants

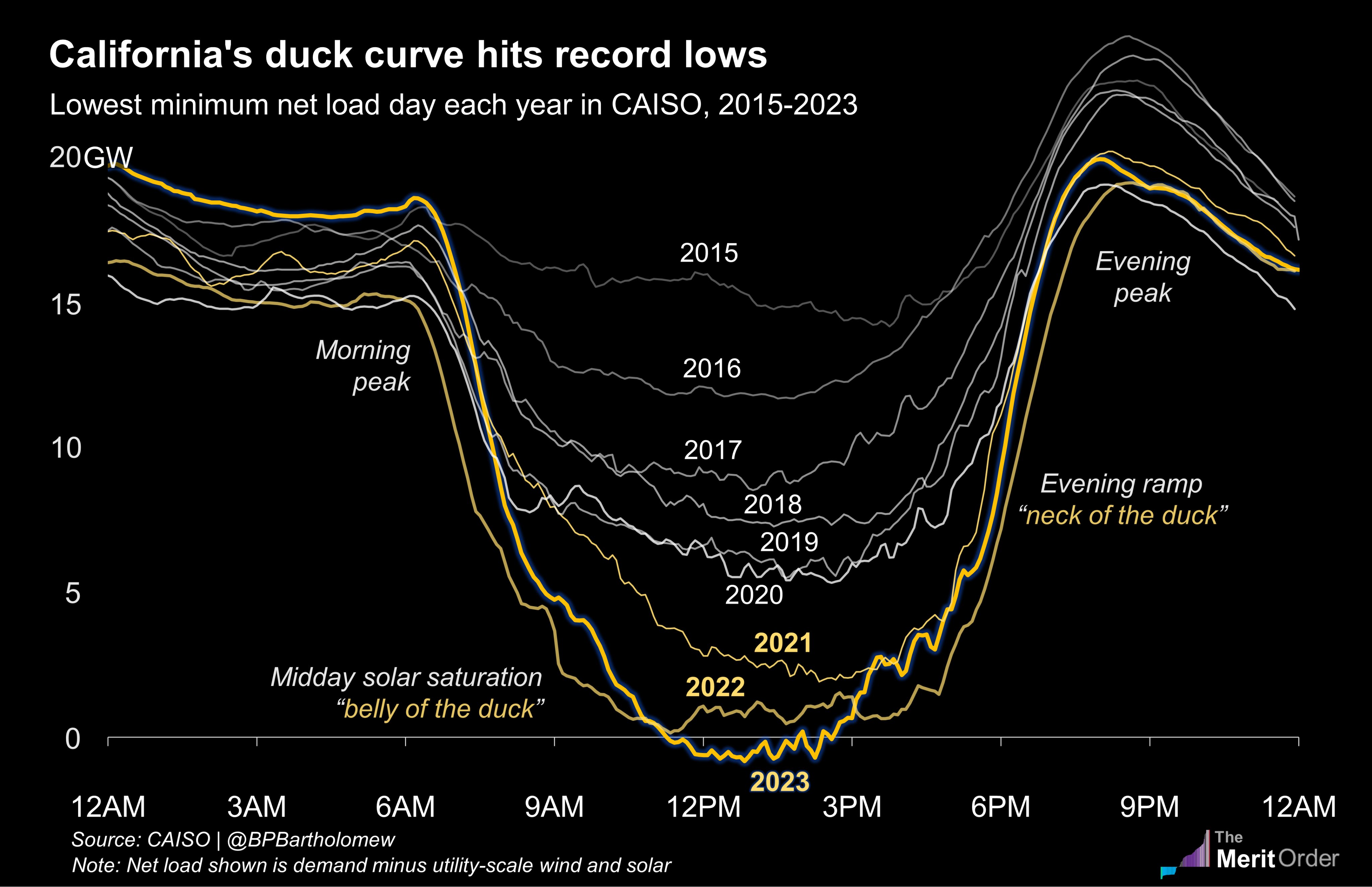

CAISO Daily Patterns of Prices and Loads

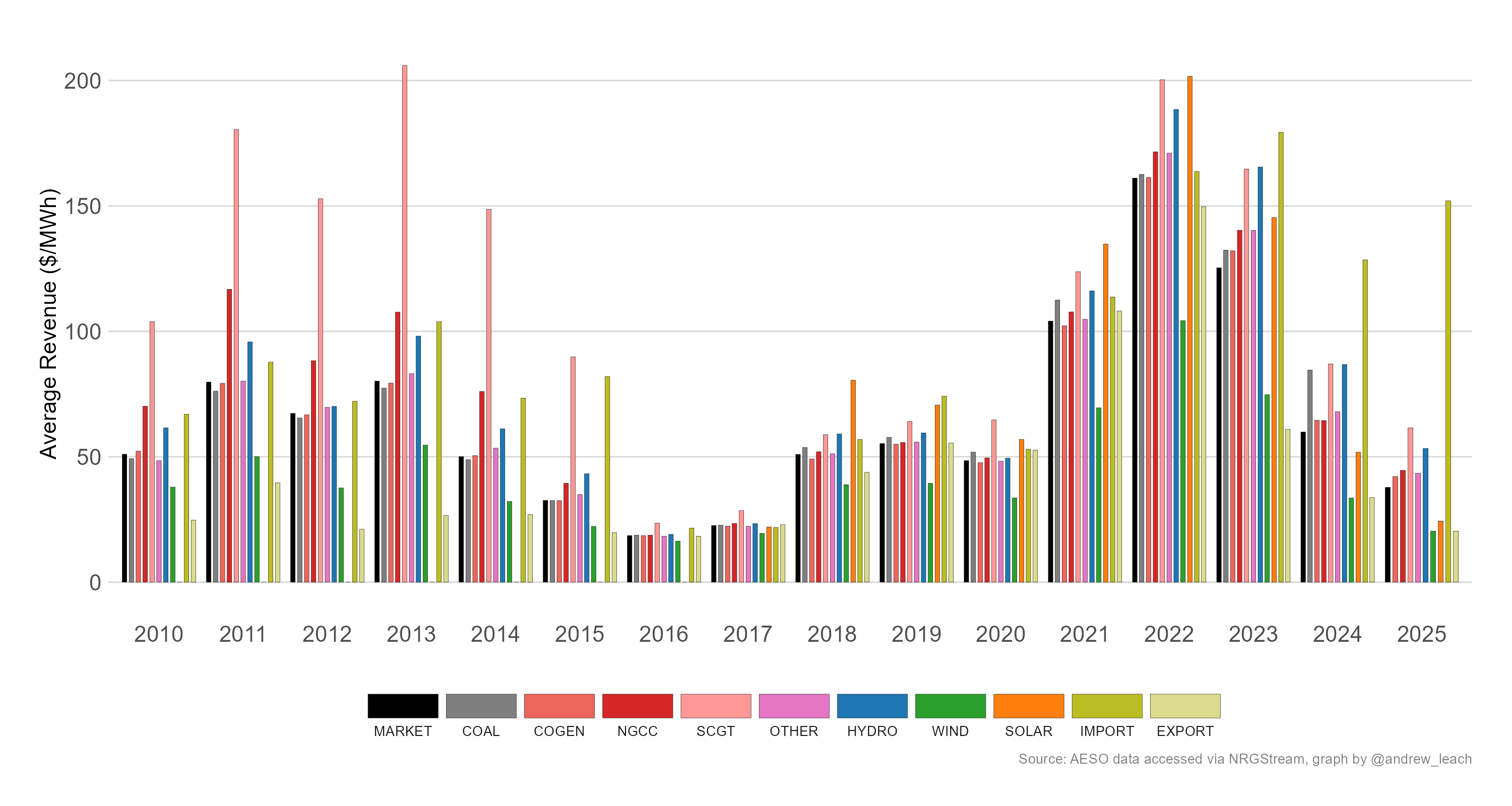

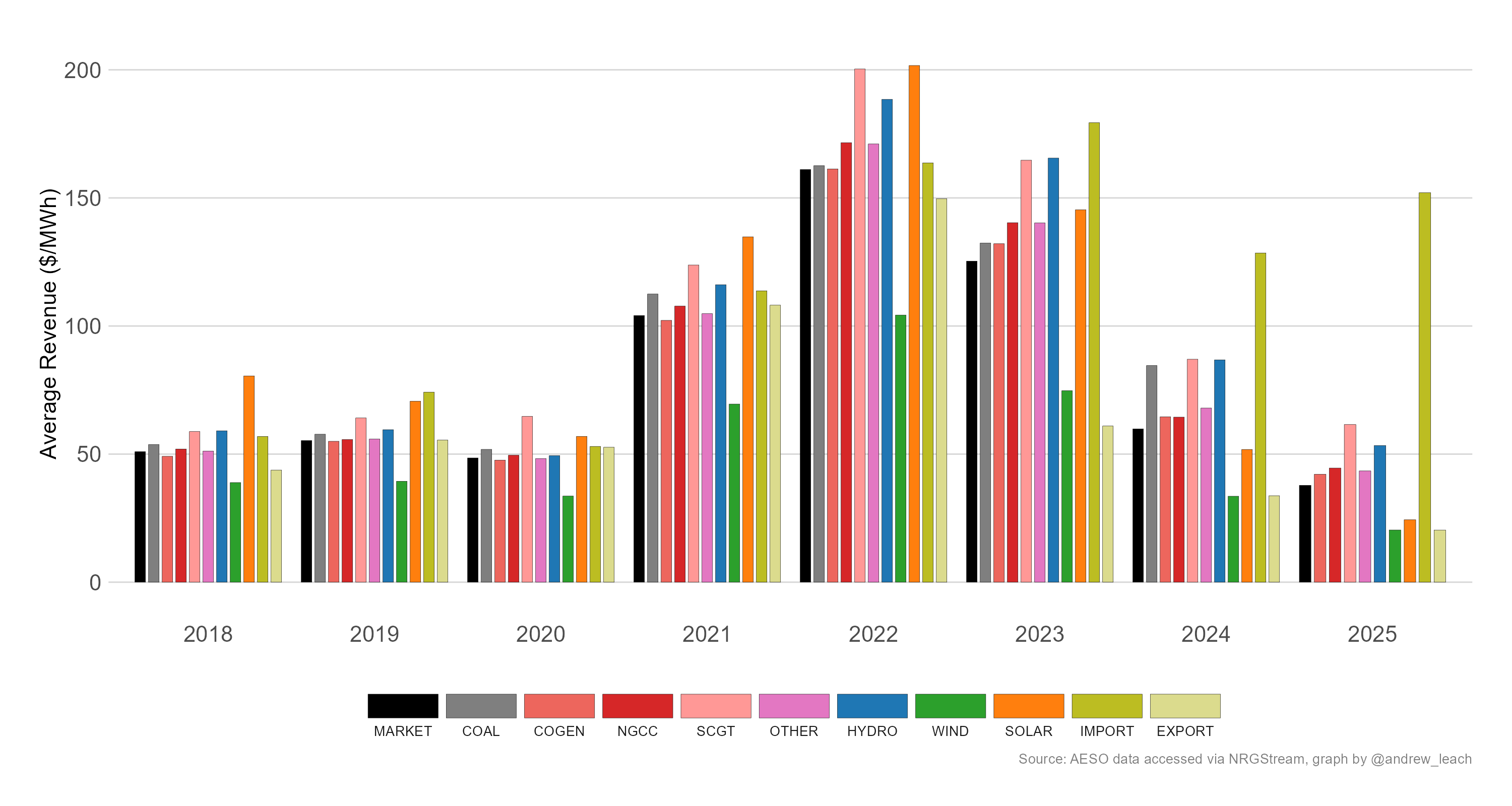

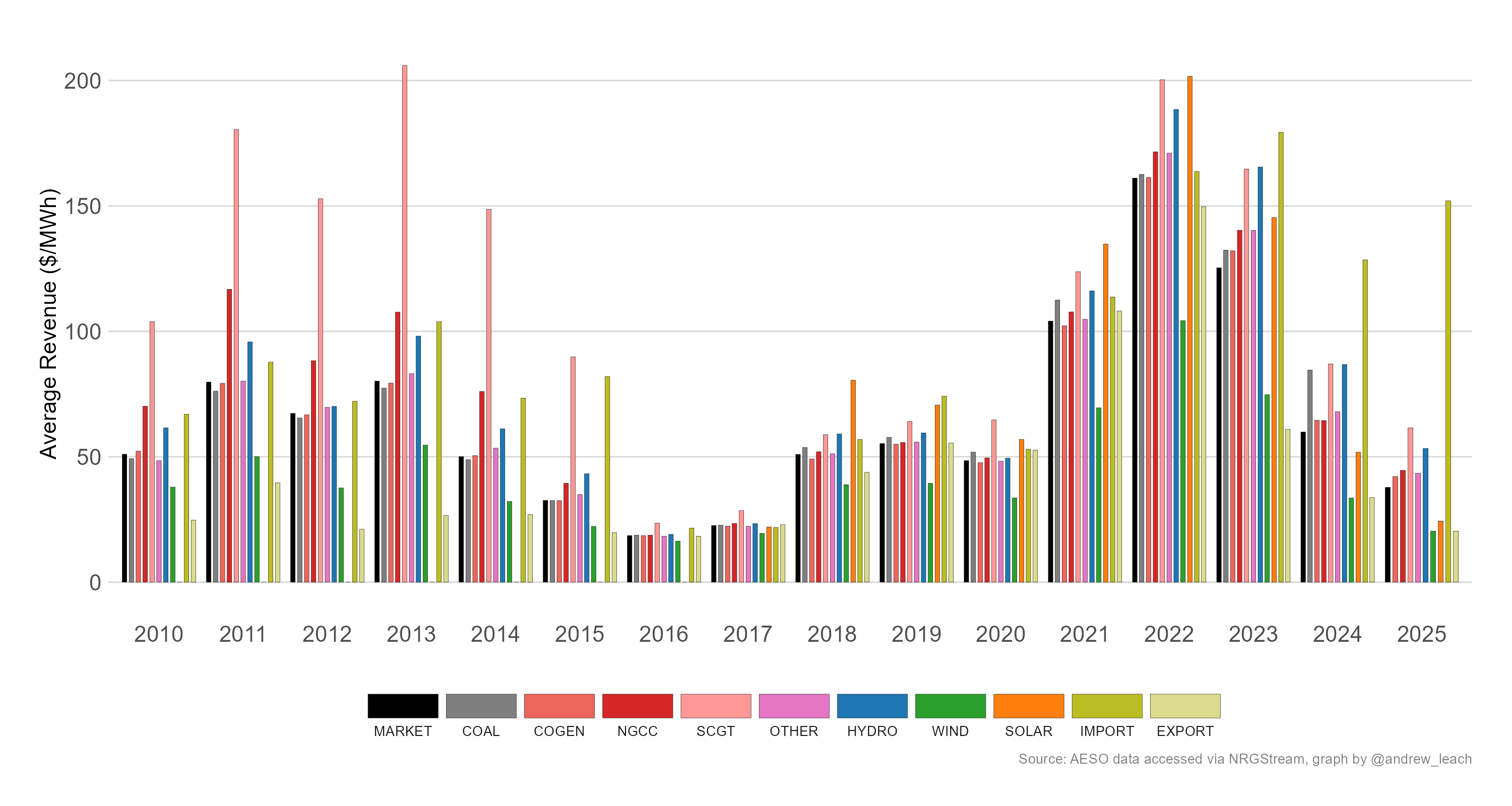

Dispatch and correlation lead to different average revenues

Dispatch and correlation lead to different average revenues

The duck curve

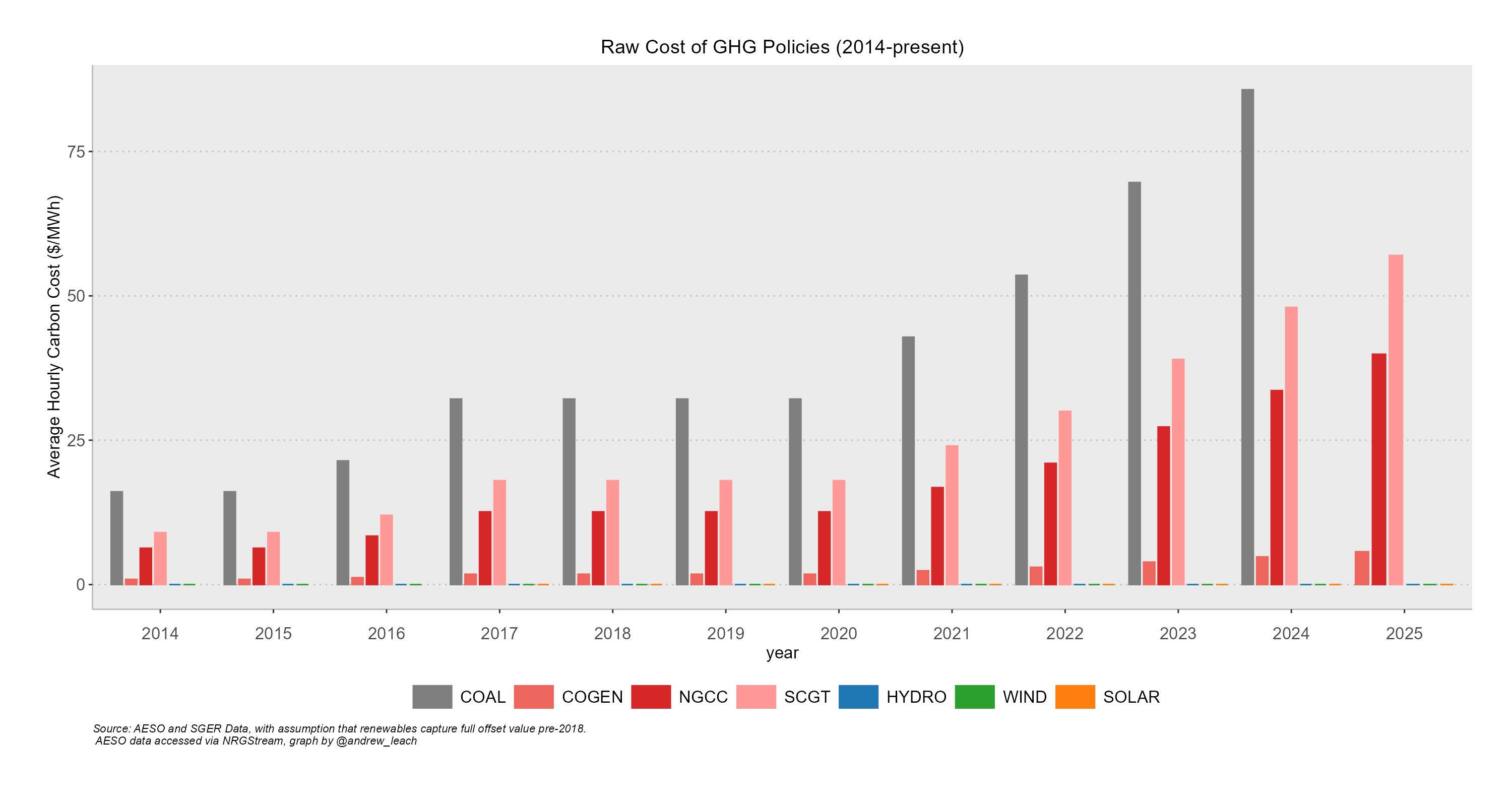

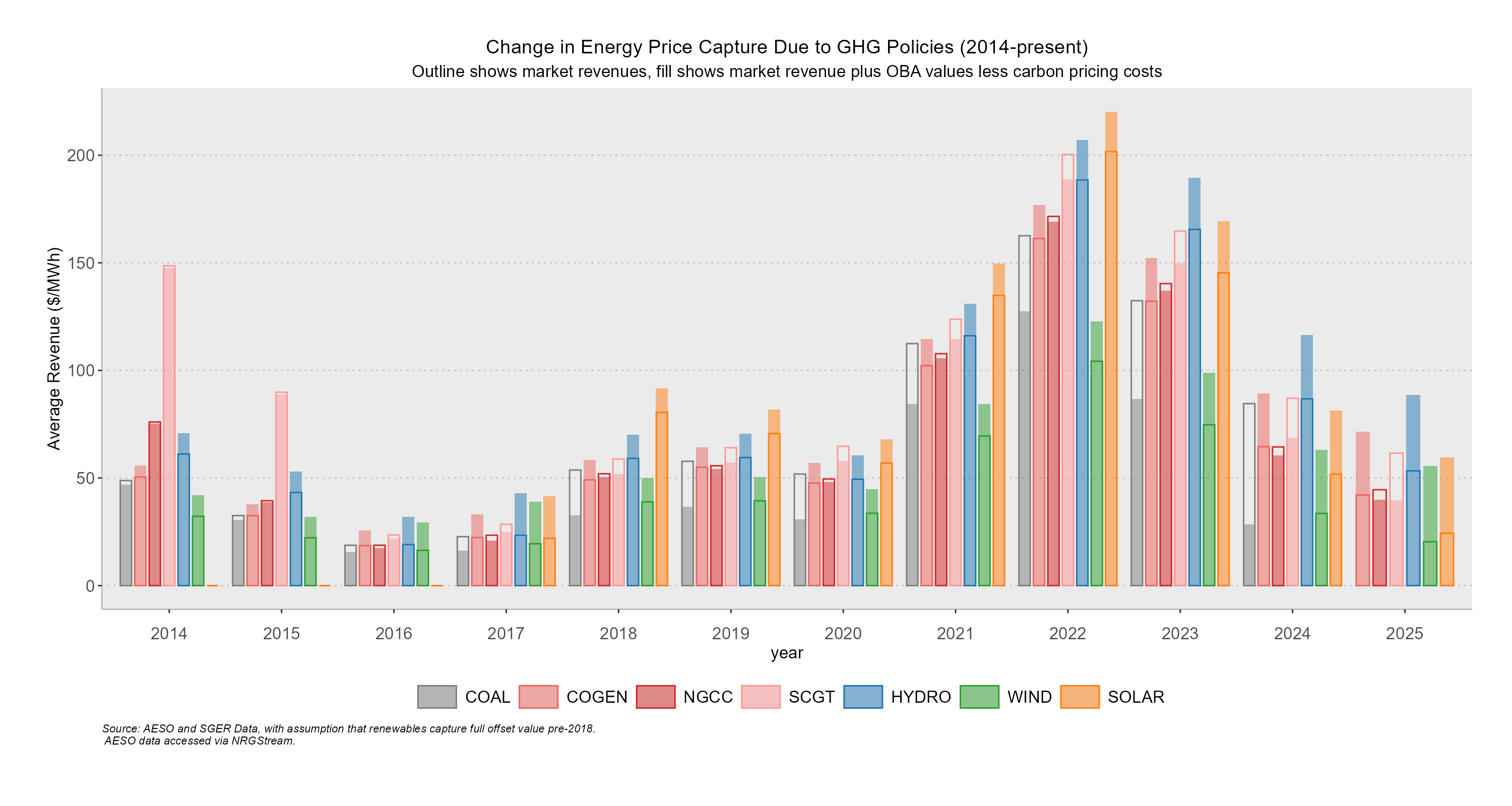

Carbon tax costs matter

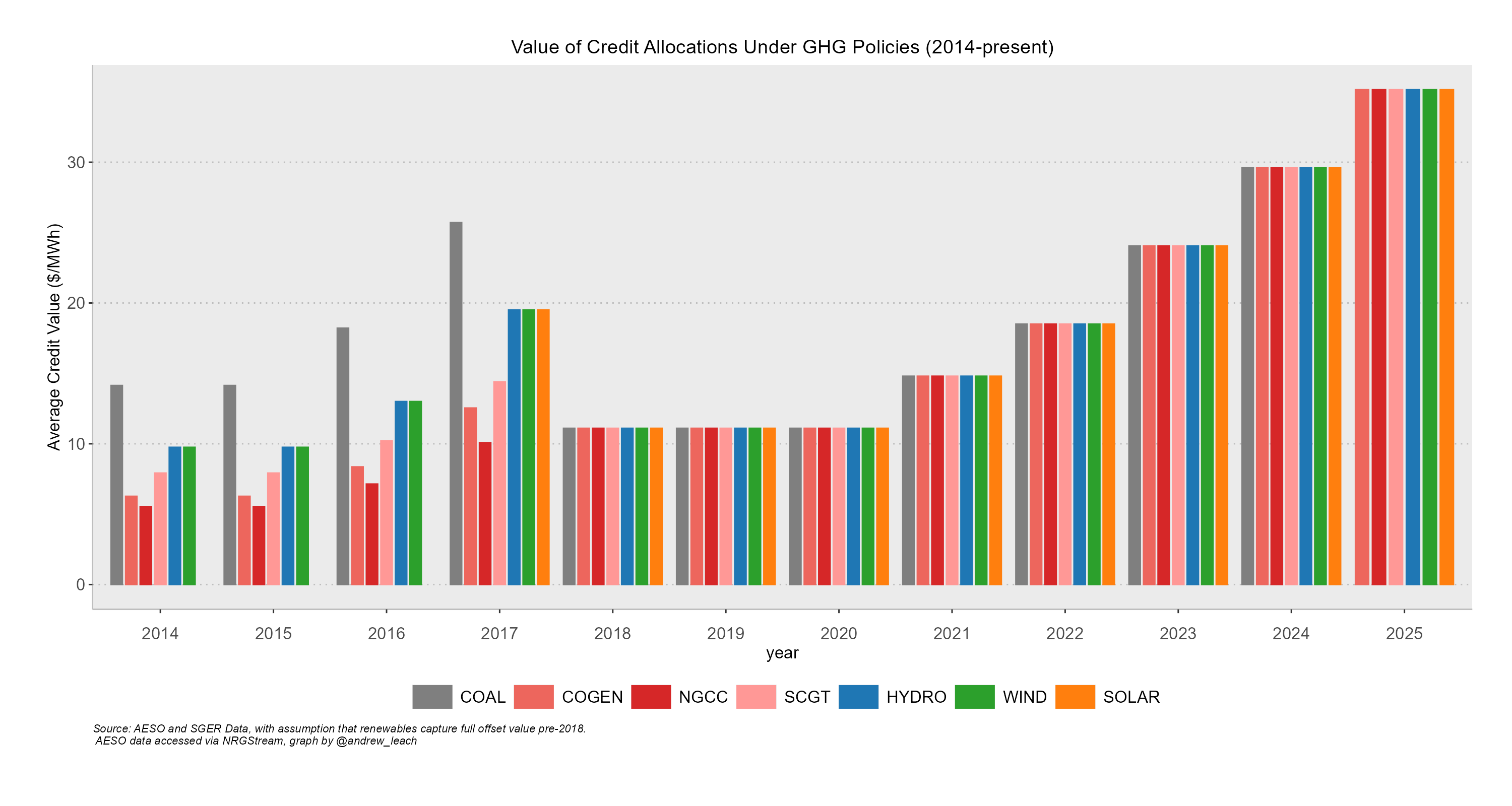

But, so does the value of output-based allocations

Combined impacts on revenues

Dispatch and correlation lead to different average revenues

Market Power And Economic Withholding

Lerner index (% markup of price over marginal cost)

Market concentration metrics (3-firm, 4-firm concentration ratios, Herfindahl Hirschman Index (HHI))

- HHI=n∑i=1S2i, where Si is the market share of each firm i in the market

Is economic withholding a bad thing?